401(k): Six Steps to Optimize Your 401(k) Plan

401(k) plans are vexing. Prospective clients frequently ask:

- “Am I contributing enough?”

- “What investment(s) should I select?”

- “What should I do with my old 401(k) plans?”

Here’s my six-step process to getting the most out of your 401(k) plan.

Step 1: Figure Out How Much to Contribute

At the very least, contribute enough to take advantage of the company match. If you can afford to so, max out the 401(k) contribution ($19,500 in 2020, plus catch-up contribution if age 50 and above). If you can’t contribute the max, contribute as much as you can afford.

Step 2: Understand the Company Match

Check your company’s benefits page or contact HR to understand the formula for the company match. A common one is “100% of the first 3%, and 50% of the next 3%”. In this case, you should contribute 6% to get the full company match of 4.5%.

Be aware of the vesting schedule. Your 401(k) plan’s vesting schedule determines how much of the company match you get to keep if you leave your company. Note that you’re always 100% vested (e.g., you have 100% ownership) of your own 401(k) contributions.

Vesting schedules vary by company. The most advantageous vesting schedule allows for immediate vesting. The least generous vesting schedule is graded over six years. In other words, you must stay with your company for six years before you have 100% ownership of the company match.

Step 3: Decide on the Contribution Type: Pre-tax or Roth

Many companies offer two flavors of 401(k) plans: the traditional pre-tax 401(k), or a Roth 401(k). The main difference is when you pay income tax.

With the traditional pre-tax 401(k), you contribute pre-tax dollars, which means you get a tax deduction upfront, but pay taxes when you withdraw from the account starting at age 591/2.

With the Roth 401(k), it’s the opposite: you contribute after-tax dollars, which means you don’t get a tax deduction upfront, but withdrawals will be tax-free starting at 59 ½.

High-income earners are generally better off contributing to a traditional pre-tax 401(k) rather than a Roth 401(k). This is because the greater your income, the higher your income tax bracket, which means contributing to a pre-tax 401(k) would lead to greater tax savings.

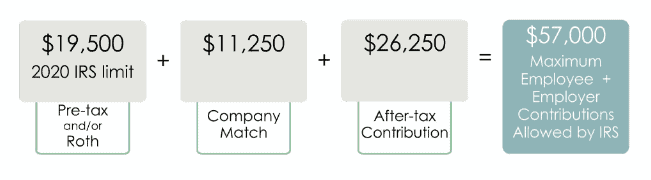

Step 4: Put it All Together: Your Contribution + Company Match + After-Tax Contributions

We’ve discussed your contribution and the company match. There is a third type of contribution that we haven’t yet discussed: “after-tax” contributions. Some companies allow you to save more than the annual $18,500 limit ($19,000 in 2019). If you make after-tax contributions, you pay taxes on the contributions today. Any gains you earn on your contribution will be taxed when you take it out. After-tax contributions are an indirect way of building Roth savings.

The IRS imposes a $57,000 limit on employee and employer contributions. This illustration puts it all together:

Step 5: Choose Your Investments

I’ve seen many new clients with a lot of cash in their retirement accounts because they either didn’t know that they should invest the cash, or they were overwhelmed by the endless list of investment options. As a starting point, pick a target date fund with a year that corresponds to your age 65. This will provide an all-in-one portfolio of multiple mutual funds covering both risky and less risky investments, which will increasingly become more conservative as you get older. You will be able to “set it and forget it.”

Step 6: Take Back 401(k) Plans from Your Old Jobs

My clients commonly have multiple 401(k) plans from old jobs, and they’re unsure what to do. You have three options:

- Keep your 401(k) plan where it is.

- Rollover (transfer) the old 401(k) into your current company’s 401(k).

- Rollover the old 401(k) to an IRA (traditional or Roth as appropriate).

I generally believe it’s best to roll over old 401(k) plans into a Rollover IRA (Individual Retirement Account). You can open a Rollover IRA account at major financial institutions like Vanguard or Schwab.

In summary:

- Understand the total contribution to your 401(k): your contribution (pre-tax or Roth), the company match, and after-tax contributions (if allowed by your employer).

- Review the vesting schedule for the company match.

- Choose the investments.

- Consolidate your old 401(k) plans in a Rollover IRA.