Snowflake IPO and Your ISOs (Incentive Stock Options)

Your Incentive Stock Options are complicated. As Snowflake’s lock-ups come off in December 2020 and March 2021, your stock options will go from a promise to (a lot of) real money.

I address frequently asked questions:

- What are stock options (in plain English)?

- When should I exercise?

- When should I sell?

- How does the tax part work?

- What is AMT?

If you want a more in-depth review, download my free guide, Preparing for an IPO.

What Are Stock Options?

Stock options represent the right (not requirement) to:

- buy stock (“exercise”)

- for a fixed price (“exercise price” or “strike price”)

- during a fixed period of time (usually 10 years)

There are two types of stock options: Incentive Stock Options (ISOs), and Non-qualified Stock Options, (NSOs). Most Snowflake employees have ISOs.

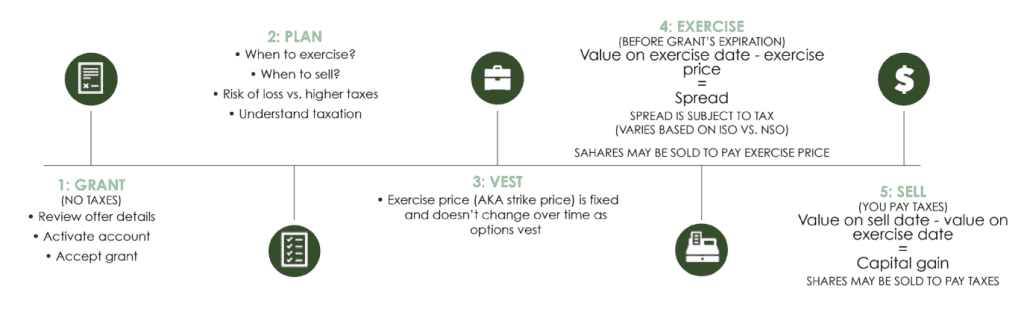

Stock Options and Their Lifecycle

The lifecycle of stock options is the same whether you have ISOs or NSOs:

Grant: you were given stock options upon hire. Perhaps you received additional grants over the years. If you haven’t already done so, activate your account on Solium, and accept your grant(s).

Plan: the IPO process will be an emotional roller coaster. Having a plan will help you mitigate the emotions.

Vest: how much time must elapse before you earn the right to exercise your options. The most common vesting schedule is 25% after one year, and then monthly or quarterly thereafter.

Exercise: once your options are vested, you have the right to buy (exercise) your company stock at a fixed price (strike price) at any point before the grant expires. Later in this article, you’ll learn a framework for deciding when to exercise your options.

Sell: once you’ve exercised your options, the final step is to sell the stocks.

Stock Option Economics

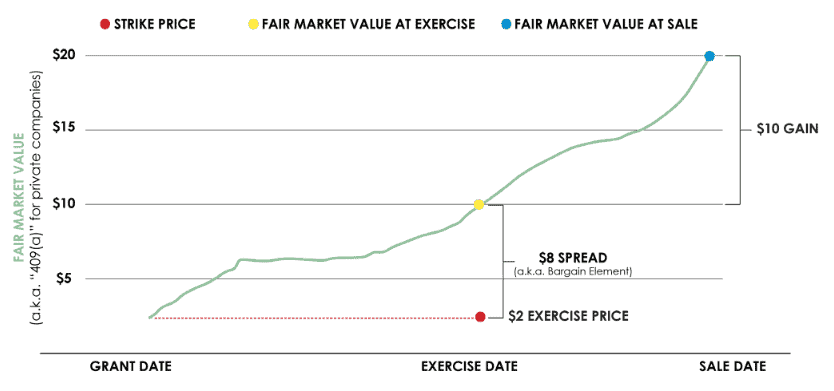

The way you make money from stock options, whether ISOs or NSOs, depends on your company’s “fair market value” at exercise and sale. “Fair market value” is a company’s share price. It’s easy to find the fair market value of a public company like Snowflake because its stock price is now public information.

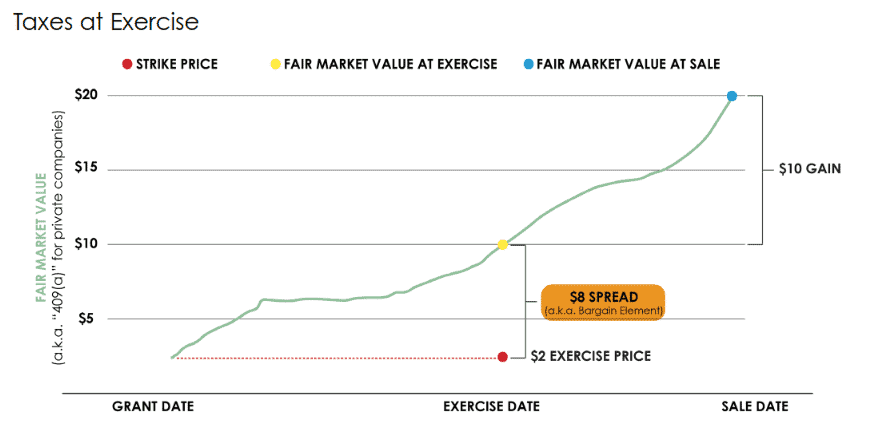

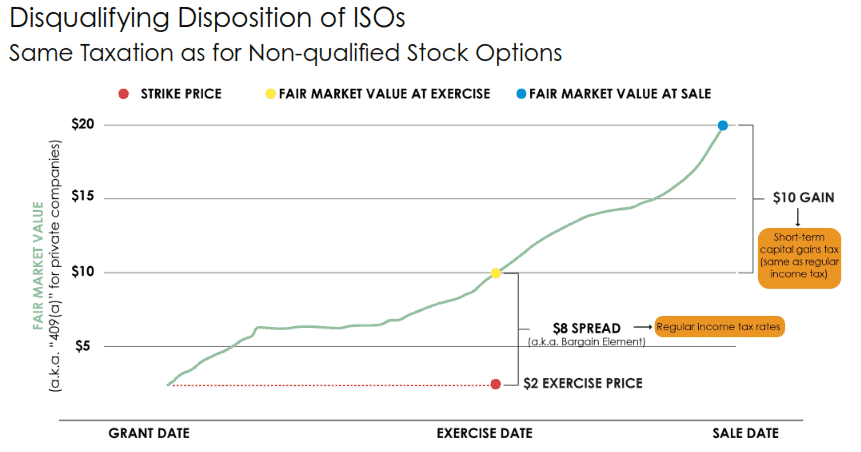

In this illustration, you’ve been granted stock options with a $2 per share exercise price (a.k.a. strike price; marked by the red dot). Let’s say you decided to exercise your stock options when Snowflake was valued at $10 per share (marked by the yellow dot).

In other words, you paid $2 for Snowflake stock that was worth $10 at the time. This $8 spread is also known as the bargain element, and I’ll discuss the taxation of the spread in the final section of this article.

Let’s say the fair market value has grown to $20 when you decide to sell – see the blue dot. (12/7/2020 note: Snowflake’s stock price continues to skyrocket and is nearly $389/share). Tax authorities consider the purchase price (a.k.a. cost basis) to be $10 ($2 exercise price + $8 bargain element). Therefore, your gain is $10 per share ($20 fair market value – $10 cost basis). I’ll discuss the taxation of the $10 gain in the final section of this article.

Decide When to Exercise Stock Options

One of the toughest decisions when it comes to your stock options is when to exercise.

Use one or both of the following frameworks to decide when to exercise:

- When intrinsic value > time value –> exercise

- When intrinsic value is a significant portion of your net worth –> exercise

Key Terminology: Intrinsic Value and Time Value

There are two components of stock option value:

- Intrinsic value (built-in profit)

- Time value (potential profit)

Calculate the intrinsic value by taking the current share price minus the exercise price. Let’s say your company’s stock is $50/share, and the exercise price is $10/share. Your built-in profit (before taxes) is $40. Some people forget to discount the intrinsic value of the stock option by the exercise price.

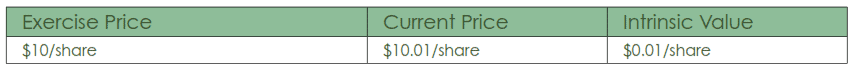

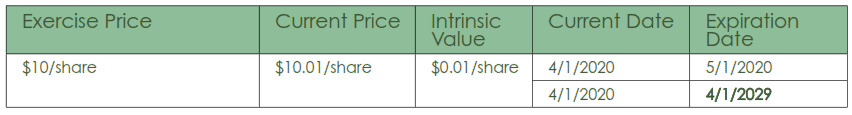

People often disregard the time value of their options. Consider this scenario:

At first, you may yawn at the $0.01 intrinsic value ($10.01 – $10). But add the following dates:

If you’re only a month away from the grant’s expiration, you’d be right to yawn. It’s unlikely the stock price will jump in a month, putting the option further “in the money” (e.g., higher intrinsic value).

However, when the grant’s expiration is 10 years away, there’s a far greater chance that the stock price will increase over time. There’s tremendous time value in the option. If the stock price climbs over the years, the beauty of stock options is that you decide when to exercise the option (e.g., when to buy the stock at $10/share).

How to Get Expert Help

A financial planner with expertise in equity compensation planning like myself can help you make the exercise decision in the context of your broader financial goals.

At the very least, before you exercise options, I recommend that you work with a tax professional to run a tax projection. The tax projection will quantify the AMT tax impact if you exercise and hold ISOs. Ideally this person should have experience with stock options; Minnie Lau, CPA is a great example.

When to Sell

We discussed the frameworks to determine when to exercise. The next step is to decide when to sell, which is a complex decision for ISOs. This is because of the tax benefits of “qualifying dispositions” of ISO shares where you get a tax break if you meet two special holding periods. I discuss the tax benefits of “qualifying dispositions” of ISOs in the next and final section.

Taxation of Incentive Stock Options (ISOs)

We’ll review taxes at exercise, and taxes at sale of the resultant shares.

This article assumes your options have vested. You’ve met the time-based requirement and have the right to exercise the options.

You can learn even more by downloading my free guide, Preparing for an IPO. The guide also covers how to prepare for the emotional roller coaster of the IPO process.

Taxes at Exercise

You’ve decided to buy Snowflake stock (exercise your stock options) for the fixed price in your grant agreement (strike price). The spread between: (a) the stock price on the exercise date, and (b) the strike price, is also known as the bargain element.

The taxation of the spread (bargain element) for ISOs can be summarized as follows:

- No “regular” income taxes

- No payroll taxes

- But the bargain element may be subject to Alternative Minimum Tax (AMT)

Building on the prior illustration, you paid $2 for SNOW stock that’s worth $10. The bargain element is $8:

The $8 per share profit is income for AMT purposes if you hold the shares past 12/31 in the year of exercise.

In terms of when you have to pay these taxes:

- No taxes are withheld when you exercise of ISOs.

- Be sure to set aside a tax reserve when you exercise ISOs. I help clients calculate this number. If you don’t have a financial planner, consult a tax professional for help. I mentioned Minnie Lau, CPA previously.

Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) rules are complicated. In a nutshell, you must calculate your tax bill twice: under the regular rules, and under the AMT rules. Each year, you must pay the greater of the two calculations.

Whether you must pay AMT depends on when you sell the shares resulting from ISO exercises:

- If you sell the shares the same year you exercised the ISO (a.k.a. disqualifying disposition), AMT doesn’t apply. Instead, the profit is taxed as compensation income (i.e., regular income taxes apply).

- If you sell the shares after 12/31, then the bargain element will count as income for AMT purposes. For example, if you exercise 1,000 ISOs on 8/1/2020, and you keep the shares past 12/31/2020, then you may have to pay AMT due 4/15/2021.

Five states also have AMT: California, Colorado, Connecticut, Iowa, and Minnesota.

Taxes at Sale

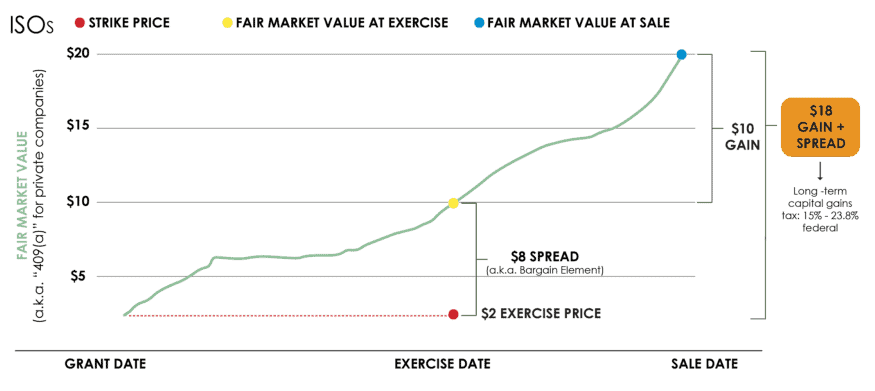

The beauty of ISOs is that you can convert the full $18 profit into long-term capital gain.

If the illustration above pertained to NSOs (Non-qualified Stock Options), only $10 is capital gain, and the remaining $8 is compensation income.

Special Holding Period Rules for ISOs

To convert the entire $18 into long-term capital gain, you must meet two holding periods. The sale date of the ISO shares must be:

- At least two years from the ISO grant date, and

- At least one year from the exercise date

The entire $18 per share profit is taxed at the lower federal long-term capital gains tax rate. This rate ranges from 15% to 23.8%. The exact rate depends on your filing status and income.

Regular income tax rates, in contrast, top out at 37%.

Note on California Capital Gains Tax

California doesn’t have a separate capital gains tax system. The same tax rate applies whether you have short-term or long-term capital gains. Your tax rate on the $18 profit will be 9.3% to 13.3%. The exact rate depends on your filing status and income.

If You Don’t Meet the Special Holding Period Rules: Disqualifying Disposition of ISOs

The “at least one year from exercise” rule is what trips up most ISO holders. If the date that you sell the company stocks is at least two years from grant date, but less than one year from the exercise date, then this is known as a “disqualifying disposition.” This means the taxation is the same as for NSOs. In other words, you effectively pay regular income taxes on the profit:

Warning Regarding Taxes and Disqualifying Disposition of ISOs

Remember that for ISOs, no taxes are withheld at exercise. For qualifying dispositions of ISOs, this isn’t a problem because you won’t owe regular income taxes or payroll taxes. (Although you may need to set aside cash for AMT).

But for disqualifying dispositions of ISOs, you’ll owe income taxes (federal and state). These taxes will NOT be withheld.

I can’t emphasize enough how important it will be to hire a financial planner, or at the very least a tax professional, before you exercise stock options. This will help you avoid a surprise tax bill on April 15th.

To learn more about the Snowflake IPO, here are all of the posts in this series:

- Blessings (and Burdens) of a Financial Windfall

- Donating Snowflake Stock: Help Charities, and Benefit Financially

- Snowflake Incentive Stock Options

- Snowflake’s Lock-up is Ending: Prepare for an Emotional Roller Coaster

- Snowflake RSUs

- Which Financial Professional Should You Hire?

- Prepare for the Full Release in March 2021