October is National Estate Planning Awareness Month. All adults, including young adults, singles, and the child-free, should have an estate plan. Estate planning is about ensuring your wishes are honored upon your death or incapacitation. Even if you’re single and/or child-free, you may have other loved ones who are relying on you. Some examples include:

- Aging parents

- A niece, nephew, or nibling

- Pets: your cat, dog, or other beloved animal

Six in ten adults don’t have a will. Be mindful of the legacy you want to leave. And think through how to care for your loved ones if you die prematurely or become incapacitated.

Estate Planning 101

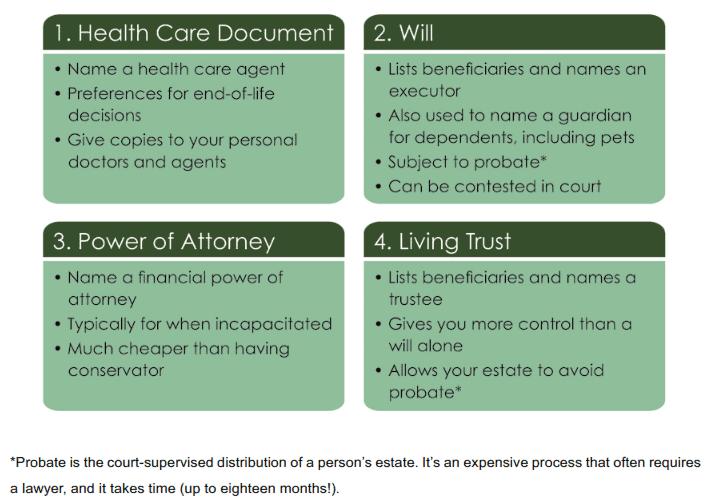

An estate plan contains four key documents:

Appoint a trusted friend or family member to carry out your wishes in these documents. You can select the same person to fulfill all of the roles. Talk to the person first and make sure they’re willing to serve.

At a bare minimum, set up your Health Care Document.

If you have minor children in your care, having a will is critical because this document names the guardian.

Note: a living trust is an optional document. If you don’t have assets that are subject to probate, you probably could skip a living trust. But if you’re concerned about family in-fighting over your estate, you probably should set up a living trust. See the Jerry Lewis story below.

Celebrity Examples

Power of Attorney: Britney Spears

From 2008 to 2021, Britney Spears’ father was appointed as her conservator. This meant that her father had the legal authority to make all decisions about her finances and health. She continued to earn millions of dollars during this nearly 14-year period, but she was unable to directly access her money. The process of requesting conservatorship requires going to court, and it’s expensive and stressful.

A Power of Attorney (also known as Financial Power of Attorney) document is much cheaper to set up, and you choose a trusted friend or relative to serve as your power of attorney.

In 2019, a separate person was appointed as “conservator of the person” to manage her healthcare decisions and other personal affairs. Her father, Jamie Spears, continued to manage the financial affairs (“conservator of the estate”). Britney Spears requested an immediate end to the entire conservatorship. Although Jamie Spears announced in a press release that he would step down, a court filing indicated that he was fighting to remain the conservator. This LA Times article describes how parents typically aren’t paid to serve as the conservator. But Jamie Spears had been collecting $16,000 a month since 2009, monthly office costs, and a percentage of the gross revenues from Britney Spears’ tours and multiyear Las Vegas residency. And she paid for two sets of attorney fees (for herself and the conservator) for lawyers she wasn’t not allowed to choose herself due to the conservatorship.

Her experience has cast a harsh spotlight on California’s conservatorship laws. California is one of more than 40 states that lack comprehensive bills of rights for people placed under conservatorship.

Health Care Document: Tim Conway

Tim Conway of The Carol Burnett Show died in May 2019 after a long illness. In the last year of his life, Conway was allegedly unable to make his own health care decisions. His wife and a daughter from a previous marriage battled publicly over his care. They reached a resolution in the end. But I’m sure each would have preferred spending more time with their husband/father rather than fighting in court. Tim Conway could have avoided the family acrimony altogether if he had a Health Care Document that clearly stated his end-of-life wishes, and named his health care agent.

Will: Prince

Prince died without a will. But the battle over his estate continued for years. Prince’s situation isn’t uncommon as six in ten adults don’t have a will. Most Americans who die without a will, however, don’t leave behind vast and complex estates. He likely was worth hundreds of millions of dollars when he died. A will alone wouldn’t have hastened the estate settlement process. But a will plus a trust would have protected Prince’s privacy, and he would have had ultimate control over Paisley Park, his music catalog, and other important parts of his legacy.

Will (But No Trust): Jerry Lewis

Comedian Jerry Lewis died in 2017. He had a complicated personal life with children from multiple marriages, and an out-of-wedlock child. Jerry Lewis’ will allegedly excluded his children from the first marriage, and ignored his out-of-wedlock child altogether. If he truly wished to leave his entire estate to his second wife and daughter from that marriage, he would have been better off setting up a trust. His celebrity, wealth, and children from multiple relationships were invitations for potential conflict. A trust would have protected his privacy because a trust avoids probate, a court process which is public record. A trust becomes irrevocable upon death, but a will can be contested in court. His children have the legal right to contest his will, and the executor of his estate (likely his second wife) could face years of court battles and family infighting.

Final Steps

The last step to make your estate plan official is signing and notarizing the paperwork in-person. Online/remote notarization isn’t allowed in California, unfortunately. But if you’re uncomfortable going into your attorney’s office, ask if they can be flexible. For example, before vaccinations were widely available, my clients’ attorney set up a card table in her driveway outside. Fortunately, most of the estate planning work before the singing can be done by email and phone/Zoom.

But your work isn’t done. You need to follow your attorney’s “funding instructions” to update beneficiaries and retitle assets in the name of your living trust. I help clients with this critical implementation step, which many people ignore.

Let People Know Where to Find Your Documents

Once you’ve finalized your documents, provide the name of your attorney to your executor and Power of Attorney.

If you’d like, you can also prepare letters of instruction with details like:

- Where to find online passwords for financial accounts.

- The location of bank and investment accounts.

- Detailed instructions on caring for surviving pets.

Summary

- At a bare minimum, set up your Health Care Document (a.k.a. advance health care directive).

- Also set up your will, and financial power of attorney.

- A trust may make sense if you want ultimate control.

- Don’t forget your pets!