RSUs (restricted stock units) are the most common form of equity compensation at public companies, and late-stage private companies. Take an in-depth look at frequently asked questions on how RSUs work, what to do with the shares, and how taxes play a key role. Learn how a company becoming publicly-traded impacts RSUs. Continue reading this page, or use the links to the left to jump to a specific section.

How do restricted stock units work?

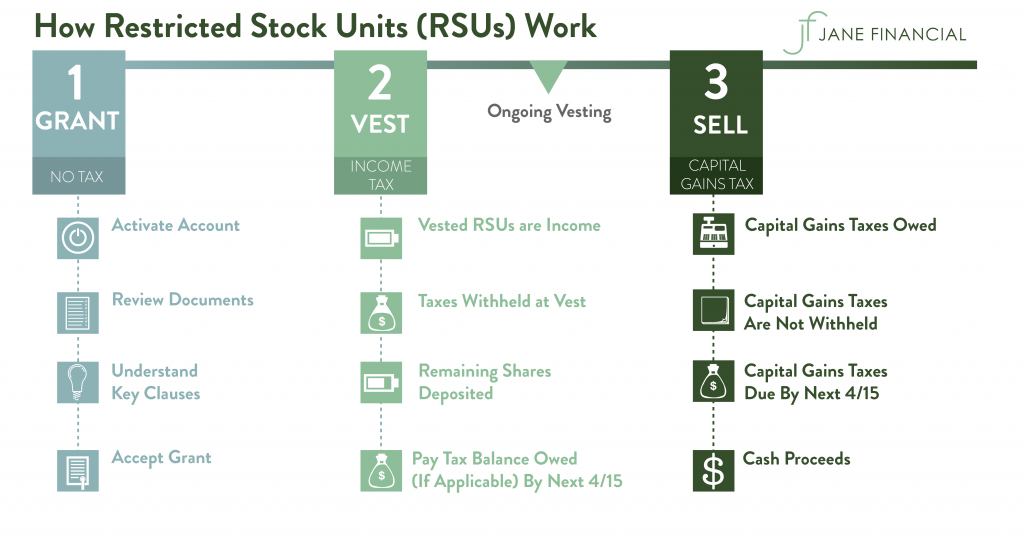

Restricted stock units (RSUs) are a form of equity compensation. The vesting schedule dictates how many shares of company stock you earn, and when. You pay income taxes on the value of the RSUs as they vest. And you pay capital gains taxes when you sell the shares.

At Grant

Let’s say you receive a job offer from a publicly-traded company that includes a $600,000 RSU grant:

- Your company calculates the quantity of RSUs (usually based on the average stock price over the most recent 20-30 day period).

- If the stock price is $100, for example, you will receive 6,000 RSUs.

- But you’re not paid 6,000 shares on Day One due to the vesting schedule.

- A common vesting schedule is over four years: 25% vest after one year (“25% cliff”), and quarterly thereafter. In this example, you’d receive 1,500 shares of company stock after one year, and then 375 shares every quarter for the next 12 quarters (three years).

When RSUs Vest: Calculation of RSU Income

When you receive the 1,500 stocks after year one, the value of these shares is taxed as income. If the stock price rises to $105, the RSU income is $157,500 (1,500 * $105). And every RSU tranche vesting quarterly thereafter is income.

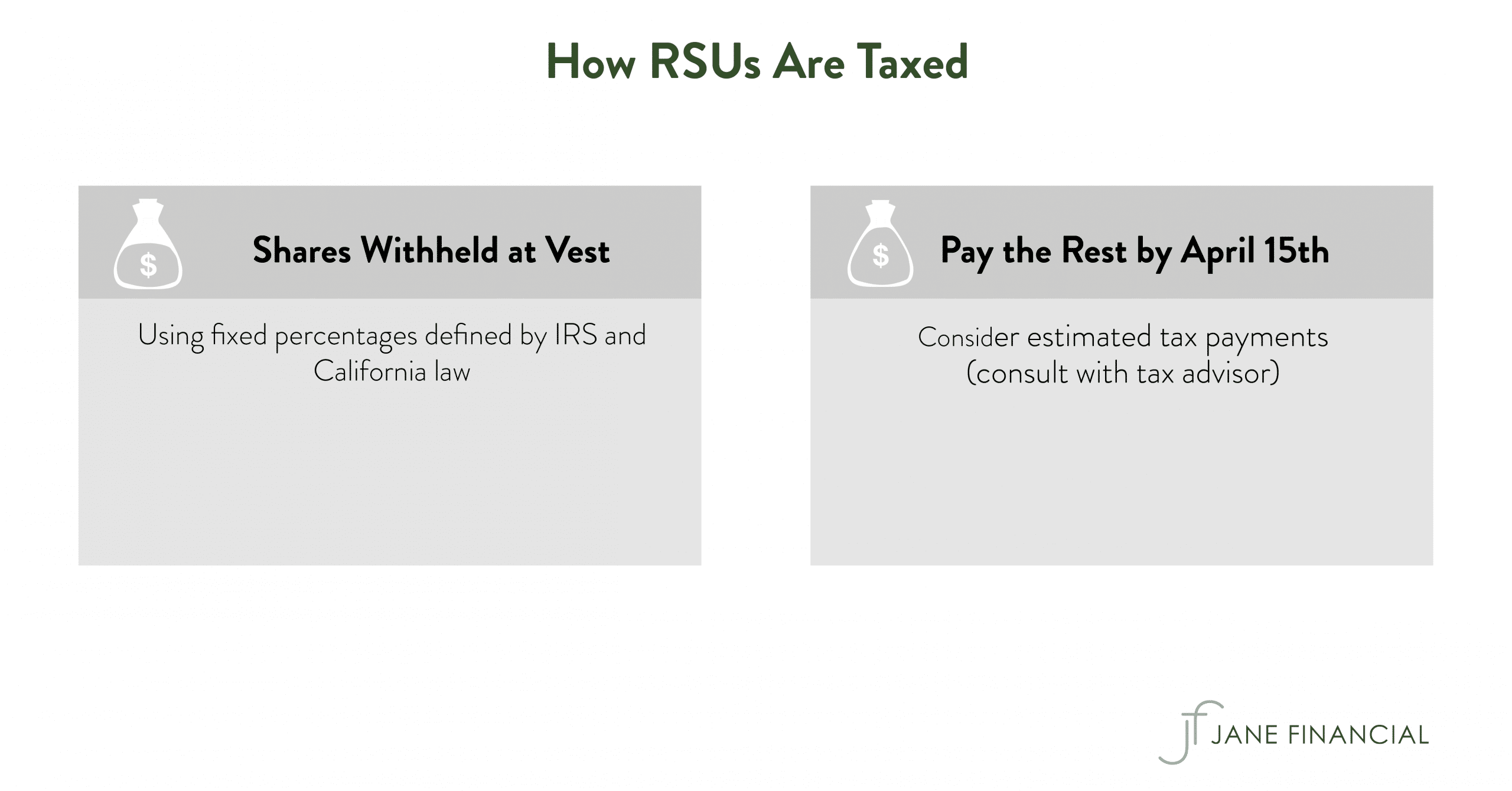

Payment of RSU Taxes

RSUs, commissions, and bonuses are examples of non-paycheck income broadly known as “supplemental wages.” Part of the taxes are paid when the non-paycheck income is received, and the rest is due by the following April 15th.

To cover the tax payment when the RSUs vest, your employer must withhold taxes on your behalf:

- Federal income tax: 22% (37% once your supplemental wages exceed $1,000,000)

- California income tax: 10.23%

- Medicare tax: 1.45%

- Additional Medicare tax: 0.9% (once your total wages exceed $200,000)

- Social Security tax: 6.2% (up to the wage limit)

- California State Disability Insurance: 1.2% (up to the wage limit). If you don’t live in California, your locality may have its own version of state disability or other payroll taxes.

By next April 15th, you must pay the balance due, if applicable. Believe it or not, the 22% federal and 10.23% California withholdings may not cover your full tax liability. Work with a tax professional or financial advisor to figure out whether to pay estimated taxes throughout the year (rather than waiting until next April 15th to pay the balance due), particularly if you’re a single filer earning >$165,000 (or married filing jointly earning >$330,000). Otherwise, you risk incurring a late payment penalty from the IRS and California FTB.

RSU Net Settlement

This refers to your equity plan administrator withholding shares for taxes as soon as your RSUs vest. This is also known as sell-to-cover settlement.

The dollar value of the total taxes divided by the stock price determines how many shares are withheld to be sold for taxes in the RSU net settlement, aka sell-to-cover settlement.

The RSU net shares are then deposited to your equity account 2-3 business days after the vesting date.

Restricted Stock Units (RSUs) from Jane Yoo, CFP®, MBA.

What should I do with company stock resulting from RSUs

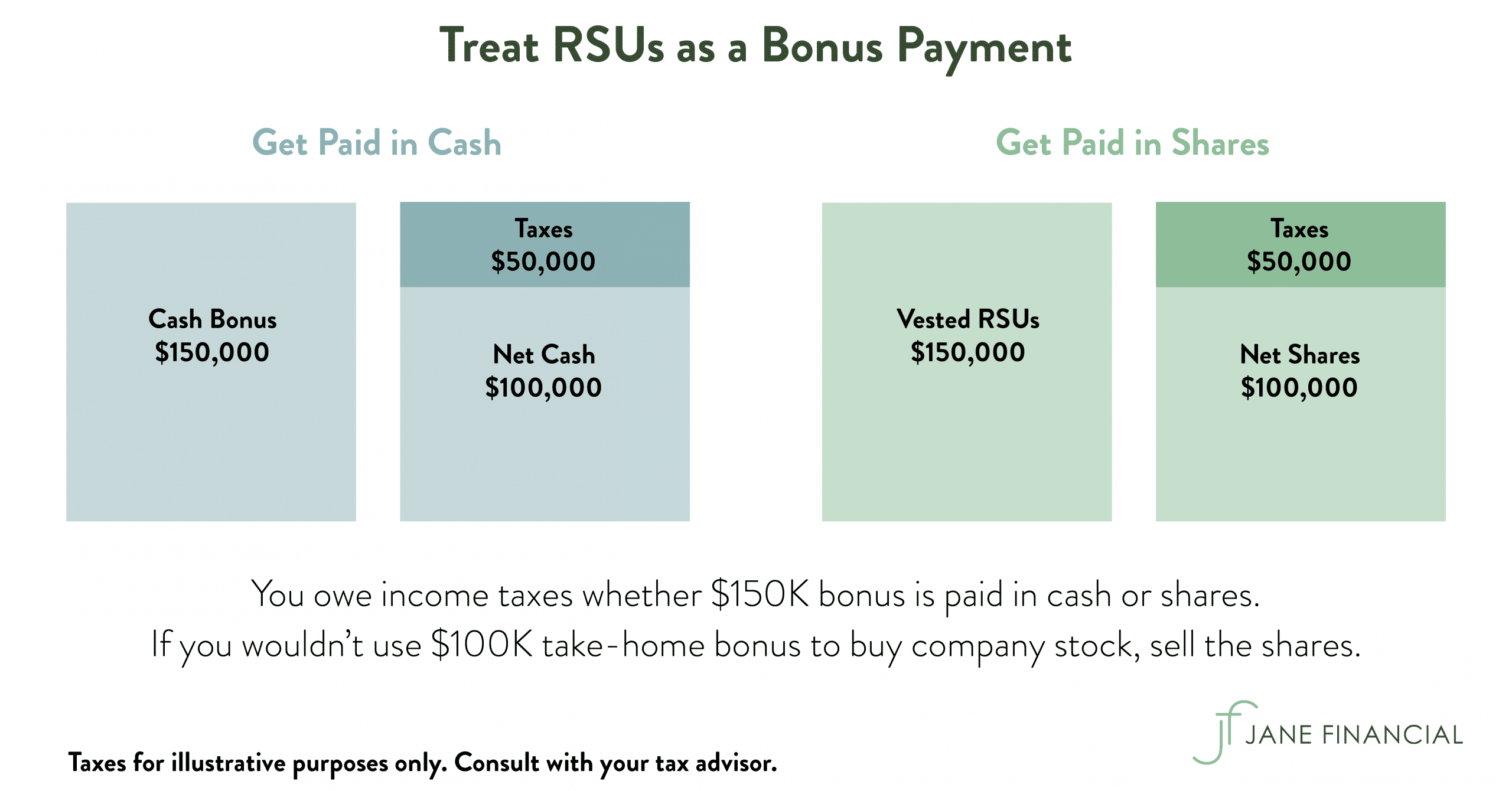

If you wouldn’t use a bonus to buy your company’s stock, convert the stock bonus (aka RSUs) into cash by selling the shares immediately. You may need to reserve some of the cash for taxes due next April 15th.

You may be tempted to hold onto your company stock because you believe in your company’s prospects. I frame the issue as follows: “If your company paid $150,000 cash bonus this year, would you use this money to purchase company stock?” Most people quickly answer, “No, I’d keep the cash” because holding onto the vested RSU shares means you’re effectively using the cash bonus to purchase company stock.

RSUs are a form of compensation. They’re a bonus payment that happens to be paid in stock rather than cash. You pay income taxes on the $150,000, whether it’s in the form of cash or RSUs.

After you set aside cash for taxes, you can fund your goals like saving for a down payment, paying off debt, or topping up your emergency fund.

I wrote an in-depth article reviewing the misconceptions vs. realities of RSUs, and how a financial planner can help you determine whether to keep, sell, or donate your company stock.

What happens to RSUs when a company goes public?

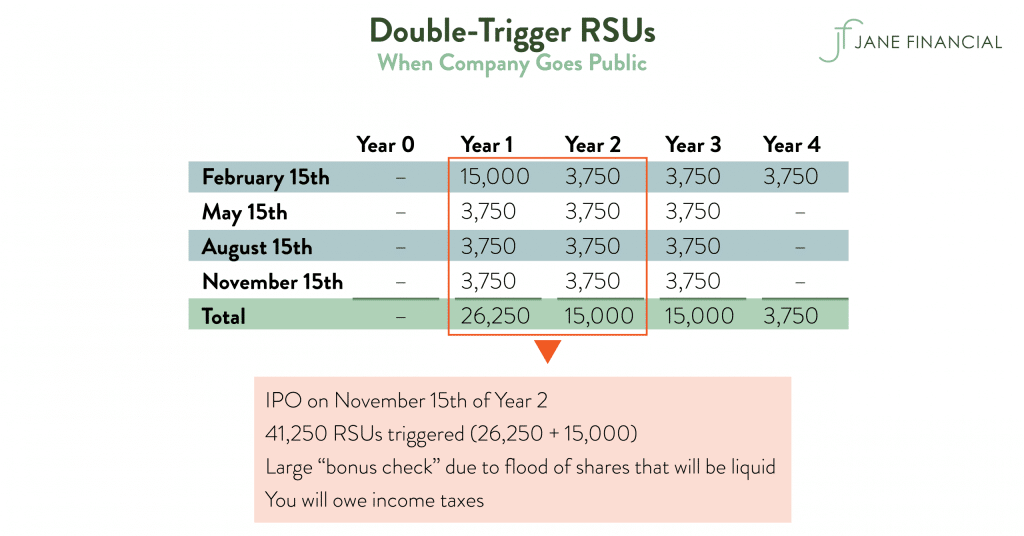

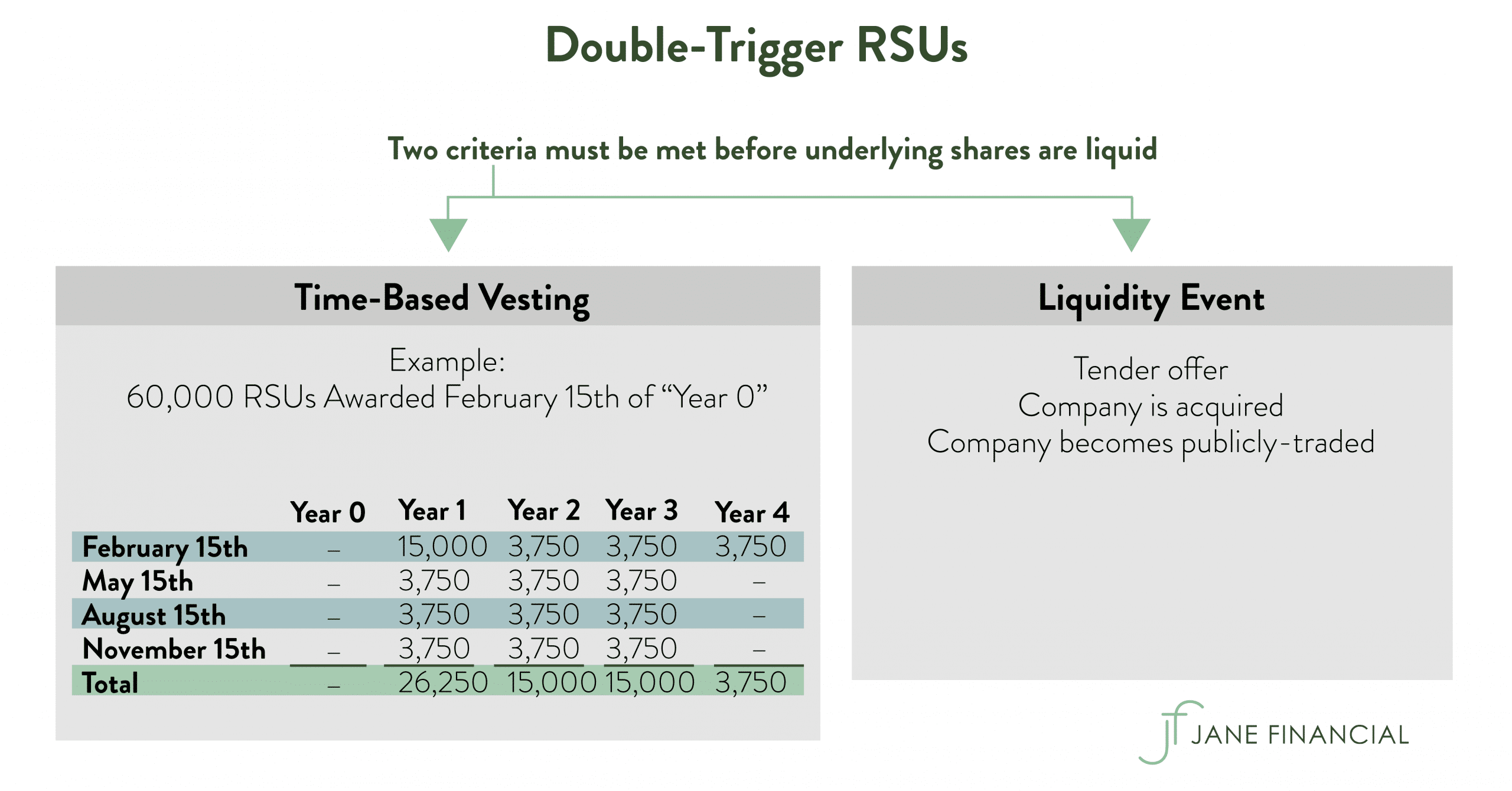

Your double-trigger RSUs will become outright shares when you meet two criteria:

- Time-based requirement: you have to work for a certain period of time. For example, 25% of your grant vests after one year, and then 6.25% per quarter over the next three years, AND

- Liquidity event requirement: for example, your company must go public (e.g., IPO), or get acquired.

If you worked at a pre-IPO company for a few years, you’ll have a gigantic “bonus check” when your company goes public due to the flood of shares that will finally be liquid. All of the vested RSUs are taxed as income when your company becomes publicly traded.

Imagine you were issued 60,000 double-trigger RSUs at a pre-IPO company (February 15th of “Year 0”). If 25% of the grant vests after one year, the 15,000 vested RSUs don’t yet count as income even though you now own 15,000 stocks. These 15,000 shares are illiquid because the company isn’t yet public.

If your company goes public on November 15th of Year 2, your 41,250 stocks are liquid now that both criteria are met.

Note that there are income tax and lockup considerations for RSUs.

Facebook pioneered the use of double-trigger RSUs, which are far more common than single-trigger RSUs. Check your RSU agreement to verify which type of RSUs you have. Refer to the “Vesting Schedule” section for details.

Single-trigger RSUs

Unlike double-trigger RSUs, there’s only the time-based criteria for your vested RSU shares to be counted as income. You pay income taxes on the RSUs as they vest even though your company is still private. Since you can’t sell shares to pay the tax bill, you must cough up the cash. Squarespace was a pre-IPO company that issued single-trigger RSUs, and they fortunately withheld enough shares to fully satisfy the tax requirement; their employees didn’t have to scramble to pay taxes the following April 15th.

Check your RSU agreement to verify which type of RSUs you have. Refer to the “Vesting Schedule” section for details. If you have single-trigger RSUs at a private company, ask your employer how to cover taxes (will they withhold shares for you, or do you have to send a check to pay for taxes?).

Can I donate restricted stock units to charity?

You can’t donate unvested RSUs. But you can donate vested RSUs to qualified charitable organizations since you own the company stocks outright.

It’s best to donate stocks that are at a gain and were purchased at least one year ago. If you’re subject to blackout periods, ask your stock admin team if you’re allowed to donate company stock outside of the trading window.

Donating your company stock is a win-win. Your favorite charitable organizations receive much-needed funds. And you benefit financially in two ways:

- Donating your company stock reduces your concentration in your company stock.

- Donating your company stock reduces your taxes in two ways.

Can I gift RSUs to someone (and get the tax writeoff)?

You can gift vested RSUs because you own the company stock outright. Financial gifts are tax-deductible only if the recipient is a qualified charitable organization.

Be aware of gift tax issues. You can gift up to $15,000 in 2021 to an individual without gift tax consequences (“annual exclusion gift”). If you have two siblings, you can give $15,000 of vested RSUs to each sibling for a total of $30,000. You can gift more than the $15,000 annual exclusion amount, but you’ll need to file to report the gifts on your tax return. You don’t have to pay gift taxes until you give away more than the lifetime gift limit ($11.7M in 2021).

The recipient doesn’t have to worry about taxes until they sell the stocks, at which point capital gains taxes may apply. Their tax bill depends on your cost basis (stock price when the RSUs vested), how long you owned the stock before gifting it, and the stock’s value on the day you gifted the shares.

How are RSUs taxed?

At IPO?

Assuming you have double-trigger RSUs, the value of the RSUs on IPO day will be taxed as income. If you worked at a pre-IPO company for a few years, you’ll have a gigantic “bonus check” on IPO day due to the flood of shares that have finally vested after meeting both requirements:

- Time-based: vesting schedule

- Liquidity event: your company’s IPO

When RSUs Vest: Calculation of RSU Income

Let’s say 6,000 RSUs vest on IPO day. I usually see companies use the IPO price to measure the taxable RSU income generated. Lyft went public on March 29, 2019 at $72, so in this hypothetical example, there was $432,000 taxable income.

Affirm went public on January 13, 2021, pricing its IPO at $49 per share. But they used the $96.36 closing price to measure the taxable income. The 6,000 RSUs translated to $578,160 taxable income (rather than $294,000 if the IPO price was used).

Payment of RSU Taxes

RSUs, commissions, and bonuses are examples of non-paycheck income broadly known as “supplemental wages.” Part of the taxes are paid when the non-paycheck income is received, and the rest is due by the following April 15th.

To cover the tax payment when the RSUs vest, your employer must withhold taxes on your behalf:

- Federal income tax: 22% (37% once your supplemental wages exceed $1,000,000)

- California income tax: 10.23%

- Medicare tax: 1.45%

- Additional Medicare tax: 0.9% (once your total wages exceed $200,000)

- Social Security tax: 6.2% (up to the wage limit)

- California State Disability Insurance: 1.2% (up to the wage limit). If you don’t live in California, your locality may have its own version of state disability or other payroll taxes.

The dollar value of the total taxes divided by the stock price determine how many shares are withheld to be sold for taxes in the RSU net settlement, aka sell-to-cover settlement.

The RSU net shares are then deposited to your equity account 2-3 business days after the vesting date.

By next April 15th, you must pay the balance due, if applicable. The default 22% federal and 10.23% California withholdings may not cover your full tax liability. Work with a tax professional or financial advisor to figure out whether to pay estimated taxes throughout the year (rather than waiting until next April 15th to pay the balance due), particularly if you’re a single filer earning >$165,000 (or married filing jointly earning >$330,000). Otherwise, you risk incurring a late payment penalty from the IRS and California FTB.

If you have single-trigger RSUs

You already paid income taxes when the RSUs vested (you met the time-based requirement). You wouldn’t owe income taxes on the RSUs that vested before IPO day.

RSUs that vest after IPO day continue to be taxed as income.

Pre-IPO?

Double-trigger RSUs are not taxed pre-IPO. Instead, they are taxed when two criteria are met:

- Time-based requirement (vesting schedule).

- Liquidity event requirement (e.g., IPO).

If you have single-trigger RSUs

Single-trigger RSUs are uncommon. When Squarespace was a private company, they were a rare example that issued RSUs that only had a single trigger (the time-based requirement, aka service requirement). Squarespace withheld enough shares to fully satisfy the tax requirement, and employees weren’t hit by a surprise tax bill the following April 15th.

Look at your equity agreement to see if you have single-trigger RSUs at a private company, and ask your employer how to cover taxes (will they withhold shares for you, or do you have to send a check to pay for taxes?).

For private companies?

Double-trigger RSUs are not taxed while a company is private. Instead, they are taxed when two conditions are true:

- Time-based requirement (vesting schedule)

- Liquidity event requirement: your company must IPO.

If you have single-trigger RSUs

Single-trigger RSUs are uncommon. When Squarespace was a private company, they were a rare example that issued RSUs that only had a single trigger (the time-based requirement, aka service requirement). Squarespace withheld enough shares to fully satisfy the tax requirement, and employees weren’t hit by a surprise tax bill the following April 15th.

Look at your equity agreement to see if you have single-trigger RSUs at a private company, and ask your employer how to cover taxes (will they withhold shares for you, or do you have to send a check to pay for taxes?).

In California?

California taxes vested RSUs as income. California taxes RSU income in two steps:

- At vest: your company is required to withhold a fixed 10.23% tax for California income tax (amongst several other taxes).

- Next April 15th: for very high earners, the 10.23% default withholding rate may not cover your full tax liability. You pay the balance due when you file your tax return the following spring. Work with a tax professional or financial advisor to figure out whether to pay estimated taxes throughout the year to California (rather than waiting until next April 15th to pay the balance due), particularly if you’re a single filer in California >$360,000 (or married filing jointly earning >$720,000). Otherwise, you risk incurring a late payment penalty from the California FTB. And even if you don’t need to pay estimated taxes to California, you may need to pay them to the IRS. Consult with a tax professional or financial advisor.

How is RSU state tax calculated?

California taxes vested RSUs as income. California taxation of RSU income happens in two steps:

- At vest: your company is required to withhold a fixed 10.23% tax for California income tax (amongst several other taxes).

- Next April 15th: for very high earners, the 10.23% default withholding rate may not cover your full tax liability. You pay the balance due when you file your tax return the following spring. Work with a tax professional or financial advisor to figure out whether to pay estimated taxes throughout the year to California (rather than waiting until next April 15th to pay the balance due), particularly if you’re a single filer in California >$360,000 (or married filing jointly earning >$720,000). Otherwise, you risk incurring a late payment penalty from the California FTB. And even if you don’t need to pay estimated taxes to California, you may need to pay them to the IRS. Consult with a tax professional or financial advisor.

How are RSUs taxed when I move to a new state?

You will not be able to completely escape California taxation if you have RSUs that were granted while you were a California resident. If you move to a lower-tax state, be prepared for CA taxes, whether those RSUs are: (a) from a public company, or (b) double-trigger RSUs at a private company that’s expecting a liquidity event. California wants its tax revenue for RSUs granted while you were a California resident. You must calculate the number of days you worked in California between the RSU grant date and vest date. The California FTB taxes the portion of RSU income that’s California source.

You Must Prove You Left California

Permanently leaving California isn’t straightforward. The California FTB is notoriously aggressive about auditing taxpayers who move to a no-tax state like Nevada or Texas. The FTB uses 29 factors to determine whether you’re still a resident under California law.

Let’s say you’ve truly established Nevada residency. You *still* can’t escape California taxes on California source income, however. This includes RSUs that were awarded when you were living in the Bay Area.

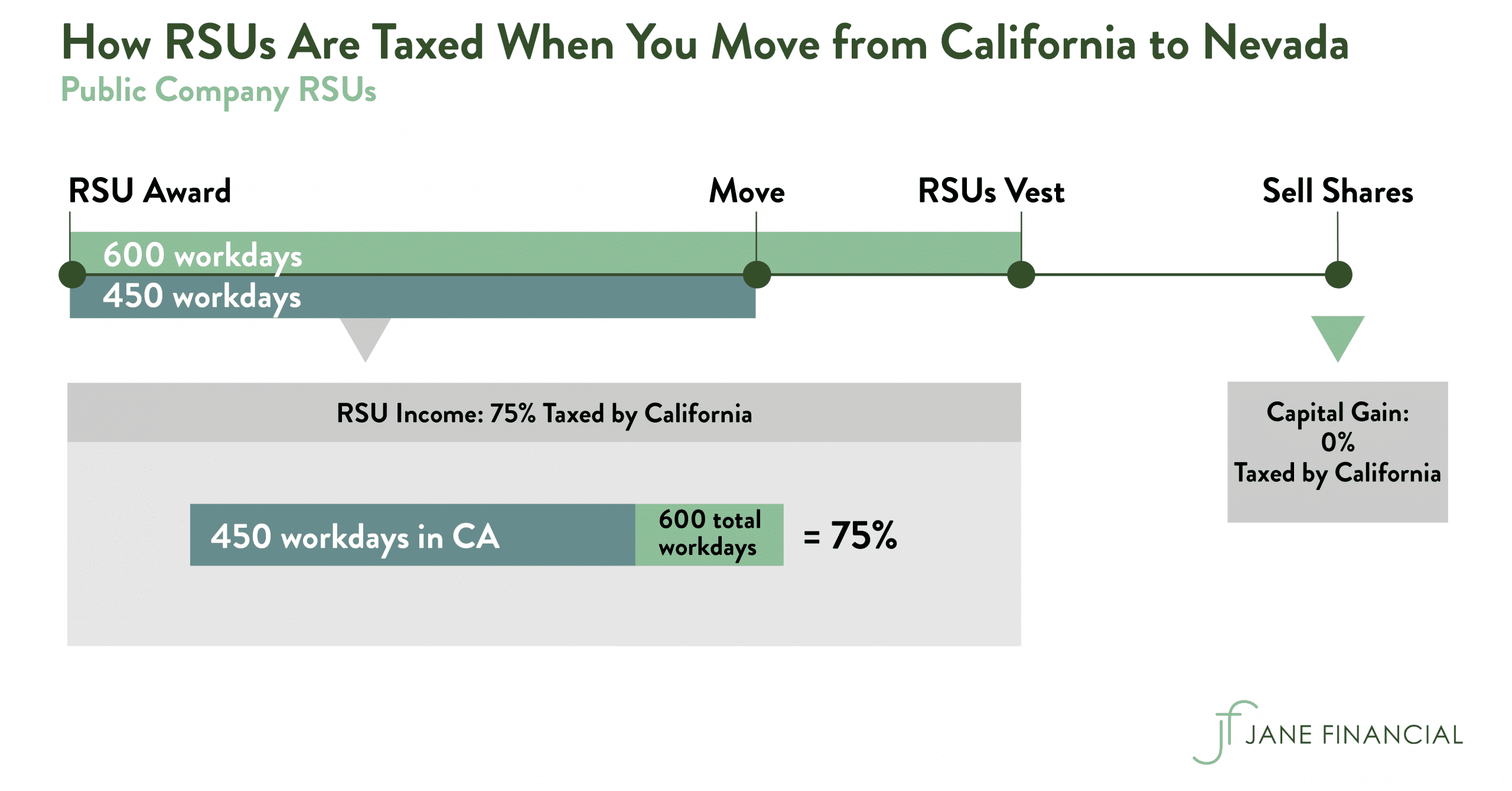

RSUs at a Public Tech Company in California

Example: you were awarded an RSU grant while living in SF, and you moved to Incline Village, NV before the grant fully vested. The RSU tranche that vests after your move is worth $50,000. If you’re thinking this $50,000 is tax-free income because NV doesn’t have income tax, you’re mistaken. Instead, California outlines in Publication 1004 that you must allocate a portion of the $50,000 income to California based on the time worked in the state:

# of workdays in California between grant and vest / # of total workdays between grant and vest

To calculate workdays, exclude holidays, weekends, and vacation days using the “Count only workdays” filter.

In this example, my interpretation of Publication 1004 is that 75% of the $50,000 income is California source. Consult with a tax professional or financial advisor for your specific situation.

You need to repeat this calculation for every subsequent tranche that vests from all RSU grants that were awarded while you lived in California. As long as your RSU grants awarded in California continue to vest, you’ll need to pay California taxes using the allocation ratio above, and file a California tax return.

This is a difficult and tedious process, and I strongly suggest you work with a tax professional who’s familiar with equity compensation and can help you with the complexities of California taxes.

Upon sale of the net shares, the capital gain is not subject to California gains tax.

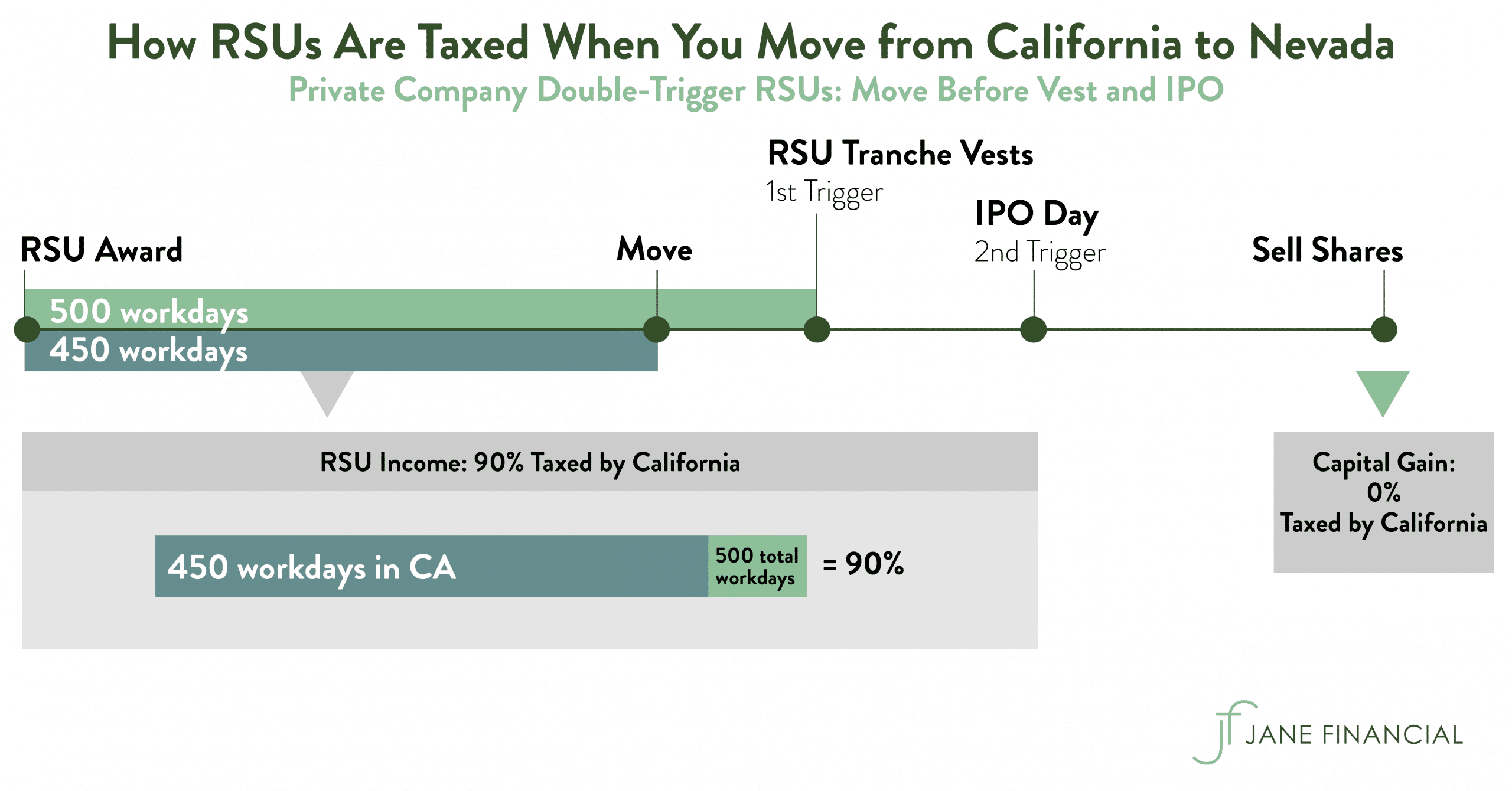

Double-trigger RSUs at a Private Company: Move Between Vest and IPO

Example: you were awarded a double-trigger RSU grant while living in SF, and you moved to Incline Village, NV after the first trigger, but before the second trigger on “IPO Day,” a catch-all phrase for a company’s liquidity event (going public by traditional IPO, direct listing, or SPAC merger; tender offer; or acquisition).

Assume the large RSU tranche that vests on IPO Day is worth $750,000. If you’re thinking this $750,000 is tax-free income because NV doesn’t have income tax, you’re mistaken. Instead, California outlines in Publication 1004 that you must allocate a portion of the $750,000 income to California based on the time worked in the state:

# of workdays in California between grant and vest / # of total workdays between grant and vest

To calculate workdays, exclude holidays, weekends, and vacation days using the “Count only workdays” filter.

Income is measured on IPO day when the RSUs meet both criteria:

- Time-based requirement (trigger #1, which occurred before the move), and

- Liquidity event (trigger #2, which occurred after the move)

My conservative interpretation of Publication 1004 is that 90% of the $750,000 income is California source because you lived in California when the time-based vesting occurred. Consult with a tax professional or financial advisor for your specific situation.

You need to repeat this calculation for every subsequent tranche that vests from all RSU grants that were awarded while you lived in California. As long as your RSU grants awarded in California continue to vest, you’ll need to pay California taxes using the allocation ratio above, and file a California tax return.

This is a difficult and tedious process, and I strongly suggest you work with a tax professional who’s familiar with equity compensation and can help you with the complexities of California taxes.

Upon sale of the resulting shares, the capital gain is not subject to California gains tax.

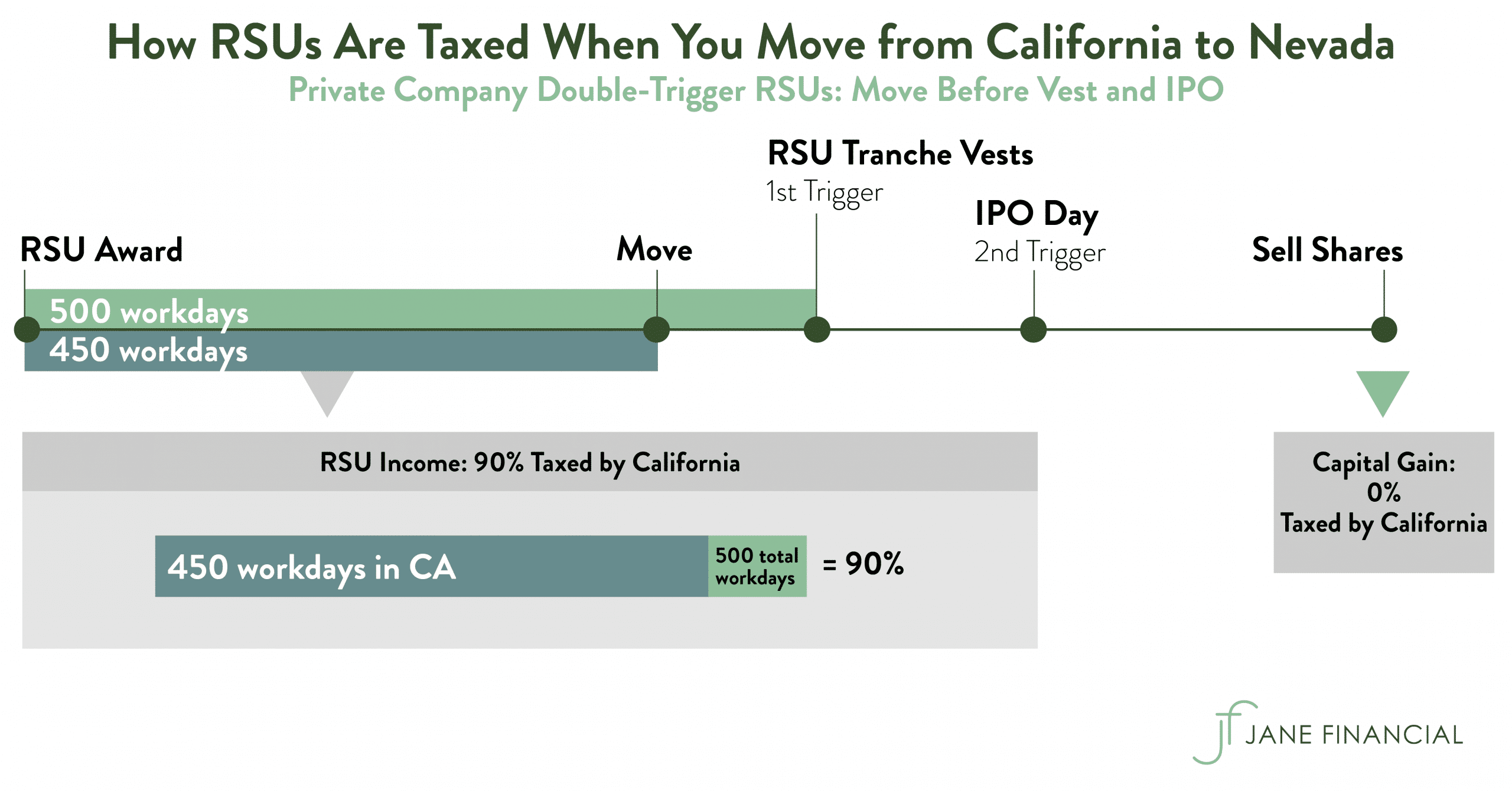

Double-trigger RSUs at a Private Company: Move Before Vest and IPO

Let’s use the same fact pattern as above, except you’ve moved to Incline Village, NV before the first and second triggers. If you’re thinking the $750,000 income on IPO Day is tax-free income because NV doesn’t have income tax, you’re mistaken. Instead, California outlines in Publication 1004 that you must allocate a portion of the $750,000 income to California based on the time worked in the state:

# of workdays in California between grant and vest / # of total workdays between grant and vest

To calculate workdays, exclude holidays, weekends, and vacation days using the “Count only workdays” filter.

My interpretation of Publication 1004 is that 100% of the $750,000 income is California source because you lived in California when the time-based vesting occurred. Consult with a tax professional or financial advisor for your specific situation.

You need to repeat this calculation for every subsequent tranche that vests from all RSU grants that were awarded while you lived in California. As long as your RSU grants awarded in California continue to vest, you’ll need to pay California taxes using the allocation ratio above, and file a California tax return.

This is a difficult and tedious process, and I strongly suggest you work with a tax professional who’s familiar with equity compensation and can help you with the complexities of California taxes.

Upon sale of the net shares, the capital gain is not subject to California gains tax.

At IPO?

Assuming you have double-trigger RSUs, the value of the RSUs on IPO day will be taxed as income. If you worked at a pre-IPO company for a few years, you’ll have a gigantic “bonus check” on IPO day due to the flood of shares that have finally vested after meeting both requirements:

- Time-based: vesting schedule

- Liquidity event: your company’s IPO

When RSUs Vest: Calculation of RSU Income

Let’s say 6,000 RSUs vest on IPO day. I usually see companies use the IPO price to measure the taxable RSU income generated. Lyft went public on March 29, 2019 at $72, so in this hypothetical example, there was $432,000 taxable income.

Affirm went public on January 13, 2021, pricing its IPO at $49 per share. But they used the $96.36 closing price to measure the taxable income. The 6,000 RSUs translated to $578,160 taxable income (rather than $294,000 if the IPO price was used).

Payment of RSU Taxes

RSUs, commissions, and bonuses are examples of non-paycheck income broadly known as “supplemental wages.” Part of the taxes are paid when the non-paycheck income is received, and the rest is due by the following April 15th.

To cover the tax payment when the RSUs vest, your employer must withhold taxes on your behalf:

- Federal income tax: 22% (37% once your supplemental wages exceed $1,000,000)

- California income tax: 10.23%

- Medicare tax: 1.45%

- Additional Medicare tax: 0.9% (once your total wages exceed $200,000)

- Social Security tax: 6.2% (up to the wage limit)

- California State Disability Insurance: 1.2% (up to the wage limit). If you don’t live in California, your locality may have its own version of state disability or other payroll taxes.

The dollar value of the total taxes divided by the stock price determine how many shares are withheld to be sold for taxes in the RSU net settlement, aka sell-to-cover settlement.

The RSU net shares are then deposited to your equity account 2-3 business days after the vesting date.

By next April 15th, you must pay the balance due, if applicable. The default 22% federal and 10.23% California withholdings may not cover your full tax liability. Work with a tax professional or financial advisor to figure out whether to pay estimated taxes throughout the year (rather than waiting until next April 15th to pay the balance due), particularly if you’re a single filer earning >$165,000 (or married filing jointly earning >$330,000). Otherwise, you risk incurring a late payment penalty from the IRS and California FTB.

If you have single-trigger RSUs

You already paid income taxes when the RSUs vested (you met the time-based requirement). You wouldn’t owe income taxes on the RSUs that vested before IPO day.

RSUs that vest after IPO day continue to be taxed as income.

Pre-IPO?

Double-trigger RSUs are not taxed pre-IPO. Instead, they are taxed when two criteria are met:

- Time-based requirement (vesting schedule).

- Liquidity event requirement (e.g., IPO).

If you have single-trigger RSUs

Single-trigger RSUs are uncommon. When Squarespace was a private company, they were a rare example that issued RSUs that only had a single trigger (the time-based requirement, aka service requirement). Squarespace withheld enough shares to fully satisfy the tax requirement, and employees weren’t hit by a surprise tax bill the following April 15th.

Look at your equity agreement to see if you have single-trigger RSUs at a private company, and ask your employer how to cover taxes (will they withhold shares for you, or do you have to send a check to pay for taxes?).

For private companies?

Double-trigger RSUs are not taxed while a company is private. Instead, they are taxed when two conditions are true:

- Time-based requirement (vesting schedule)

- Liquidity event requirement: your company must IPO.

If you have single-trigger RSUs

Single-trigger RSUs are uncommon. When Squarespace was a private company, they were a rare example that issued RSUs that only had a single trigger (the time-based requirement, aka service requirement). Squarespace withheld enough shares to fully satisfy the tax requirement, and employees weren’t hit by a surprise tax bill the following April 15th.

Look at your equity agreement to see if you have single-trigger RSUs at a private company, and ask your employer how to cover taxes (will they withhold shares for you, or do you have to send a check to pay for taxes?).

In California?

California taxes vested RSUs as income. California taxes RSU income in two steps:

- At vest: your company is required to withhold a fixed 10.23% tax for California income tax (amongst several other taxes).

- Next April 15th: for very high earners, the 10.23% default withholding rate may not cover your full tax liability. You pay the balance due when you file your tax return the following spring. Work with a tax professional or financial advisor to figure out whether to pay estimated taxes throughout the year to California (rather than waiting until next April 15th to pay the balance due), particularly if you’re a single filer in California >$360,000 (or married filing jointly earning >$720,000). Otherwise, you risk incurring a late payment penalty from the California FTB. And even if you don’t need to pay estimated taxes to California, you may need to pay them to the IRS. Consult with a tax professional or financial advisor.

How is RSU state tax calculated?

California taxes vested RSUs as income. California taxation of RSU income happens in two steps:

- At vest: your company is required to withhold a fixed 10.23% tax for California income tax (amongst several other taxes).

- Next April 15th: for very high earners, the 10.23% default withholding rate may not cover your full tax liability. You pay the balance due when you file your tax return the following spring. Work with a tax professional or financial advisor to figure out whether to pay estimated taxes throughout the year to California (rather than waiting until next April 15th to pay the balance due), particularly if you’re a single filer in California >$360,000 (or married filing jointly earning >$720,000). Otherwise, you risk incurring a late payment penalty from the California FTB. And even if you don’t need to pay estimated taxes to California, you may need to pay them to the IRS. Consult with a tax professional or financial advisor.

How are RSUs taxed when I move to a new state?

You will not be able to completely escape California taxation if you have RSUs that were granted while you were a California resident. If you move to a lower-tax state, be prepared for CA taxes, whether those RSUs are: (a) from a public company, or (b) double-trigger RSUs at a private company that’s expecting a liquidity event. California wants its tax revenue for RSUs granted while you were a California resident. You must calculate the number of days you worked in California between the RSU grant date and vest date. The California FTB taxes the portion of RSU income that’s California source.

You Must Prove You Left California

Permanently leaving California isn’t straightforward. The California FTB is notoriously aggressive about auditing taxpayers who move to a no-tax state like Nevada or Texas. The FTB uses 29 factors to determine whether you’re still a resident under California law.

Let’s say you’ve truly established Nevada residency. You *still* can’t escape California taxes on California source income, however. This includes RSUs that were awarded when you were living in the Bay Area.

RSUs at a Public Tech Company in California

Example: you were awarded an RSU grant while living in SF, and you moved to Incline Village, NV before the grant fully vested. The RSU tranche that vests after your move is worth $50,000. If you’re thinking this $50,000 is tax-free income because NV doesn’t have income tax, you’re mistaken. Instead, California outlines in Publication 1004 that you must allocate a portion of the $50,000 income to California based on the time worked in the state:

# of workdays in California between grant and vest / # of total workdays between grant and vest

To calculate workdays, exclude holidays, weekends, and vacation days using the “Count only workdays” filter.

In this example, my interpretation of Publication 1004 is that 75% of the $50,000 income is California source. Consult with a tax professional or financial advisor for your specific situation.

You need to repeat this calculation for every subsequent tranche that vests from all RSU grants that were awarded while you lived in California. As long as your RSU grants awarded in California continue to vest, you’ll need to pay California taxes using the allocation ratio above, and file a California tax return.

This is a difficult and tedious process, and I strongly suggest you work with a tax professional who’s familiar with equity compensation and can help you with the complexities of California taxes.

Upon sale of the net shares, the capital gain is not subject to California gains tax.

Double-trigger RSUs at a Private Company: Move Between Vest and IPO

Example: you were awarded a double-trigger RSU grant while living in SF, and you moved to Incline Village, NV after the first trigger, but before the second trigger on “IPO Day,” a catch-all phrase for a company’s liquidity event (going public by traditional IPO, direct listing, or SPAC merger; tender offer; or acquisition).

Assume the large RSU tranche that vests on IPO Day is worth $750,000. If you’re thinking this $750,000 is tax-free income because NV doesn’t have income tax, you’re mistaken. Instead, California outlines in Publication 1004 that you must allocate a portion of the $750,000 income to California based on the time worked in the state:

# of workdays in California between grant and vest / # of total workdays between grant and vest

To calculate workdays, exclude holidays, weekends, and vacation days using the “Count only workdays” filter.

Income is measured on IPO day when the RSUs meet both criteria:

- Time-based requirement (trigger #1, which occurred before the move), and

- Liquidity event (trigger #2, which occurred after the move)

My interpretation of Publication 1004 is that 100% of the $750,000 income is California source because you lived in California when the time-based vesting occurred. Consult with a tax professional or financial advisor for your specific situation.

You need to repeat this calculation for every subsequent tranche that vests from all RSU grants that were awarded while you lived in California. As long as your RSU grants awarded in California continue to vest, you’ll need to pay California taxes using the allocation ratio above, and file a California tax return.

This is a difficult and tedious process, and I strongly suggest you work with a tax professional who’s familiar with equity compensation and can help you with the complexities of California taxes.

Upon sale of the net shares, the capital gain is not subject to California gains tax.

Double-trigger RSUs at a Private Company: Move Before Vest and IPO

Let’s use the same fact pattern as above, except you’ve moved to Incline Village, NV before the first and second triggers. If you’re thinking the $750,000 income on IPO Day is tax-free income because NV doesn’t have income tax, you’re mistaken. Instead, California outlines in Publication 1004 that you must allocate a portion of the $750,000 income to California based on the time worked in the state:

# of workdays in California between grant and vest / # of total workdays between grant and vest

To calculate workdays, exclude holidays, weekends, and vacation days using the “Count only workdays” filter.

In this example, my interpretation of Publication 1004 is that 75% of the $50,000 income is California source. Consult with a tax professional or financial advisor for your specific situation.

You need to repeat this calculation for every subsequent tranche that vests from all RSU grants that were awarded while you lived in California. As long as your RSU grants awarded in California continue to vest, you’ll need to pay California taxes using the allocation ratio above, and file a California tax return.

This is a difficult and tedious process, and I strongly suggest you work with a tax professional who’s familiar with equity compensation and can help you with the complexities of California taxes.

Upon sale of the net shares, the capital gain is not subject to California gains tax.

What is the RSU withholding rate in California and other states?

California withholds 10.23% as each RSU tranche vests. RSU income, bonuses, and sales commissions are a type of income called supplemental wages, which are subject to a series of mandatory flat rates for federal and state taxes.

For other states, EY published this withholding rate guide for all 50 states in 2021. EY (Ernst & Young) is a leading global accounting firm.

Are restricted stock units subject to 409a?

No. Only deferred RSUs are subject to 409A, which is a section of the IRS code that applies to nonqualified deferred compensation. There are two types of deferred compensation:

- Qualified deferred compensation. Your company’s 401(k) plan is an example of a qualified deferred compensation plan, which is subject to strict IRS regulations, such as contribution limits, and “anti-discrimation” rules that require 401(k) plans to be available to the entire workforce, not just C-level executives.

- Non-qualified deferred compensation (NQDC). This is compensation like RSUs that you’ve earned (vested) in one year, but you receive the vested shares (and tax bill) in a later year. Most companies don’t offer NQDC plans, and if they do, they’re limited to C-level executives and VPs.

Are restricted stock units included in w2?

Yes, they’re included in your Form W-2 as wages because RSUs are compensation. Box 1 shows your total wages, which includes your base salary, bonuses (if applicable), and RSU income. If you want to know how much of the Box 1 is from RSU income, look at Box 14, which may detail the RSU income. You report RSUs on your tax return by entering the W-2 data.

RSUs are bonuses that are paid in the form of company stock. The RSU income is calculated as the RSUs vest:

- Quantity of RSUs vested

- Times your company’s closing stock price

Your equity plan administrator (Fidelity, Schwab, E*Trade, etc) performs these calculations as each tranche of RSUs vests, and they report this information to your payroll department.

Are restricted stock units subject to FICA?

Yes, RSUs are subject to FICA taxes, aka Social Security and Medicare.

- Social Security: 6.2% (up to a wage limit)

- Medicare: 1.45%

- Additional Medicare: 0.9% (once your total wages exceed $200,000)

- California State Disability Insurance: 1.2% (up to a wage limit; this is California’s version of FICA taxes.

Are restricted stock units qualified or unqualified?

RSUs are unqualified, aka nonstatutory. This is important because nonstatutory equity compensation like RSUs is subject to income tax and FICA tax withholding. To dig deeper into the IRS code, there are two broad categories of equity compensation.

First, nonstatutory (unqualified) equity compensation is governed by Section 83 of the IRS code. This category includes:

- Restricted Stock/Restricted Stock Units

- Non-qualified Stock Options (NSOs)

Second, statutory (qualified) equity compensation is governed by Sections 421-424 of the IRS code. This category includes:

- Employee Stock Purchase Plans (ESPP)

- Incentive Stock Options (ISOs)

ESPP and ISOs are not subject to FICA taxes (Medicare and Social Security), and income taxes are not withheld upfront.

Do RSUs pay dividends?

Unvested RSUs don’t pay dividends. You must remain employed at your company to earn the company stock over time in accordance with your vesting schedule. Once the RSUs vest and you own the company stock outright, you have dividend rights. Few tech companies pay dividends, however. Instead of distributing a portion of net income to shareholders, they use profits to reinvest in the company.

Do RSUs have a strike price and expiration date?

RSUs don’t have a strike price. This is a concept that applies to stock options and refers to the fixed price at which you can buy your company stock. In contrast, RSUs are company stock that are given to you according to your vesting schedule.

Double-trigger RSU grants at private companies have an expiration date. Typically they expire seven years from grant. The goal is for a liquidity event (tender offer, acquisition, or IPO/direct listing/SPAC merger) to occur before your double-trigger RSU grant expires.

Can I sell restricted stock units?

You can sell vested RSUs. The vesting schedule dictates how much company stock you earn over time. Once you earn (vest) the RSUs and own the company stock outright, you’re free to sell the resulting stock. Many companies enforce blackout periods, in which case you must sell during a trading window.

Can you negotiate a vesting period?

You can negotiate the vesting period, particularly if you’re a key employee. Someone like Jony Ive (to use an extreme example) has a lot of negotiating clout. If you’re negotiating with a public company, you’re more likely to successfully negotiate the vesting schedule if you’re a VP and above. If you’re negotiating with a private company, however, key employees also include non-executives like engineers and designers.

An example of negotiating the vesting period is an accelerated vesting schedule. If you’re a superstar product designer at a pre-IPO company who doesn’t plan to stay long, you could negotiate a vesting schedule that accelerates on the IPO date.

Another example is to negotiate a shorter vesting period. The typical vesting schedule is over a four-year period with a one year cliff (for example, 25% after one full year, then 6.25% per quarter for the next three years). You could try to negotiate a three-year vesting period instead, for example.

What is a RSU lockup period?

The RSU lockup period is enforced after a company goes public during which employees and other company insiders are forbidden from selling shares. In a traditional IPO, the lock-up period lasts six months. But companies are being creative: some traditional IPOs release the lockup period in only four months, or they open interim trading windows for employees to sell a small portion of shares before the lockup comes off. Companies that go public via direct listing often allow employees to sell 100% of shares from day one. Other direct listings like Coinbase, however, allowed employees to sell 15% upfront, and then enforced a lockup period, which is typically associated with traditional IPOs.

During the lockup period, you will see zero shares available for sale in your equity management account.

What is a RSU liquidity event?

If you have RSUs from a private company, there are three potential liquidity events: going public, tender offer, and acquisition. Going public includes a traditional IPO, direct listing, or SPAC merger. A tender offer is when investors like VC firms offer to buy shares from employees at a premium over the FMV (fair market value, or “409A valuation”). A tender offer would give you an opportunity to sell shares even though your company is private. An acquisition can either be an all-cash (where all of your equity is cashed out immediately), all-stock (swapping your equity for the acquirer’s equity), or a mix of cash and stock. Acquisitions don’t follow a standard playbook.

What is RSU liquidation?

To make money from your private company RSUs, a liquidity event must occur. There are three potential liquidity events: going public, tender offer, and acquisition. Going public includes a traditional IPO, direct listing, or SPAC merger. A tender offer is when investors like VC firms offer to buy shares from employees at a premium over the FMV (fair market value, or “409A valuation”). A tender offer would give you an opportunity to sell shares even though your company is private. An acquisition can either be an all-cash (where all of your equity is cashed out immediately), all-stock (swapping your equity for the acquirer’s equity), or a mix of cash and stock. Acquisitions don’t follow a standard playbook.

What is a RSU double trigger?

Double-trigger RSUs are the most common type of RSUs issued by private companies. You’ll be able to sell the company stock when you meet two criteria:

- Time-based requirement: you have to work for a certain period of time. For example, 25% of your grant vests after one year, and then 6.25% per quarter over the next twelve quarters (three years).

- Liquidity event requirement: for example, your company goes public (e.g., IPO), or gets acquired.

How to evaluate a RSU compensation package?

Evaluate RSUs as one piece of your total compensation:

- Cash

- Equity (such as RSUs)

- Employee benefits

Calculate the annual value of your cash and equity comp by totaling:

- Base salary

- Bonus, if any (typically is % of base)

- RSU grant divided by four (assuming a four-year vesting schedule): if you’re promised an $800,000 RSU grant, you’ll be paid $200,000 of company stock per year as the RSUs vest.

You can use a salary comparison tool like Blind to evaluate your total compensation package against other employers for your job function in your local geographic area.

Don’t include the sign-on bonus in the calculation above since this isn’t a recurring payment.

In terms of employee benefits, tech companies offer generous benefits, and if you’re going from one publicly-traded tech company to another, you won’t see meaningful differences. If you’re considering going from a public to pre-IPO company, however, you probably will be giving up valuable benefits like the 401(k) match, and HSA employer contributions.

Rather than framing your compensation as “RSU vs base salary”, consider RSUs in the context of your total compensation.

Are RSUs supplemental income?

RSUs are supplemental income. Supplemental wages (to use IRS parlance) refer to payments beyond your regular paycheck, including:

- Vested RSUs

- Bonuses

- Sales commissions

- Severance pay

The IRS and California FTB withhold taxes from your work earnings, whether it’s your regular paycheck or supplemental wages like vested RSUs. But the amount withheld varies:

- Regular paycheck: tax withholdings based on your W-4 (for most people, they last filled this out when they were hired)

- Supplemental wages: fixed percentages defined by IRS and California law

Do RSUs count as income?

A: Yes: RSUs are supplemental income, which means your employer must withhold taxes when the RSUs vest. You must pay the balance due, if applicable, by next April 15th when you file your tax returns.

What is a RSU net settlement?

RSU net settlement refers to your employer withholding shares for taxes as soon as your RSUs vest. This is also known as sell-to-cover settlement.

Your equity plan administrator calculates the tax withholdings on behalf of your employer using fixed percentages set by IRS and California regulations.

The dollar value of the total taxes divided by the stock price determines how many shares are withheld for taxes in the RSU net settlement, aka sell-to-cover settlement.

The RSU net shares are then deposited to your equity account 2-3 business days after the vesting date.

How can I minimize capital gains tax on RSUs?

You can either donate long-term appreciated shares, or hold onto the shares for at least one year before selling.

Donating shares would allow you to avoid capital gains taxes altogether. It’s best to donate long-term investments with large capital gains. The receiving organization must be a qualified charitable organization. If you’re subject to trading windows, read your company’s Insider Trading Policy or ask the stock admin team if you’re allowed to donate company stock during a blackout period.

If you sell the shares at a gain, you must pay capital gains taxes to the IRS and California. The IRS gives a tax break for selling investments held over one year:

- Long-term capital gains: 15% to 23.8% (depends on your income)

- Short-term capital gains are taxed at your standard income tax rate: up to 37% in 2021

If you’re a very high earner (>$440K for single filers, and >$500K if married filing jointly), your long-term capital gains tax rate is 23.8%, which is lower than your 37% marginal tax bracket. Work with a financial advisor to decide if this difference is enough to justify holding onto your company stock for an entire year.

Keep in mind that California (and several other states) also taxes capital gains. California does not give you a tax break for long-term capital gains: you pay your standard income tax rate on all capital gains!

Can I gift or transfer restricted stock units?

You can gift or transfer vested RSUs since you own the shares outright. In terms of gifting shares:

- To a qualified charity: some companies allow employees to donate shares at any time, including during a blackout period. Others allow donation of stock only during an open window. Check with your company to be sure. Gifting long-term appreciated holdings is typically the optimal strategy.

- To a non-charity (family member, friend, etc): you likely will have to wait for an open trading window. Check your company’s Insider Trading Policy or ask your stock admin team to be sure. If you gift more than the annual exclusion limit to one person ($15,000 in 2021), you have to report the gift on your tax return. But you won’t have to pay gift taxes until you exceed the lifetime gift limit ($11.7M in 2021), which very few people will approach.

In terms of transferring shares to a different brokerage account, beware of violating your company’s blackout periods. It’s best to keep shares in the default equity account since your plan administrator (Schwab, Shareworks, etc) enforces blackout dates and trading windows. If you transfer your company stock to a different brokerage account, your plan administrator can’t prevent you from selling during a blackout period, which would violate your company’s insider trading policy.

You can’t gift or transfer unvested RSUs.

When should I sell restricted stock units?

Sell the shares as soon as the RSUs vest if you wouldn’t use an equivalent cash bonus to buy company stock. RSUs are a bonus payment that happens to be in stock rather than cash. If you were paid a cash bonus, and you wouldn’t use the money to buy company stock, turn the stock bonus into cash by selling the shares immediately. If you have short-term goals like buying a house, sell the shares to fund a down payment.

What happens to my restricted stock units if I divorce?

In a community property state like California, you’ll need to determine what portion of RSUs granted during the marriage are community property vs. separate property. Determining community vs. separate depends on the RSU grant date and vesting schedule, your date of marriage, and the date of separation.

The portion that’s community property is owned 50/50 unless you have a prenuptial agreement that supersedes default California law. With the help of a divorce mediator or your attorney, you can decide whether to:

- Divide the community property RSUs where the employee spouse transfers the shares to the ex-spouse upon vest, or

- Set up a buyout agreement where the employee spouse keeps all RSUs in exchange for an equivalent value in cash or other assets

The portion that’s considered separate property belongs 100% to the employee spouse.

You and your spouse must fully disclose your finances to each other during the divorce process. This includes disclosing equity-based compensation like RSUs.

What happens to my restricted stock units if I leave my company?

If you quit or are fired, you forfeit unvested RSUs. Consider coordinating your quit date with your next RSU vesting date. If your next tranche of RSUs vest on November 15th, quit on November 16th, for example.

Special notes on double-trigger RSUs at a private company:

- If you quit before the liquidity event, you likely can keep the shares that vested before your departure. Check your equity incentive plan document and your grant agreements.

- If you’re fired after the time-based vesting event but before the liquidity event, your ability to keep the stock may be at your company’s discretion. Again, review your equity incentive plan document and your grant agreements.

If you’re contemplating retirement, you’ll need to review your company’s equity incentive plan, as well as your grant agreements, to see how your employer defines retirement (number of service years or age), and whether your RSU vesting will continue post-retirement or accelerate upon retirement.

Be sure to check out our other articles on Restricted Stock Units:

If you need guidance on integrating your restricted stock units into your overall financial plan, schedule a free consultation.

Jane Yoo, CFP®, MBA, is an Oakland, CA fee-only financial advisor. Jane Financial provides comprehensive financial planning and investment management to Superstar Women in Tech who need help with their stock options and RSUs. The typical Jane Financial client is a high-performing Gen X or Millennial woman whose company has an imminent or recent IPO. As a fee-only, fiduciary, and independent financial advisor, Jane Yoo is never paid a commission of any kind, and has a legal obligation to provide unbiased and trustworthy financial advice.