Welcome to the Jane Financial Blog

Sort by Topic

- All

- Benefits

- Career

- Equity comp

- Estate planning / legal

- Featured

- General

- Housing

- Insurance

- Investing

- Mindfulness

- Snowflake

- Spending

- Taxes

My homeowner clients often have a wish list of home improvement projects. Embarking on a major renovation for the first time can feel daunting. I collected my clients’ FAQs and interviewed Alice Chiu, founder of Miss Alice Designs in San Francisco, for her expert opinion. What’s the difference between an interior designer, interior decorator, architect, […]

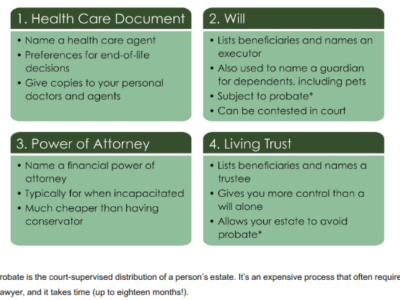

All adults, including young adults, singles, and the child-free, should have an estate plan. Estate planning is about ensuring your wishes are honored upon your death or incapacitation. Although your knee-jerk reaction may be, “I don’t need to worry about this because I don’t have a spouse or children”, you may have other loved ones […]

Escaping the Bay Area or California altogether has been a hot topic in the news. In 2020, many people left the expensive Bay Area, which led to massive drops in SF rents. I was interviewed on KQED Forum in September 2020 on this topic (I come in at the 37:18 mark). But a July 2021 […]

RSUs (Restricted Stock Units) are company stock that will be paid according to a vesting schedule. The taxation of RSUs isn’t straightforward. And what’s even more difficult is deciding what to do with the resulting stocks. Learn about the top two comments I hear regarding RSU shares, and how I reframe the conversation with clients. […]

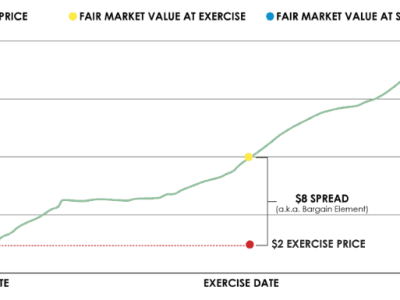

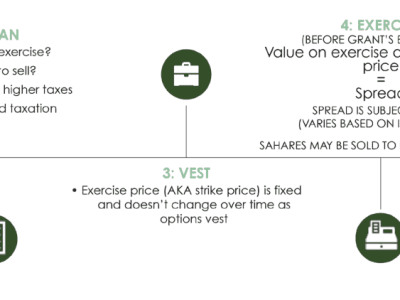

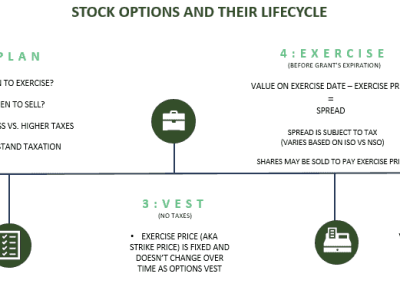

Incentive Stock Options are complicated. If you’re an early employee of Affirm, Snowflake, or soon-to-IPO companies like Coinbase, you likely are facing a windfall. Before you go down the rabbit hole of AMT and taxes in general, learn the basics of stock options. And at the very least, talk to a CPA before you exercise […]

Congratulations on your company’s IPO! Now comes the hard part as you wait for the lockup period to end. Traditionally, companies enforced a 180-day lockup period. Recent IPOs from Affirm, Snowflake, and Airbnb have released the lockup across two or even three phases. Airbnb, for example, had an early lockup release in December 2020, and […]

Transitions, even positive ones like a financial windfall from an IPO, can be overwhelming. You may be uncertain about what to do with your upcoming windfall from your company’s IPO. Let’s focus on the longer-term (and perhaps unexpected) ripple effects of the IPO. I’ll also cover money scripts to see how your early beliefs about […]

In part one of the Open Enrollment series, I discussed the three most valuable benefits offered by most companies: health insurance, Flex Spending Accounts (FSA), and Health Savings Accounts (HSA). In this article, I will discuss the other common benefits offered by employers: Dental insurance Vision insurance Life insurance Disability insurance Accidental death & dismemberment insurance […]

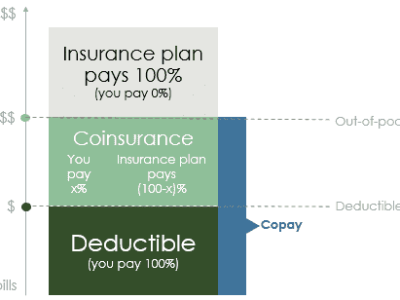

Open enrollment season approaches. The acronyms and jargon are overwhelming: PPO, EPO, HMO, FSA, HSA, deductible, co-pay, co-insurance…You could give up and choose the same benefits for next year. But certain benefits that don’t renew automatically. And if your personal circumstances have changed, it may make sense to update your benefits: Changes to your health: […]

COVID-19 continues to rage around the world. A young product manager and MIT graduate shared her sad story of being unable to work since recovering from a viral infection like COVID-19 in 2009. This SF Chronicle story shares COVID-19 survivors’ real-time struggles. These survivors, or “long-haulers,” face a slow and painful recovery. Two close friends […]

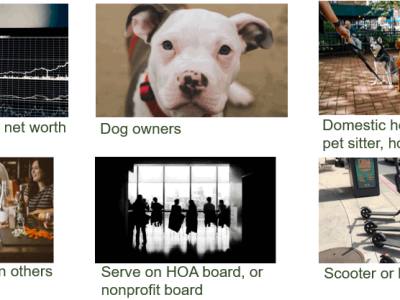

Do you work for a company that recently went public? Your stock options and RSUs likely will translate to significant dollars. In this article, you’ll learn about liability protection, a common blind spot for the newly wealthy. You’ll also get tips on how to get liability insurance, and how much you need. When I work […]

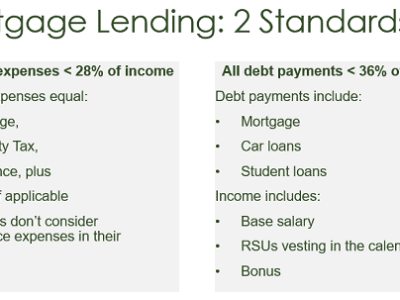

Mortgages are a hot topic in the news. Rates are at an all-time low. If you have homeowner friends, they’re likely refinancing (replacing their mortgage with a new one at a lower rate). If you’re shopping for your first home, I recently described how to prepare for the home buying process. Today’s post is about […]

The pandemic is accelerating many of my clients’ home buying timeline. San Francisco renters are leaving in droves. A buyers’ market is developing for SF condos that don’t have private outdoor space. Buying a home will likely be the biggest purchase of your life. I’ve outlined five steps you can take to start preparing. #1. […]

Stock options and taxes are top of mind when I speak to people whose companies are going public. In my previous post, we reviewed the basics of stock options. In this post, we’ll review taxes, including the dreaded AMT. We’ll look at: Non-qualified Stock Options (NSOs) Incentive Stock Options (ISOs) Within each of these sections, we’ll […]

Your stock options are complicated. You may have several questions: When should I exercise? What should I do with the shares once we go public? What is a lock-up period? How does the tax part work? What the heck is AMT? The IPO market is thawing. Soon, you’ll be able to convert your stock options […]

Income taxes are one of your largest expenses. But it’s easy to ignore income taxes. They’re automatically withheld from your paychecks. Then you file your tax return in the spring, and you either get a refund or owe money to the IRS. Most people repeat this process for the rest of their lives. It’s worth […]

Edited 6/2/2020 and 6/4/2020: if you’re angry/disturbed/depressed by racial injustices like George Floyd’s murder, there are many ways you can help. Here’s a short list of organizations to financially support, as well as a few fundraisers for victims’ survivors: The Movement for Black Lives (email Charles Long, [email protected], in advance if you want to donate stock) […]

Against the backdrop of the COVID-19 epidemic, we experienced the sharpest and fastest bear market in history. The term “bear market” refers to market drops of more than -20%. The S&P 500 (large US stocks), for example, was down -35.2% between 2/19/2020 and 3/23/2020. For context: During the Global Financial Crisis, the bear market occurred […]

In normal times, early April means hunting down your W-2 and other forms, and slogging through TurboTax. Because of the COVID-19 crisis, however, you have an extra three months to file your taxes. You now have until July 15, 2020 to file your taxes with the IRS and your state. California is one of 43 […]

COVID-19 cases continue to climb in the US. California and New York are now under shelter-in-place orders. Bay Area and Seattle companies are requiring that people work from home for the month of March, if not longer. Now more than ever, we need to prioritize self-care. In today’s blog post, I’ll mostly on emotional and […]

Earlier this year, I posted about mindfulness and your financial and overall health. I’ve compiled those posts on the principles of mindfulness, and tips on managing burnout, and mindful spending. You can follow me on Instagram and LinkedIn for future tips.

Have you discussed marriage with your partner? Paying for the wedding might be your biggest worry: booking the venue, shopping for a dress/tuxedo, organizing the honeymoon…A pre-nup is probably not on your list. Recently, I’ve been answering questions about marital agreements, aka pre-nups and post-nups. Although the title of this blog post is tongue-in-cheek, I’m […]

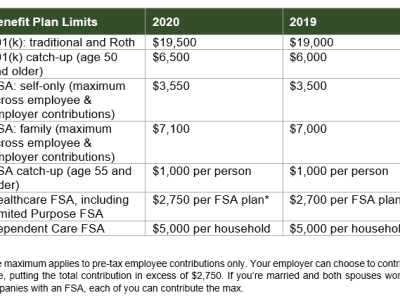

Happy New Year! If you review your paystub, you’ll see several deductions for your 401(k) and other workplace benefits. The IRS has updated how much you can contribute to the following benefit plans via paycheck deductions in 2020: You can update your 401(k) […]

401(k) plans are vexing. Prospective clients frequently ask: “Am I contributing enough?” “What investment(s) should I select?” “What should I do with my old 401(k) plans?” Here’s my six-step process to getting the most out of your 401(k) plan. Step 1: Figure Out How Much to Contribute At the very least, contribute enough to take […]

Do you feel exhausted by relentless news headlines? David Sipress of the New Yorker said this cartoon is one of his most popular creations. Perhaps you have an impulse to check your Facebook or Twitter feeds. […]

Over the last few weeks, I shared advice from women with Bay Area ties across a wide range of industries. I’ve compiled the advice here. I admire high-achieving women, whether they’re high-profile stars like comedian Ali Wong, or local experts like Mary Russell, attorney at Stock Option Counsel. I’m especially struck by the resilience of […]

Congratulations: your RSUs are about to fully vest! RSUs issued by a private company are sometimes called “double-trigger RSUs.” You must meet two criteria for your RSUs to fully vest: (1) you have to work for a certain period of time (e.g., 25% of your RSU grant vests every 12 months), and (2) your company […]

A 6.4 magnitude earthquake hit Ridgecrest, CA on July 4th,2019. The next day, there was an 7.1 magnitude aftershock. This was Southern California’s strongest earthquake in 20 years. Homeowner, condo, and renter’s insurance will not cover earthquake damage. Several Bay Area clients have asked whether they should buy earthquake insurance. I share my framework on […]

“The advice of an employment attorney will make things better. Most people think of a lawyer as someone you engage when you’re about to sue someone, or when you’re going to about to get divorced. But having one doesn’t mean that you are going to be litigating. It means that you’re going to be having […]

I celebrated my 40th birthday in May. Over the last five weeks, I shared money and life lessons from the first four decades of my life. I’ve compiled them here. Follow me on LinkedIn and Instagram to stay in touch.

I recently shared 15 tips on how my Superstar Women clients make the most of their stock compensation, 401(k), cash management, and investments. I’ve compiled them here. You can follow me on Facebook, Instagram, and LinkedIn for future tips. […]

It’s performance assessment season. You’ve earned a well-deserved promotion at work. Hopefully the new job title also comes with more money! I’d like to discuss the four components of your updated compensation package: cash compensation, equity compensation, employee benefits, and taxes. Cash Compensation This includes your base salary and cash bonus. Divide your new base […]

Summary: Get organized: save the source documents (Plan Document, Option/RSU Agreement) Define your goals, which will provide the context for whether to keep or sell your company stock Learn a framework for deciding when to exercise your stock options Be ready for a rollercoaster ride during the lockup period Work with a financial planner (the […]

Summary: Because of the 2018 Tax Cuts and Jobs Act, most of my clients will receive tax cuts due to lower marginal tax rates across brackets, and reforms to AMT (Alternative Minimum Tax) Because of the expanded standard deduction, most of my clients will have simpler tax returns (i.e., they will not itemize) For the […]

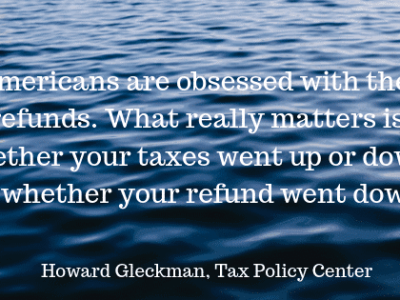

Summary: 2018 tax reform led to tax cuts for most Americans Tax cuts were in the form of slightly higher paychecks, which were hard to notice People who are expecting a large refund check will be disappointed This month, I’m writing about taxes. Federal tax law changed in 2018 due to the Tax Cuts & […]

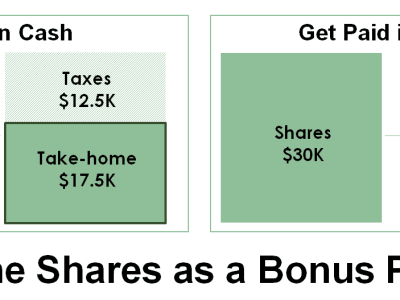

Two reasons to sell the shares as soon as the RSUs vest are: If you were paid a cash bonus, you wouldn’t use the money to buy company stock. So turn the stock bonus into cash by selling the shares immediately. You need to save for short-term goals (e.g., down payment). It’s better to take […]

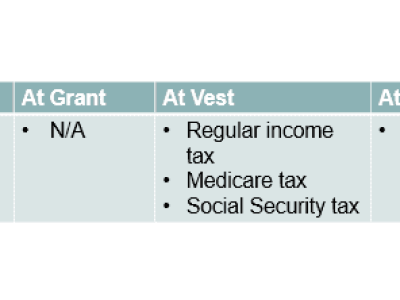

RSUs are the most common way that public companies grant company stock to employees. The term “restricted” refers to the vesting schedule, or the specified period that must elapse before you’re paid the shares of stock. You pay taxes on the value of the RSUs at vesting. And you pay taxes when you sell the […]

If you’re considering adult braces, I say from firsthand experience that it’s worth it. I’ve had braces twice in my life: from age 15-17, and 35-37. As a teenager, I wore the retainer as instructed for a few years, but I fell out of the habit during college. Over the next 18 years, my teeth […]

International Cat Day, August 8th, is a testament to cats’ popularity. As a prospective cat owner, be aware that caring for your feline companion will be a long-term commitment. Cats live 15 years on average, and the total lifetime cost will be substantial. Total Lifetime Cost: At Least $12,500 Set a budget. According to the […]