What are stock options?

Your stock options represent the right to buy company stock for a fixed price for a fixed period of time. Private companies that are 2+ years from going public typically issue stock options. Read on to learn about the two types of stock options: Incentive Stock Options (ISOs), and Non-qualified Stock Options (NSOs)

How Do Stock Options Work?

Employee stock options give you the right (not requirement) to buy company stock (“exercise”) for a fixed price (“strike price”) for a fixed period of time (usually 10 years). Once you exercise options, you own company stock.

To make money from stock options, whether Incentive Stock Options (ISOs) or Non-qualified Stock Options (NSOs), the hope is that the company’s stock price will be significantly higher than your strike price.

Example: your strike price is $2, and you exercise stock options when the stock is worth $10.

You’ve paid $2 for shares that are worth $10. This $8 spread is also known as the bargain element. The taxation of the bargain element differs for ISOs versus NSOs.

If you later sell the stocks for $20 per share, the $10 ($20 sale price minus $10 cost basis) is capital gain.

Refer to the “Taxation of Stock Options” section to learn more about how the bargain element and capital gain are taxed.

Why Are Stock Options Valuable?

Two Sources of Stock Option Value

- Intrinsic value (paper profit)

- Time value (potential profit)

Intrinsic Value

Your paper profit is the current share price (“409A” for private companies) minus the strike price.

Example: if Cloudflare’s stock price is $20/share, and your strike price is $2/share, the intrinsic value is $18. I often see prospective clients miscalculate their intrinsic value by forgetting to subtract the $2 strike price.

Time Value

Time value represents the future potential profit from waiting to exercise the option.

If you’re only one week away from the stock option grant’s expiration, there’s little time value. It’s unlikely the stock price will jump significantly in value. Most of the option value is in the intrinsic value.

If you have 9 years until the option expires, however, there’s a much higher chance that the stock price will increase over time. You can wait it out and exercise the option when the price is right.

Software like StockOpter attempts to quantify the time value of employee stock options. If the intrinsic value comprises the bulk of the overall option value (Insight Ratio in StockOpter parlance), that’s a sign you should “cash in your chips” and exercise the option.

Refer to When To Exercise NSOs.

Leverage

“Leverage” is another term describing the future potential profit. Leverage typically refers to borrowing money to invest. It’s a risky move that can magnify gains if prices go up (and magnify losses if prices drop!).

Employee stock options offer the potential for magnified gains with no risk of loss, however. There’s no risk of loss because if the company’s value drops below your $2 strike price (making it an “underwater” or “out-of-the-money” option), you can choose not to exercise.

The magnified gains are explained by your fixed strike price, and your ability to delay exercising the stock option.

Example: Buying Cloudflare (NET) Stock

Let’s compare me (a non-Cloudflare employee) buying a share of Cloudflare (NET) vs. a Cloudflare employee obtaining NET by exercising stock options:

- If I bought Cloudflare (NET) in February 2020 at $20 per share and sold for $40 per share on July 10, 2020, my return would’ve been 100% in only five months.

- The Cloudflare employee benefits from the growth in the stock price from $20 to $40 even though they don’t yet own the stock. They can wait until July 10th to pay $2 for a stock that’s worth $40, leading to a 1,900% return.

Stock Options Are Risky

Stock options offer the potential for magnified gains with no risk of loss. But stock options are a high-risk investment because your potential profit can disappear.

WeWork employees learned this painful lesson in 2019. They were expecting a stock option windfall from the $47B company’s IPO. Instead, the company cancelled the IPO amidst an uncertain future.

WeWork eventually went public through a SPAC merger in October 2021, but the value of the company was 20% of its 2019 value.

Who Issues Stock Options?

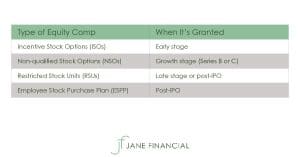

Early stage companies tend to issue Incentive Stock Options (ISOs), and growth stage companies (Series B or C) typically issue Non-qualified Stock Options (NSOs). Public companies rarely issue stock options.

In 2012, Airbnb issued NSOs. But if you joined Airbnb after its December 2020 IPO, you received RSUs only.

Key Terms

Grant

You receive stock options when your employer grants a specific number of stock options subject to a vesting schedule.

Vest

The vesting schedule specifies the period of time you must wait before you’ve earned the right to exercise the options. A common vesting schedule is over four years: 25% vest after one year (“25% cliff”), and monthly thereafter.

Exercise

Buy company stock at the strike price specified in your stock options agreement.

Strike Price

The fixed price at which you’re buying company stock.

Example

You join an early-stage private company and you’re granted 240,000 options. If your options vest over four years with a one-year cliff, you earn the right to exercise 60,000 (25%) stock options after one year, and 5,000 options per month for the next 36 months.

Are Stock Options Better Than RSUs?

Stock options are better if you want to strike it rich, but they are high-risk, high-reward. RSUs are better if you want a sure thing.

Stock Options: High-Risk, High-Reward

If you join a startup, you likely sacrifice base salary in exchange for stock options, which represent a potential windfall if the company has an exit event. By paying lower salaries, startups free up cash to invest in the company’s growth.

It’s unlikely that a private company will have an exit event, however. In a 2021 Crunchbase study, only 7% of startups made exits during 2011-2018 (0.8% via a public offering).

Cowboy Ventures’ 2013 study found that only 0.07% of private US-based software companies started since 2003 became “unicorns” valued at over $1 billion.

If you’re lucky enough to receive stock options at a company with an exit event, stock option “leverage” explains the financial windfall.

Refer to Why Are Stock Options Valuable?

RSUs: A Sure Thing (But Lower Payout)

Restricted stock units will always have value (assuming your company is publicly-traded). This is true even if the stock price drops below the price on the RSU grant date. Let’s say you were granted 30,000 RSUs, and the stock price on the RSU grant date is $20 ($600,000 total grant value). If the stock price dropped to $15 upon the 25% cliff vest, the 7,500 RSUs are worth $112,500 (7,500*$15). Although it’s disappointing to experience a stock price drop, you’re still getting something.

Because RSUs will always have value at public companies, the windfall from RSUs usually is much lower compared to stock options from a startup.

How Are Stock Options Priced?

Your strike price is determined by your company’s Fair Market Value (“FMV”) on your stock option grant date. For private companies, the FMV is also known as the 409A value. The most common method to determine the 409A is by obtaining an independent appraisal.

Your CFO is responsible for updating the 409A value at least annually. If your company has a material event, which includes closing a new round of financing, the 409A must also be updated.

Can Stock Options Expire?

Stock options typically expire 10 years from the grant date, or 90 days after your termination date, whichever is earlier.

What Happens To My Stock Options If I Leave My Company?

If you leave your company before the stock option grant’s 10-year expiration date, you usually have 90 days to exercise your vested stock options before they expire. Check your stock option agreement for the “post-termination exercise period” or “PTEP.”

Incentive Stock Options must follow this 90-day rule because of IRS regulations, specifically Section 422(a).

Non-qualified Stock Options don’t have to follow this 90-day rule. And in recent years, companies have offered longer PTEPs. Pinterest shifted to a seven-year period in 2015, for example.

If your company allows you to exercise your ISOs after 90 days, the ISOs will convert to NSOs.

When To Exercise NSOs

You have two key decisions to make:

- When to exercise

- When to sell the resulting stock

The tax rules for employee stock options are the same whether your company is public or private.

Key Assumptions For NSOs

- Your company’s stock is publicly-traded.

- You sell the shares immediately.

Frameworks To Decide When To Exercise NSOs

Here are general frameworks to follow when deciding whether to exercise NSOs:

- If the option proceeds allow you to attain important personal goals (down payment, tuition for kids…), exercise the NSOs.

- Exercise when intrinsic value > time value.

- Exercise when intrinsic value is a significant portion of your net worth.

Refer to Why Are Stock Options Valuable for a review of intrinsic value and time value.

Consult a tax professional or financial planner before you exercise NSOs. Refer to the “Taxation of Stock Options section” for an overview of how most (but not all) taxes are withheld when you exercise NSOs.

When To Sell The Shares

Once you exercise the NSOs, you’ll own company stock. Generally speaking, it’s best to sell the shares immediately.

What To Avoid With NSOs

A common strategy is to quickly exercise NSOs and hold the shares > 1 year for long-term capital gains treatment.

Unlike ISOs, however, NSOs are taxed at exercise. By delaying your NSO exercise, you benefit by deferring income taxes.

Another benefit of waiting to exercise is that you preserve leverage. In the Cloudflare example above, stock option leverage boosted returns from 100% to 1,900%. If you exercise NSOs, the shares you own no longer have leverage; you’re just like any other Cloudflare stockholder who bought shares in July 2020.

Most importantly, waiting to exercise means you won’t lose your hard-earned cash if your company doesn’t have an exit event. Consider WeWork employees who quickly exercised NSOs and held the shares for long-term treatment. Unfortunately for them, the 2019 IPO was shelved:

- They ended up with potentially worthless stock after using their hard-earned cash to exercise options.

- Plus they still owed taxes on the paper income (FMV at time of exercise minus strike price) that didn’t materialize.

WeWork eventually went public through a SPAC merger in October 2021, but the company was worth 20% of its 2019 value.

Finally, a benefit of immediately selling the shares is risk reduction. I often speak with prospective clients who are worried about their concentration in company stock and vested options. After exercising and immediately selling the shares, you can reinvest the proceeds in a diversified portfolio, or use the money for important goals like a down payment or children’s tuition.

This article discusses the mechanics of how to exercise, and how to sell the stocks (assuming your company is publicly-traded).

When To Exercise ISOs

Exercise And Hold The Shares Until Qualifying Disposition

Generally speaking, it’s best to exercise ISOs as soon as they vest. Because ISOs are typically granted at early-stage companies:

- The exercise cost is usually lower (low strike price means less cash outlay to exercise)

- The 409A usually isn’t much higher than your strike price (smaller bargain element means lower likelihood of AMT)

Investment Risk

By exercising ISOs, however, you’re essentially making a high-risk venture investment. You’ll own shares in a private company that may never have an exit event. You need to accept the risk that your investment could drop to $0.

Qualifying Disposition

But if you’re confident an IPO or other exit event will happen, exercising now starts the clock on the “one year from exercise rule.” If you meet the two holding periods, you convert the entire profit into long-term capital gain.

Be aware of AMT. If you don’t sell the shares in the year of exercise, the bargain element from exercising ISOs is AMT income (“AMT adjustment”).

Once you’ve held the shares at least two years from grant, and at least one year from exercise, you can sell the shares in a qualifying disposition. The entire profit (FMV on date of sale minus strike price) is long-term capital gain.

Whether you should sell in a qualifying disposition is a complex question that I help clients answer:

- You’ve likely earned a significant return if you compare the FMV to your strike price. Do you believe the company’s stock price will continue to grow?

- What would selling the shares allow you to achieve in life? If you want to take a sabbatical, for example, sell the shares and use the proceeds (after setting aside a tax reserve) to enjoy fun-employment.

Refer to the “Taxation of Stock Options” section for more detail on qualifying disposition rules, and AMT.

QSBS (Qualified Small Business Stock)

Another reason to exercise ISOs as soon as they vest is the tax savings from Qualified Small Business Stock (QSBS). In a nutshell, you pay 0% federal capital gains tax on up to $10M of gains from startup stock.

The IRS has very strict rules defining a Qualified Small Business, including:

- Domestic C corporation

- Company assets <$50 million when you obtained the stock

- You’ve held the stock at least five years

Given the magnitude of the potential tax savings, you definitely should consult a tax professional who has experience with QSBS.

It will be important to keep documentation from your employer. For example, your CFO or the company’s auditor can prepare a “tax opinion letter” that explains the date range that common and preferred shares met the Qualified Small Business criteria.

Note: California doesn’t give a tax break for QSBS.

Advanced Strategy: Early Exercise And 83(b) Election

Typically, you can only exercise vested stock options. Some companies, however, allow early exercise where you can exercise unvested options. If you early exercise unvested options, you own restricted stock. You don’t own the shares outright because the stock options were unvested at the time of early exercise. These restricted shares become outright shares in accordance with your vesting schedule.

Check your stock option agreement or ask your Equity team whether early exercise is allowed.

Tax Benefit Of Early Exercise + 83(b) Election

The early exercise of ISOs accelerates AMT income to the year of early exercise. This is a worthwhile strategy if the bargain element doesn’t trigger AMT, and you’re comfortable with making a high-risk, high-reward venture investment.

You’ll need to work with a tax professional or financial planner to run a tax projection to determine whether AMT applies.

When you early exercise ISOs, you should file an 83(b) election, which is a form letter that you send to the IRS notifying them that you’ve decided to accelerate AMT income by early exercising ISOs.

You must file the 83(b) election within 30 days of early exercising your unvested ISOs. If you miss the deadline, you run the risk of a hefty AMT bill in the future.

- By not filing the 83(b) election, you postpone the AMT income, which seems like a good thing because you avoid AMT at early exercise.

- But the risk is that you’re postponing the measurement of that AMT income. If the stock price skyrockets when the ISOs vest (and your restricted shares become outright shares), this could generate a huge AMT bill.

Work with a tax professional or financial advisor before you early exercise ISOs.

How To Pay Exercise Cost And Taxes

You need cash to: (1) exercise the options (pay the strike price), and (2) pay taxes.

If you have 2,500 vested options at $2 strike price, you’ll need $5,000 cash to exercise the options.

If you have 2,500 vested options at $20 strike price, then you’ll have to cough up $50,000, which is a significant amount of cash for most people.

Exercising options is a taxable event. You’ll owe income taxes after exercising NSOs, and after a disqualifying disposition of ISOs. You may owe AMT after exercising ISOs if you don’t sell the shares in the year of exercise.

Consult a tax professional or financial planner with stock option expertise to run a tax projection before you exercise stock options.

Wait Until The IPO (Or Other Exit Event)

If you don’t have the cash to cover the exercise cost and required taxes, you can simply hold off on exercising options until your company’s exit event.

Financing Stock Option Exercises

It’s easier to exercise stock options in public companies because of the “cashless exercise” method that requires no cash outlay on your part. You can sell shares to pay for the exercise cost and required taxes.

For a private company, however, you can’t sell shares since there isn’t a public market for the shares. If you need cash to cover the exercise cost and taxes, you could obtain financing. Companies like ESO Fund and SecFi offer nonrecourse loans for the exercise cost and required taxes.

- If a company doesn’t have an exit event, the employee isn’t responsible for repaying the loan.

If the company goes public, you must repay the loan and also a percentage of the stock’s upside. Learn more in this Forbes article.

After I Exercise Options, What Should I Do With The Stock?

Refer to When to Exercise NSOs and When to Exercise ISOs for more detail.

I also wrote an article discussing what you can do with stock if your company is publicly-traded.

How To Sell Private Company Stock Before An Exit Event

Find Out If You’re Allowed To Sell

Review your Stock Option Grant Agreement and the Plan Document to see if you’re allowed to sell shares. You may see a clause called the “Right of First Refusal” where your employer has first dibs on buying your shares. Usually companies give themselves 30 days to decide whether to buy an employee’s shares.

Some companies require that you receive board approval, which is a bigger hurdle.

How To Sell Pre-IPO Stock

Companies like Forge Global and Equity Zen provide a “secondary market” that connects startup employees (who want to sell pre-IPO company stock) and potential buyers. Each marketplace will have different fees, minimum transaction sizes, and even different prices for the shares.

Be aware that these secondary market providers serve shareholders like yourself, AND investors who are hoping to buy pre-IPO stock.

FYI, the “primary market” refers to companies selling new stocks and bonds to the public for the first time. An IPO is an example.

What Determines The Stock Price In The Secondary Market

Supply and demand:

- Palantir was private for 17 years and had a great deal of supply, which reduced the price of its stock.

- If a prominent VC firm invests in the company, that tends to increase demand (and therefore the stock price).

Shop around at various private marketplaces for the best price.

How Are Stock Options Taxed Upon Exercise?

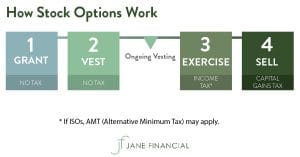

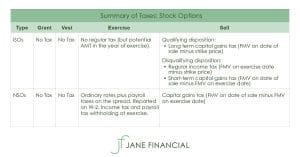

ISOs and NSOs are not subject to tax at grant or when they vest.

However, taxes apply when you:

- Exercise stock options (answered below), and

- Sell the resulting stock (refer to How Are Stock Options Taxed Upon Sale?).

When you exercise stock options, the spread between: (a) the stock price on the exercise date, and (b) the strike price, is also known as the bargain element.

The bargain element ($8 in the illustration) is taxable, and the taxation of the $8 bargain element is different for NSOs and ISOs.

Non-qualified Stock Options (NSO)

The $8 per share bargain element is compensation income (NOT capital gain, which applies when you sell the resulting shares). Most of the taxes are withheld upfront, and the rest is due by the following April 15th. The $8 bargain element will be included in your W-2, and is subject to payroll “FICA” taxes (Social Security, Medicare).

If you exercise NSOs at a public company, your stock plan administrator likely will give you the choice to sell shares to cover taxes (“cashless exercise”).

If you exercise NSOs at a private company, you must wire cash to your employer to cover the mandatory tax withholdings.

Before you exercise options, be sure to consult a tax professional or financial advisor.

Incentive Stock Options (ISO)

The $8 bargain element for ISOs is taxed differently compared to NSOs:

- No “regular” income taxes (i.e., the $8 is NOT compensation income)

- No payroll “FICA” taxes (Social Security, Medicare)

- However, exercising ISOs may trigger Alternative Minimum Tax (AMT)

No taxes are withheld upfront when you exercise ISOs.

Before you exercise ISOs, it’s critical to consult a tax professional or financial advisor to estimate this tax reserve.

What Is AMT?

The Alternative Minimum Tax (AMT) was created to keep wealthy taxpayers from using deductions to avoid paying taxes. AMT ensures all taxpayers pay a minimum amount of tax.

Every year, you must calculate your tax bill twice: under the regular rules, and under the AMT’s special rules. Each year, you must pay the higher of the two. If you DIY with TurboTax, the software is running both calculations.

Think of AMT as a pre-payment of regular tax. If you incur AMT, you may receive an AMT credit (“Minimum Tax Credit”) in subsequent years.

ISO exercises are a common trigger of AMT. If you hold the resulting shares past December 31st of the year of exercise, the bargain element will count as income for AMT purposes. If the AMT formula yields a higher tax than the regular formula, you will owe AMT.

If you sell the shares the same year you exercised the ISOs, AMT doesn’t apply. Instead, the profit is taxed as compensation income (i.e., regular income taxes apply).

How Are Stock Options Taxed Upon Sale?

The difference in the fair market value on: (a) the date of sale, and (b) the date of exercise is capital gain. Capital gains are either long-term or short-term.

Long-term capital gains taxes (up to 23.8% as of 2021) are lower than short-term (up to 37% as of 2021).

California (and several other states) also taxes capital gains. California does not give you a tax break on long-term capital gains: you pay your standard income tax rate on all capital gains! California income tax rates are up to 13.3%.

Capital gains taxes vary for NSOs and ISOs.

NSO Capital Gains Tax

Building on the illustration above, you now own shares that are worth $20 per share. The new purchase price (“cost basis”) is $10: $2 strike price plus the $8 spread (“bargain element”) on which you were taxed at exercise. If you sell the shares, your capital gain is $10 per share ($20 current value – $10 cost basis):

Capital Gains Tax: Federal

The amount of federal capital gains tax you owe depends on the holding period.

If you hold the shares 1 year or less, short-term capital gains tax applies to the $10. Short-term capital gains are taxed at the same rate as compensation income.

If you hold the shares > 1 year, you pay long-term capital gains tax: 15%-23.8% as of 2021. The exact rate depends on your filing status and income. The tax rate for long-term capital gains tax is lower than for compensation income.

Capital Gains Tax: California

California doesn’t have preferential treatment of long-term capital gains. The same tax rate applies whether you have short-term or long-term capital gains. California is the highest tax state in the US. Your tax rate on the $10 profit will be 9.3% to 13.3%. The exact rate depends on your filing status and income.

Capital Gains Taxes Are Not Withheld

Your equity plan administrator will not withhold capital gains taxes when you sell the shares. If you sell the NSO shares immediately after exercise (refer to When to Exercise NSOs), the capital gain will likely be negligible simply because there isn’t much time for the stock price to move.

If you’re selling at a significant capital gain, be sure to set aside a tax reserve when you sell the resulting shares. And paying estimated taxes before next April 15th is worth considering.

Consult a tax professional or financial advisor for your specific tax situation.

ISO Capital Gains Tax

In the above NSO illustrations of the $18 profit, only $10 was capital gain, and the remaining $8 was compensation income.

The beauty of ISOs is that you can convert the entire $18 profit into long-term capital gain if you meet two holding periods.

Qualifying Disposition Of ISOs

To convert the entire $18 into long-term capital gains, you must meet two criteria. The sale date of the ISO shares must be:

- At least two years from the ISO grant date, and

- At least one year from the exercise date

Capital Gains Tax: Federal

If you meet the two holding period rules, you pay long-term capital gains tax on the entire $18 profit: 15%-23.8% as of 2021. The exact rate depends on your filing status and income.

Capital Gains Tax: California

California doesn’t have preferential treatment of long-term capital gains. You’ll pay 9.3% to 13.3% on the entire $18 profit. The exact rate depends on your filing status and income.

Capital Gains Taxes Are Not Withheld

Your equity plan administrator will not withhold capital gains taxes when you sell the shares. Plan ahead and set aside cash for taxes. To avoid late payment penalties, you may need to pay estimated taxes to the IRS and/or California FTB before the April 15th deadline.

Disqualifying Disposition of ISOs

If the sale of your shares doesn’t meet the two holding period rules, this is a “disqualifying disposition” of ISOs.

The “at least one year from exercise” rule is what trips up most ISO holders. If the date that you sell the company stocks is at least two years from the grant date, but less than one year from the exercise date, this is a disqualifying disposition:

- $8 bargain element (compensation income) taxed at standard income tax rates (federal + California)

- $10 short-term capital gain, which also is taxed at standard income tax rates (federal + California)

Taxes Are Not Withheld In Disqualifying Disposition of ISOs

The $8 bargain element is compensation income that will be reported on your Form W-2. You’ll owe federal and state income taxes, but not payroll “FICA” taxes (Social Security, Medicare). However, your employer is not required to withhold income taxes on your behalf.

And if you sell the shares at a capital gain, your employer is not required to withhold capital gains taxes on your behalf.

It’s so important to hire a financial planner, or at the very least a tax professional, before you exercise stock options. This will help you avoid a surprise tax bill on April 15th.

How Are Stock Options Taxed If I Leave California?

Prove You’ve Established Residency In A Different State

Permanently leaving California isn’t straightforward. The California FTB is notoriously aggressive about auditing taxpayers who move to a no-tax state like Nevada or Texas. The FTB uses 29 factors to determine whether you’re still a resident under California law.

Let’s assume you’ve established Nevada residency, for example. You *still* might owe California taxes on stock options that were awarded when you were living in the Bay Area.

Exercise Options Before Moving Out Of California

If you exercise NSOs and ISOs before you move:

- The entire bargain element (fair market value on the exercise date minus the strike price) is 100% “California source”. For NSOs (and ISOs if you sell the stock in the same year you exercise the ISO), the bargain element is compensation income. For ISOs where you don’t sell the stock in the year you exercised the ISO, your California tax return must make an AMT adjustment (with a potential AMT credit in the subsequent year).

- When you sell the resulting shares while living in Nevada, the capital gain is state tax-free since Nevada doesn’t have capital gains tax (0% California source since you’re a non-resident at sale).

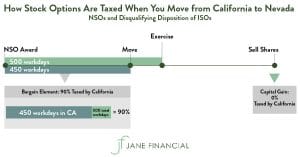

Exercise NSOs After Moving Out Of California

The $8 bargain element will be partially taxed by California (refer to “How Are Stock Options Taxed Upon Sale”). According to Publication 1004, you must allocate a portion of the $8 per share bargain element to California based on the time worked in the state:

# of workdays in California between grant and move / # of total workdays between grant and exercise

Let’s say you exercise 50,000 NSOs after moving to Nevada. If you thought the $400,000 total bargain element is state tax-free, unfortunately this won’t be the case due to the “allocation ratio” described above. Instead, 90% of the $400,000 compensation income is California source.

Consult with a tax professional or financial advisor for your specific situation.

To calculate workdays, exclude holidays, weekends, and vacation days using the “Count only workdays” filter.

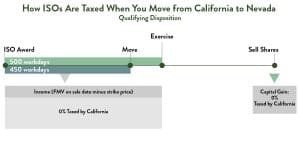

Exercise ISOs After Moving Out Of California

Disqualifying Disposition

The sale date of the resulting shares is <2 years from grant, and/or <1 year from exercise.

Bargain Element: Partially California Source

The tax treatment is the same as exercising NSOs after moving out of California. In other words, the $8 bargain element will be partially taxed by California. Calculate the allocation ratio to determine what percentage of the bargain element is subject to California income tax.

If You Don’t Sell Stock In The Year You Exercised The ISO

You must file a California tax return for the year you exercised the ISO. The California return will include the bargain element (“AMT adjustment”) for AMT purposes. If you owe California AMT, you may have a potential AMT credit in the subsequent year.

The AMT adjustment will be partially California source; use the same allocation ratio calculation to determine this percentage.

Sell Stock In the Same Year You Exercise The ISO

No AMT adjustment is required.

Capital Gain: 0% California Source

The $10 capital gain will not be taxed by California because you’re a non-resident on the date of sale.

Qualifying Disposition

If you exercise an ISO (whether or not you’re a California resident) and later sell the stock in a qualifying disposition while a nonresident, the $18 capital gain is actually 100% Nevada source. Even though the ISO grant was awarded while a California resident, none of the $18 gain (FMV on date of sale minus strike price) is California source.

A qualifying disposition is when the sale date is at least 2 years from grant and at least 1 year from exercise.

Your California tax return must make an AMT adjustment in the year you exercise the ISO (with a potential AMT credit in the subsequent year). The AMT adjustment will be partially California source; use the same allocation ratio calculation to determine this percentage.

Sudden Wealth

Transitions, even positive ones like a financial windfall from an exit event like an IPO, can be overwhelming. You may be uncertain about what to do with your upcoming windfall. And who will you turn to for sympathy?

You could commiserate with coworkers, but money is such a personal topic. Or maybe you don’t want to run the risk of resentment if you have more options than your colleague (or if THEY have more than you!).

Your friends and family probably won’t understand. Your new wealth may even impact your relationships. A financial windfall presents both blessings and burdens.

IPO Lockup: Prepare For An Emotional Rollercoaster

Once a company goes public via IPO, employees can’t sell their shares right away. This is because of the lockup period that blocks insiders (like employees) from selling shares.

In a traditional IPO, the lockup period lasts six months. But companies are being creative: some traditional IPOs release the lockup period in only four months, or they open interim trading windows (“early release”) for employees to sell a small portion of shares before the lockup fully comes off. Snowflake offered an early release during which employees could sell 25% of vested options and shares in December 2020. Their lockup was fully released in March 2021.

Companies that go public via direct listing often allow employees to sell 100% of shares from day one. Some direct listings like Coinbase, however, allowed employees to sell 15% upfront, and then enforced a lockup period, which is typically associated with traditional IPOs.

Going Public

Going public includes a traditional IPO, direct listing, or SPAC merger.

Merger/Acquisition

An acquisition can either be an all-cash (where all of your equity is cashed out immediately), all-stock (swapping your equity for the acquirer’s equity), or a mix of cash and stock. Acquisitions don’t follow a standard playbook.

Tender Offer

A tender offer is when investors like VC firms offer to buy shares from employees at a premium over the FMV (fair market value, or “409A valuation”). A tender offer would give you a company-endorsed opportunity to sell shares even though your company is private.

You also can sell shares via secondary marketplaces like Forge Global, but you likely will need permission from your company. Refer to How to Sell Private Company Stock Before an Exit Event.

Can I Donate Stock Options To Charity?

You can’t donate stock options (whether vested or unvested). But once you exercise and own the company stocks outright, you can donate the shares.

It’s best to donate stocks that are at a gain and are long-term holdings:

- Stocks from NSO exercise at least one year and one day ago

- Stocks from ISO exercise that meet the qualifying disposition rules (acquired at least two years from grant date, and at least one year from exercise date)

If you’re subject to blackout periods, ask your stock admin team if you’re allowed to donate company stock outside of a trading window.

Donating your company stock is a win-win: your favorite charitable organizations benefit, and you benefit financially as well:

Can I Gift or Transfer Stock Options?

You can’t gift or transfer stock options (whether vested or unvested). But once you exercise and own the company stocks outright, you can gift or transfer the shares.

In terms of gifting shares:

- To a non-charity (family member, friend, etc): you likely will have to wait for an open trading window. Check your company’s Insider Trading Policy or ask your stock admin team to be sure. If you gift more than the annual exclusion limit to one person ($15,000 in 2021), you have to report the gift on your tax return. But you won’t have to pay gift taxes until you exceed the lifetime gift limit ($11.7M in 2021), which very few people will approach.

- To a qualified charity: refer to Can I Donate Stock Options to Charity?

If you’re thinking about transferring shares of your company stock to a different brokerage account, beware of violating your company’s blackout periods. It’s best to keep shares in the default equity account since your plan administrator (Schwab, Shareworks, etc) enforces blackout dates and trading windows. If you transfer your company stock to a different brokerage account, your plan administrator can’t prevent you from selling during a blackout period, which would violate your company’s insider trading policy.

Can I Gift Stock Options (And Get The Tax Writeoff)?

You can’t gift stock options, but you can gift the shares once you’ve exercised the option.

Financial gifts are tax-deductible only if the recipient is a qualified charitable organization. Refer to Can I Donate Stock Options to Charity?

When you make financial gifts to an individual (non-charity), be aware of gift tax issues. You can gift up to an “annual exclusion” amount. If you have two siblings, you can give $16,000 of stock to each sibling in 2022 for a total of $32,000. You can gift more than the annual exclusion amount, but you’ll need to file to report the gifts on your tax return. You don’t have to pay gift taxes until you give away more than the lifetime gift limit ($12.06M in 2022).

What Happens To My Stock Options If I Divorce?

In a community property state like California, you’ll need to determine what portion of stock options granted during the marriage are community property vs. separate property. Determining community vs. separate depends on the stock options grant date and vesting schedule, your date of marriage, and the date of separation.

- The portion that’s community property is owned 50/50

- Separate property belongs 100% to the employee spouse

You and your spouse must fully disclose your finances to each other during the divorce process. This includes disclosing equity-based compensation like stock options.

If you have a prenuptial agreement, this will supersede default California law.

About Jane

Jane Yoo, CFP®, MBA, is an Oakland, CA fee-only financial planner. Jane Financial provides comprehensive financial planning and investment management to tech employees who need help with their stock options and RSUs. The typical Jane Financial client is a high-performing tech employee whose company has an imminent or recent IPO. As a fee-only, fiduciary, and independent financial advisor, Jane Yoo is never paid a commission of any kind, and has a legal obligation to provide unbiased and trustworthy financial advice.

If you need guidance on integrating your restricted stock units into your overall financial plan, schedule a free consultation.