Income Tax 101: Your Tax Return in Plain English

Income taxes are one of your largest expenses. But it’s easy to ignore income taxes. They’re automatically withheld from your paychecks. Then you file your tax return in the spring, and you either get a refund or owe money to the IRS. Most people repeat this process for the rest of their lives.

It’s worth reviewing your tax return, however. Yes, your tax return is dozens of (mind-numbing) pages long. But you can save time by focusing on a two-page section called Form 1040. Read on to learn how to interpret this important financial document.

Income Tax Return

Form 1040 summarizes your novel of a tax return in two pages. The 1040 follows this basic structure:

- Add up all sources of income.

- Reduce your income (“deductions”).

- Calculate taxable income.

- Calculate your tax bill.

- Figure out your refund or balance due.

Income Tax Formula

Form 1040 calculates your tax bill as follows. If you’d like to follow along using your tax return, refer to the highlighted line items. Click to jump to the relevant section in this article:

Gross Income (line 7b of Form 1040)

– Above the line deductions (line 8a of Form 1040)

= Adjusted Gross Income, “AGI” (line 8b of Form 1040)

– Below the line deductions (line 9 of Form 1040)

= Taxable Income (line 11b of Form 1040)

= Total tax (line 16 of Form 1040)

Withheld from paychecks and investment income (line 17 of Form 1040)

Estimated tax payments, if any (line 18d of Form 1040)

= If you overpaid: you’ll receive a refund (line 20 of Form 1040), OR

= If you didn’t pay enough: you’ll owe the IRS (line 23 of Form 1040)

Estimated tax penalty may apply (line 24 of Form 1040)

Gross Income

Unless it’s a gift or inheritance, the IRS will count money received for work or from investments as income. Common examples of income for my clients include:

- Base salary

- Bonus

- RSUs that vest during the tax year

- ESPP income (the difference between the purchase date’s value versus the discounted purchase price is taxable income)

- Exercise of Non-qualified Stock Options

- Disqualifying exercise of Incentive Stock Options

- Sales commissions

- Interest income

- Investment income in taxable, non-retirement accounts (dividends, capital gains)

Note on Pre-tax Deductions

Let’s say your total income is $400,000, and you max out your traditional 401(k). When you file your tax return, the IRS won’t count the full $400,000 as gross income because of pre-tax deductions like 401(k) contributions.

If you examine your pay stub, you likely have types pre-tax deductions. Common examples include your 401(k), insurance premiums, and HSA/FSA. If your pre-tax deductions total $25,000, then the IRS concludes your gross income equals $375,000.

Above-the-line Deductions

Above-the-line deductions are also known as Adjustments to Income. Few of my clients are able to take advantage of these Adjustments to Income because they’re not educators, members of the Armed Forces, or self-employed. Or their earnings are too high, which preclude them from deducting student loan interest.

You can take above-the-line deductions even if you don’t itemize. Refer to the “Below-the-line Deductions” section below to learn about the standard deduction versus itemized deductions.

Adjusted Gross Income (AGI): Why it’s Important

Your AGI determines whether you’re eligible for certain tax credits or deductions. For example:

- When deducting charitable contributions, you can generally deduct up to 60% of your AGI.

- The limit in 2020 for gifts of cash to public charities is 100% of AGI.

- You can deduct unreimbursed medical expenses if they are at least 7.5% of AGI.

- Tax breaks for education, such as the student loan interest deduction, are limited or eliminated if your AGI is too high.

Let’s assume above-the-line deductions = $0. As a result:

$375,000 gross income

– $0 above-the-line deductions

= $375,000 AGI

Below-the-line Deductions: Standard Deduction vs. Itemized Deductions

Next, the IRS allows you to further reduce this $375,000 AGI in one of two ways:

- Standard deduction, or

- Itemized deductions

Every year, you can choose between taking the standard deduction, or itemizing your deductions, whichever is greater.

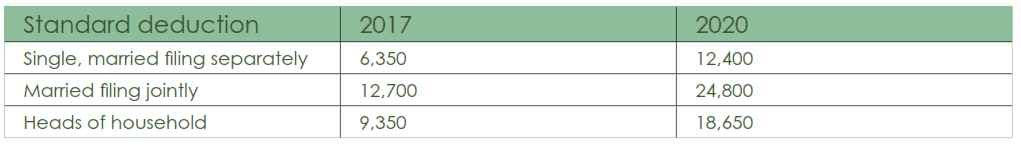

Standard Deduction

The standard deduction is a fixed amount based on your filing status.

Itemized Deductions

“Itemizing” refers to tallying all expenses as allowed by the IRS to deduct from your income, lower taxable income, and therefore lower your total tax bill.

Examples of expenses that can be itemized:

- State income taxes and property taxes (although this is subject to a $10,000 cap thanks to the 2017 Tax Cuts & Jobs Act)

- Mortgage interest

- Charitable gifts

- Unreimbursed medical expenses if they are at least 7.5% of AGI (as discussed in the AGI section).

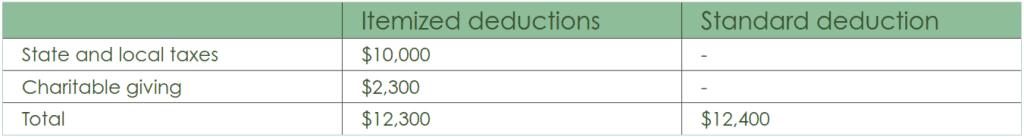

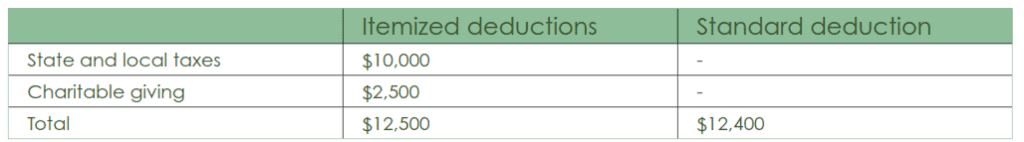

Illustration: Standard Deduction

In this illustration of a single filer, they are better off taking the standard deduction rather than itemizing:

They’re better off taking the standard deduction because $12,400 > $12,300.

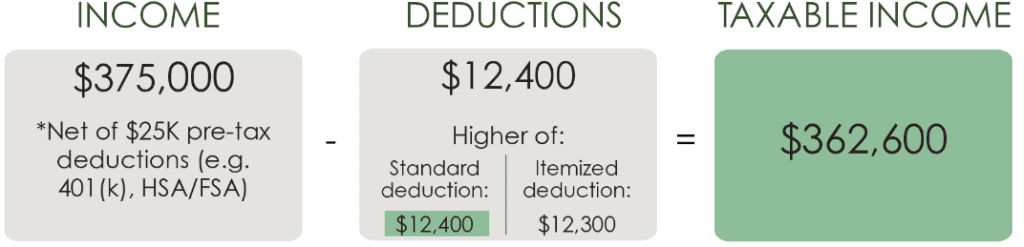

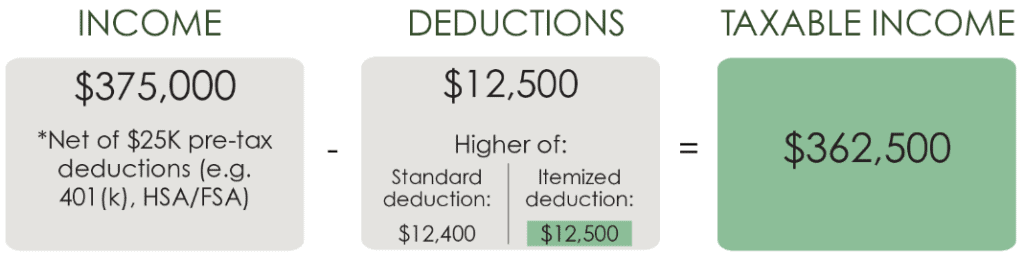

Taxable Income

AGI – Below-the-line Deductions = Taxable Income. Therefore, taxable income = $362,600:

Illustration: Itemized Deductions

In this illustration of a single filer, they are better off itemizing rather than taking the standard deduction.

Impact of the Tax Cuts and Jobs Act

After the tax reform of late 2017, most taxpayers were better off taking the standard deduction rather than itemizing.

One reason is that the standard deduction increased substantially.

Another reason was the cap on state and local income taxes. This was an annoying change for California and New York residents. The maximum State and Local Tax deduction is now $10,000 ($5,000 a year for married filing separate taxpayers). Previously, there was no limit. There are two components of State and Local Taxes (sometimes referred to as “SALT” in the news):

- Deduction for either: (a) state income taxes, or (b) state sales taxes, whichever is higher.

- Deduction for state/local property taxes.

Even if your California income taxes (and property taxes if you’re a homeowner) are way higher than $10,000, you can only itemize $10,000 at most for State and Local Tax. That’s why I used “$10,000” as the number for state income taxes in the illustrations above.

The $10,000 SALT cap and the higher standard deduction means that you’re likely to be taking the standard deduction, particularly if you don’t have a mortgage. If charitable giving is important to you, continue to support organizations. Just be aware that you may not be able to itemize these donations because you’re better off taking the standard deduction.

You can see from the illustration above that if your only itemized deductions are state income tax and charitable giving, single filers must donate at least $2,401 to be better off itemizing rather than taking the standard deduction.

If you’d like to learn more about the Tax Cuts and Jobs Act, I wrote a detailed article about the top three changes my clients experienced after the tax reform.

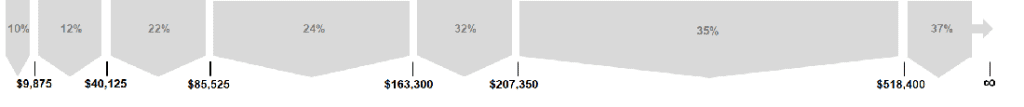

Total Tax and Progressive Tax Rates

US income taxes are an example of a “progressive” tax system. Let’s assume your taxable income is $362,500.

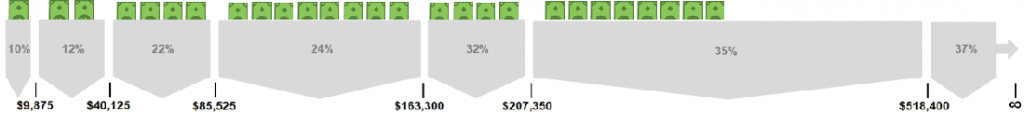

Let’s look at the 2020 tax brackets for single filers. This illustration is based on a great article by Vox:

$362,500 taxable income falls in the 35% tax bracket. Some people mistakenly believe they owe 35% taxes on the entire $362,500. Federal income taxes are progressive, not flat. The Vox article illustrates tax brackets as pockets. Imagine that the green bills represent $362,500 taxable income:

- Only the first $9,875 can fit in the first pocket: you owe 10% on this.

- The income you earn past $9,875 goes into the next pocket: you owe 12% on the money in this pocket.

- The income you earn past $40,125 goes into the next pocket: you owe 22% on the money in this pocket, and so forth.

If you got a huge raise and your taxable income was $518,401, then this would push you into the next pocket, or the 37% bracket. BUT only the incremental $1 would be subject to 37% taxes.

Taxes Already Paid

Withheld From Paychecks and Investment Income

In the US, you must pay income taxes throughout the year. The income taxes are withheld from your paychecks because the IRS doesn’t want to wait until next April 15th for its money.

If you have a taxable investment account, some investors ask their financial institution to automatically withhold taxes on investment income earned during the year.

Estimated Tax Payments

You may need to make estimated tax payments throughout the year. See the Estimated Tax Payments section below to learn more.

Total Tax vs. Tax Refund

Don’t confuse tax refunds with your total tax bill. Most taxpayers are happy to receive a big refund check. But your true goal should be to minimize your total tax bill, and have a small refund.

Why You Should Avoid Tax Refunds

I tell my clients to avoid a large tax refund. This allows them to avoid giving the government an interest-free loan. The goal is for the taxes paid throughout the year (withheld from paychecks, estimated tax payments, etc) to match their tax liability. Practically speaking, a tax refund of about $1,000 is close enough.

I wrote a blog post about this topic if you’d like to read further.

Estimated Tax Payments

You pay income taxes as they’re deducted from each paycheck.

Another way to pay income taxes is through estimated tax payments. These estimated tax payments are due quarterly in April, June, September, and January.

You may be wondering, “You just said I should avoid tax refunds. So can I just wait until next April to pay whatever I owe?”

The reason you may want to pay estimated tax payments (on top of having taxes deducted from your paycheck) is because of the Estimated Tax Penalty.

Note that in 2020, estimated taxes that would have been due in April and June are now due on July 15th, 2020.

Estimated Tax Penalty, and Safe Harbor Payment

The IRS (and California FTB) expects you to pay a minimum amount of taxes by year-end. This is known as the safe harbor payment.

IRS and California determine safe harbor amounts as the smaller of:

- 100% of the tax shown on last year’s tax return*, or

- 90% of this year’s taxes

*If you’re a high earner with AGI > $150,000 ($75,000 if married filing separately) on last year’s tax return, replace 100% with 110%.

You will need to pay estimated taxes if your withholdings don’t meet the safe harbor rules. Otherwise, the IRS charges a penalty for underpayment known as the estimated tax penalty.

Owing a balance to the IRS is okay as long as you meet the safe harbor requirements.

Equity Compensation and Estimated Tax

If you work for a public Bay Area or Seattle company like Google, Cloudflare, or Microsoft, you have income in addition to your base salary. This income is usually in the form of Restricted Stock Units (RSUs).

You may also have received stock options when your employer was private. Exercising stock options will also generate income.

Usually companies will sell shares on your behalf to cover taxes. But this may only cover most (not all) of your tax liability. And tax withholding doesn’t occur for Incentive Stock Option exercises.

Stock option exercises is one situation where it makes sense to hire a tax professional rather than DIY’ing with TurboTax. Be sure to consult a tax professional before major transactions like exercising stock options, or your company’s IPO.

To learn how donating your company stock can help you save on taxes, support important causes, AND reduce your concentration risk, download my free guide, Financial Self-Care for Superstar Women.

If you’re looking for a tax-focused financial planner who specializes in equity compensation, schedule a free consultation.