Open Enrollment: How to Select Benefits for Next Year

Open enrollment season approaches. The acronyms and jargon are overwhelming: PPO, EPO, HMO, FSA, HSA, deductible, co-pay, co-insurance…You could give up and choose the same benefits for next year. But certain benefits that don’t renew automatically. And if your personal circumstances have changed, it may make sense to update your benefits:

- Changes to your health: maybe you endured a serious illness and want to switch to a health insurance plan with lower out-of-pocket costs.

- Moving: maybe you’ll change to a new doctor or dentist who’s closer to your new home.

- Planning for increased healthcare expenses: if you need serious dental work like a root canal, you may want to increase your FSA/HSA contribution.

Because company benefits are so valuable, I encourage you to review the open enrollment materials.

In this article, I discuss the three most valuable benefits: health insurance, Flex Spending Accounts (FSA), and Health Savings Accounts (HSA). In part two, learn about other common benefits like dental, vision, and life insurance.

Health Insurance

This is the most important (and confusing) benefit to review during open enrollment.

Terminology

Let’s start with the simplest concept: the premium. This is cost for the health insurance, and it’s deducted from each paycheck. You pay the premium even if you never go to a doctor.

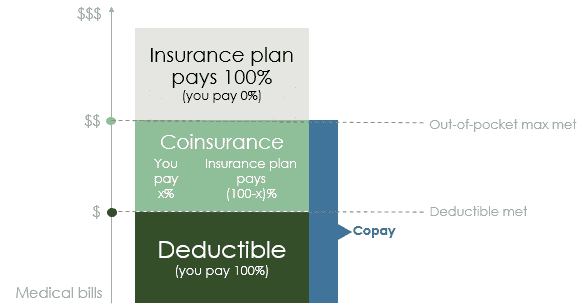

Once you start going to the doctor, the concept of “cost sharing” comes into play:

- Deductible: what you must pay before insurance kicks in.

- Copay: a fixed amount that you pay each time you go to the doctor. Copays sometimes count toward the deductible.

- Coinsurance: after you meet your deductible (but not the out-of-pocket max), you pay a percentage of the expense.

- Out-of-pocket maximum: sum of deductible, coinsurance, and all copays.

Types of health insurance

Here are the four common types of health insurance plans: HMO, PPO, EPO, and POS. When I review my clients’ open enrollment materials, I most commonly see HMOs and PPOs. I see EPOs less often, and I’ve yet to see POS plans.

| HMO | PPO | EPO | POS | |

| Acronym for | Health Maintenance Organization | Preferred Provider Organization | Exclusive Provider Organization | Point-of-service |

|

Overview |

A primary care doctor manages your care and refers you to specialists. There’s no coverage for out-of-network providers (other than in an emergency). | You don’t need a referral from a primary care doctor to see a specialist. You can see an out-of-network doctor, but you’ll have to pay more. PPOs usually have the highest premium of the four plans. | Like a PPO, you don’t need a referral from a primary care doctor to see a specialist. Like an HMO, there’s no coverage for out-of-network providers (other than in an emergency). | Similar to a PPO, you can see out-of-network providers, but you’ll have to pay more. Like an HMO, the primary care doctor coordinates your care and refers you to specialists. |

| What doctors you can see | In-network only | Any in the PPO’s network. You can see out-of-network doctors, but you’ll pay more. | In-network only | In-network providers to whom your primary care doctor refers you. You can see out-of-network doctors, but you’ll pay more. |

High Deductible Health Plans (HDHP)

There’s a subcategory of health plans, High Deductible Health Plan (HDHP). The HMO, PPO, EPO, and POS can come in an HDHP flavor.

- Premium: an HDHP generally has lower premiums compared to other plans.

- Deductible: at least $1,400 for an individual or $2,800 for a family. Your preventive care is free even if you haven’t met the deductible.

- Copays or coinsurance: Other than preventive care, you must pay all medical expenses up to your deductible. You can use money in your HSA to pay these costs.

- High deductible plans don’t pay anything until the deductible is met

What plan should you pick?

If you’re healthy and only go to the doctor for your annual physical and OB/GYN visit, the HDHP is probably your best bet. You can contribute the savings in premiums to your HSA to pay for your deductible, copays, and coinsurance until you reach your out-of-pocket limit. If you have a medical emergency and your HSA balance isn’t enough to meet the out-of-pocket maximum, make sure you have enough in your emergency fund to pay for out-of-pocket health expenses.

If you value having your choice of doctors, select a PPO or EPO. You don’t need a referral from your primary care physician to see a specialist. You also can see out-of-network doctors, although you will have to pay more. The downside to a PPO plan is that the premium will be more expensive than the other plans.

HSA vs. FSA

Both are accounts to which you can contribute pre-tax dollars to save for qualified medical expenses such as qualifying prescriptions, deductibles, copays, and coinsurance. There are important differences, however:

| HSA | FSA | |

| Eligibility to contribute | Must have a High Deductible Health Plan (HDHP) | You can contribute regardless of the health insurance plan you select |

| Contribution max (2020) | $3,600 ($7,200 for families), plus $1,000 catch-up contribution if age 55+ | $2,750 |

| What happens if you change employers | You keep the HSA funds because you own the account | You lose unused funds because your employer owns the account |

| When you can access the funds | You have complete access to your annual election at any time, even if you haven’t yet contributed that amount | You only have access to what’s actually been deposited into your HSA account |

| Rolling over funds year-to-year | Unused funds don’t expire. The funds can be invested to grow tax-free, and you can keep growing these savings for retirement.

Accumulated savings can be withdrawn after age 65 without penalty. If funds are used for non-medical expenses prior to age 65, the funds are subject to: (1) income taxes and (2) 20% penalty. |

Your employer decides whether you can keep unused funds. There are three options:

|

| Proof needed for reimbursement | None at the time of reimbursement, but you should keep records separately. When you file your tax return, you must file Form 8889 (your tax preparer or Turbo Tax can generate this) | Receipt containing:

|

| Ability to change contribution amount outside of open enrollment | Allowed | Not allowed unless qualifying event (e.g. marriage, divorce, new child) |

Limited Purpose FSA

This a special type of FSA for qualified medical expenses. It’s “limited purpose” because you can only use the funds for dental and vision expenses. If you have an HSA, you can also fund a Limited Purpose FSA up to $2,750.

Dependent Care FSA

There are two types of FSAs: healthcare FSAs (discussed above), and Dependent Care FSAs. The Dependent Care FSA is another pre-tax benefit account that you can use to pay for child and adult care services so that you can go to work:

- If you have a child in your care under the age of 13 and lives with you over half the year, eligible dependent care expenses include daycare, preschool, summer day camp, and before or after school programs.

- If you have a spouse or relative who is physically or mentally incapable of self-care and lives in your home, eligible dependent care expenses include adult daycare, and elder care in your home. For those of you with aging parents who live with you, consider contributing to a Dependent Care FSA.

Summary

- The HDHP health insurance plan is probably your best bet if you’re healthy and only go to the doctor for your annual physical and OB/GYN visit

- The PPO or EPO is best if you value having your choice of doctors since you don’t need a referral from your primary care physician to see a specialist

- Even if you don’t want to change your benefits coverage through work, remember to renew your HSA or healthcare FSA, and Dependent Care FSA enrollments annually