Self-Care During an Unnerving Time

COVID-19 cases continue to climb in the US. California and New York are now under shelter-in-place orders. Bay Area and Seattle companies are requiring that people work from home for the month of March, if not longer.

Now more than ever, we need to prioritize self-care. In today’s blog post, I’ll mostly on emotional and mental health, with a few comments on the financial markets. I’ll be sharing advice on how to accept our new reality, and focus on what you can control.

At the very end of this article, I share Mr. Rogers’ words of encouragement from his final episode of Mister Rogers’ Neighborhood (get your tissues ready).

Staying Sane and Adapting

I’ve been working from home for several years. But even so, the disruptions have been very jarring. Gyms are closed, so I no longer see my trainer and workout buddies. My favorite restaurants and cafes are closed during the shelter-in-place order.

https://twitter.com/roxiqt/status/1240384686242832384

Notice the Emotion

Last week was an emotional roller coaster for me:

- Monday: a shelter-in-place order was announced for all Bay Area counties effective at midnight.

- Tuesday (St. Patrick’s Day): this was my sister’s birthday, and I was planning to go over with St. Patty’s Day trinkets for my nieces. But after the order was announced, I reluctantly stayed home.

- Wednesday: it was only Day 2 on lockdown, and I was feeling stressed. My gym was temporarily closed, so I couldn’t blow off steam with exercise. Although restaurants can offer take-out, my favorites were closed. My new reality really sank in, and out of distress, I went to the only restaurant I could find and bought a cheeseburger, onion rings, and ice cream sandwiches. Then I stress-ate everything for lunch. Not surprisingly, I was listless the rest of the day.

On Thursday, my old instincts told me to power through my to-do list. Luckily, I remembered to do my daily lunchtime “HALT” check-in. Sitting with my thoughts and emotion (Loneliness, as well as Sadness) helped me feel better, and it was a first step to accepting our new reality.

Focus Inward

It’s easy to fall into the trap of monitoring the news or endlessly scrolling through Instagram or Twitter. No one knows when the spread of COVID-19 will be under control. But we will survive and come out on the other side.

The next few weeks (or possibly months) will require that we sacrifice in the short-term. It’s tough to physically distance ourselves from friends and loved ones, but doing so will protect our healthcare workers and vulnerable neighbors. In the meantime, my advice is to focus on what you can control. One of the things you can control is your breath.

Haemin Sunim is a Buddhist monk in South Korea who gained fame as the “Twitter monk.” I turned to his Twitter account for guidance and liked this retweet:

Day 1 of self isolation + crisis-combating quote: "When the mind looks outward, it is swayed by the heavy winds of the world. But when the mind faces inward, we can find our center and rest in stillness" – @haeminsunim

— JP Balmonte (@jpbacteria) March 17, 2020

Haemin Sunim wrote two New York Times bestsellers, most recently Love for Imperfect Things. I re-read chapter 6 on Healing, and I found his words on the power of your thoughts to be relevant (pages 183-184):

We all experience feelings of depression at some point in our lives. When you do, notice that the fuel for depressed feelings is negative thoughts. If we keep feeding the feeling with those thoughts, the feeling grows stronger and stays longer. Rather than being trapped in negative thoughts, shift your attention to your body and breathe deeply. As the mind clears, so will the feeling.

Meditation is an ancient practice of sitting still and quieting your mind through conscious breathing. Consider meditating every day. Even two minutes a day improves my mood and focus. And if you’re skeptical of the spiritual aspect, think of meditation as brain exercise where you’re training your brain to bring back its focus over and over.

Berkeley-based therapist, Annie Wright, has a wonderful Instagram account. She recently shared a blog post describing the physical and mental health benefits of focused breathing from the perspective of our autonomic nervous system. Her post includes other practical tools to manage your anxiety around COVID-19.

If you’d like help getting started, psychologist Tara Brach, Ph.D., offers free guided meditations.

Facing Fears: Write Them Down

Amy Florian is a bereavement consultant based in Chicago. She used her personal experience of being widowed at a young age to train financial advisors on helping clients through loss and life transitions. She recently published specific tips on how to function during frightening time in our world. She describes a simple technique for facing your fears by writing them down:

One proven strategy is to take a few minutes and write about your fears. The simple act of putting your fears on paper where you can see them makes them more manageable…

So try this simple technique. Down the left side of a piece of paper, make a list of your fears about this pandemic. Don’t think them through or analyze them while writing, getting them out on paper regardless of their rationality.

Then on the right side, brainstorm and come up with a list of options to balance the fears, no matter how outlandish each option might seem. You can sort through them later and choose what makes the most sense for you.

What I’m Doing

Mental and Emotional Self-care

https://www.instagram.com/p/B9WMpL-gvyS/?utm_source=ig_web_copy_link

Practicing gratitude has really helped me. Here’s what I’m grateful for today:

- My cat, Zoe.

- Good health.

- My wonderful clients.

- My patio, where I can exercise, and feed the squirrels and birds.

- My sister and close friends. I haven’t talked on the phone this much in years, which has been a silver lining.

And when this crisis ends, I will be grateful for the many things I took for granted:

https://www.instagram.com/p/B94h9wUg4cZ/?utm_source=ig_web_copy_link

Things to Read, Watch/Listen, and Do

- Meal planning: after stocking up on groceries, I was devouring all of my quarantine snacks. Resuming my meal planning routine has helped me feel more in control. This podcast episode by Dr. Katrina Ubell, MD, How To Not Eat Your Way Through A Pandemic, was a good reminder to resume my healthy eating routine.

- I’m looking into a monthly craft subscription box. Something that doesn’t require a lot of artistic talent would be best!

- Nerdette podcast, which has great interviews with authors. Last week, they released short episodes with words of encouragement and advice on adapting in these unsettling times.

- Schitt’s Creek: it took me awhile to discover this show, but I caught up by binge-watching on Netflix. The current (and final) season is available on Amazon Prime if you’re a cord-cutter like me. Moira Rose is my favorite character.

- Star Wars: The Clone Wars: this is an animated series that covers the time period between Episodes II and III. This show actually makes the prequel movies bearable. My favorite fictional character of all-time, Ahsoka Tano, returns in the newly-released season 7.

- Star Wars comics: Darth Vader (2017) picks up immediately after the end of Episode III when Anakin Skywalker, now Darth Vader, discovers that Padme is dead. Darth Vader (2020) is a new series that covers the time period after Episode V when Luke Skywalker discovers that Darth Vader is his father.

- There are a wide range of free online workouts to stay healthy. My trainer sent us this 10-minute, no equipment workout to follow everyday.

Staying Informed

- Ars Technica’s comprehensive guide to COVID-19, Don’t Panic, is updated once a day at 12 PM Pacific. This website is a good way to stay informed and avoid information overload.

How to Help

- Consider pre-paying service providers who are the hardest-hit. For me, this is my personal trainer, cat sitter, and hairstylist.

- Sign up for NextDoor.com and see if any of your neighbors need help with picking up groceries or prescriptions. Through NextDoor, I learned about Oakland At Risk Match to match healthy young adults with low-risk factors, and our neighbors who are at-risk of COVID-19.

- Order takeout or delivery from your local community. The Oakland Chamber of Commerce has an updated list of restaurants that are open for limited service.

- Donate PPE (personal protective equipment): UCSF is accepting donations of critical supplies at donation sites in San Francisco and Oakland.

(Brief) Financial Commentary

For most of my clients, the world of investments is the last thing on their minds. But in case you’re interested, here’s a quick recap of what’s been happening in the markets, recent government interventions, and my advice to clients.

Quick Market Recap

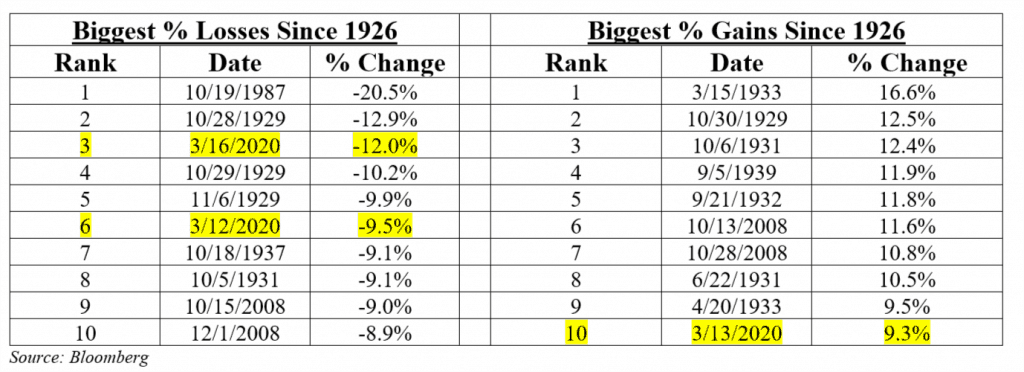

The volatility of the last few days is historic – both up and down. For the S&P 500, a gauge of the US stock market, three days in March 2020 make it into the top 10 biggest up or down daily moves since 1926.

If the recent market drop felt like it happened quickly, that’s because it did. This is the fastest bear market in history: it took just 16 days for the S&P 500 to fall more than 20% from its recent high. During the financial crisis, the S&P 500 took about 175 days to drop 20% from its peak.

We’re also witnessing a 17-year low in oil prices with oil heading to $25 per barrel. The price drop is due to an pricing war between Saudi Arabia and Russia, as well as low demand for fuel due to work and travel lockdowns. How does the broader energy industry impact the stock market? Energy companies represent a large portion of the US stock market at 6.5% (as measured by the S&P 500). As oil prices drop, energy stocks are declining as well, contributing to the bear market.

My Advice to Clients: Stay the Course

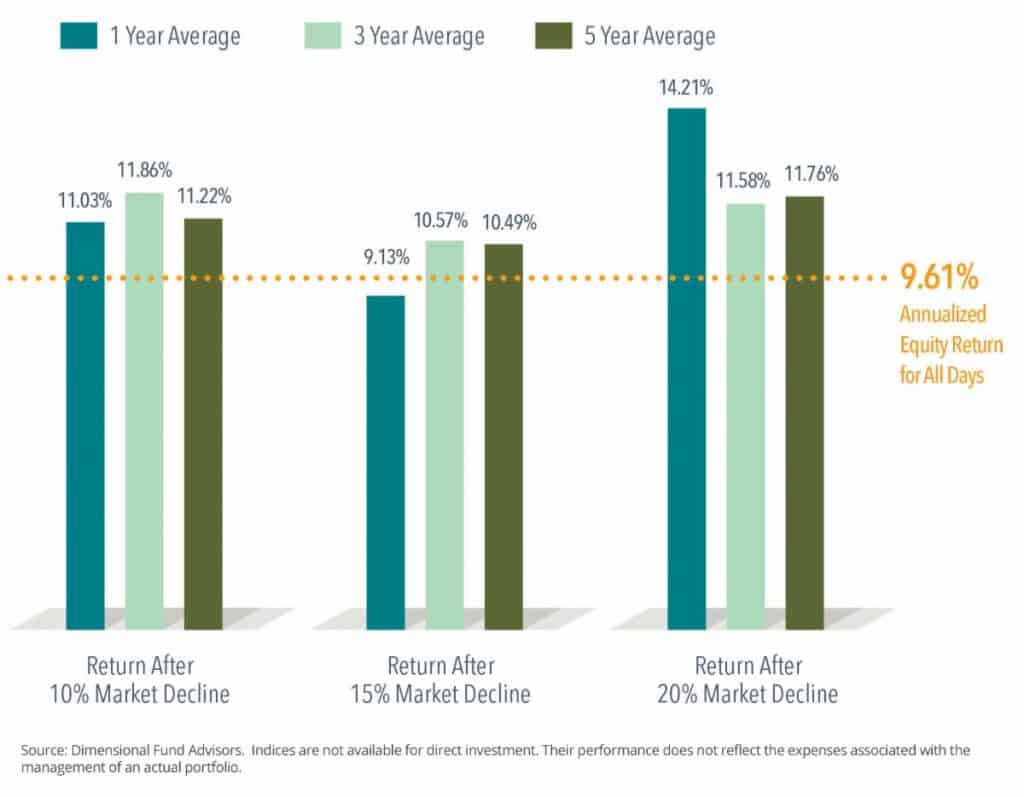

No one knows how the COVID crisis will unfold, or how it will impact the financial markets. But better times are ahead if you can remain patient. After every period of market disruption, no matter how significant, markets have recovered and rewarded the patient investor.

This graphic shows the average 1, 3, and 5 year returns of the US stock market after market declines of 10%, 15%, and 20%.

Other Advice to Clients

Stick to the investment plan. For the most part, my clients are very fortunate to have job security. They also work in white-collar professions and can work from home. Because I work with high-earning professionals (rather than retirees), they aren’t relying on their portfolio to pay the bills. And as a result, they can afford to take the long view and continue to invest in the stock and bond market. Their portfolios are structured for all seasons: stocks for prosperous times, and cash and bonds to ride out the storms.

Invest one lump sum. I’ve gotten great questions from my clients about how to invest: should they make a single large purchase? Or should they stagger their purchases (a.k.a. “dollar-cost averaging”) over several weeks, investing a fixed amount every week to avoid playing the market?

I recommend a single large purchase. Research has shown that investment performance is actually superior when you make one large purchase rather than dollar-cost averaging. Stocks and bonds have historically produced higher returns than cash to compensate for their greater risks. By investing a lump sum right away, investors have been able to take advantage of these risk premia for a slightly longer period.

Admittedly, there are psychological benefits to dollar-cost averaging as it gives you a greater sense of control. This approach can moderate the impact of an immediate market dip if one were to occur. The trade-off has been a lower return in the majority of market scenarios.

If it helps you to sleep better at night, then go ahead with the dollar-cost averaging approach. You’ll want to create regular schedule (whether weekly or monthly) where you invest all of the cash within one year at most.

You can read this short Vanguard article on the pros and cons of investing “all at once” vs. “slow and steady.”

Take comfort in your emergency fund. For a few clients who work in industries that will be impacted by the downturn, they can take comfort in having a healthy emergency fund. I recommend 3-6 months for salaried professionals, and as high as 12 months for self-employed individuals.

Words of Encouragement from Mr. Rogers

If you’re a Millennial or Gen X’er who grew up in the US, you likely watched Mr. Rogers’ Neighborhood on PBS. I still remember the enchanting crayon factory episode. Mr. Rogers’ birthday was March 20th, and he would have been 92 years old. The Nerdette podcast shared these comforting words from Mr. Rogers’ final episode. Have your tissues ready!

“You know, it happens so often: I walk down the street and someone 20, or 30, or 40 years old will come up to me and say, “You are Mr. Rogers, aren’t you?” And then they tell me about growing up with the neighborhood, and how they’re passing onto the children they know what they found to be important in our television work. Like expressing their feelings through music, and art, and dance, and sports, and drama, and computers, and writing. And invariably, we end our little time together with a hug. I’m just so proud of all of you who have grown up with us. And I know how tough it is some days to look with hope and confidence on the months and years ahead. But I would like to tell you what I often told you when you were much younger: I like you just the way you are. And what’s more, I’m so grateful to you for helping the children in your life to know that you’ll do everything you can to keep them safe, and to help them express their feelings in ways that will bring healing in many different neighborhoods. It’s such a good feeling to know that we’re lifelong friends.”