Is Your Company Going Public? Three Steps to Prepare

Summary:

- Get organized: save the source documents (Plan Document, Option/RSU Agreement)

- Define your goals, which will provide the context for whether to keep or sell your company stock

- Learn a framework for deciding when to exercise your stock options

- Be ready for a rollercoaster ride during the lockup period

- Work with a financial planner (the sooner the better) who’s experienced with stock option and RSU planning

Context: Bay Area IPOs, Equity Compensation Overview

Tech IPO headlines are plentiful in 2019. Lyft went public in late March; Pinterest and Airbnb are other tech companies that will likely IPO later in the year. If you’re an employee at a company that has (or will) go public, such as Lyft, Pinterest, and Slack, an IPO is an exciting and perhaps nerve-wracking time. You likely have stock options or Restricted Stock Units (RSUs). Learn how the impact of your company’s IPO will depend on the type of equity compensation you possess.

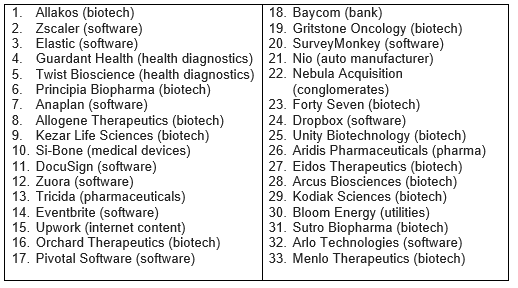

Pop Quiz: Bay Area IPOs

Question #1: how many Bay Area companies went public in 2018?

Answer: 33

Question #2: what industry was the most represented in this IPO class?

Answer: healthcare. You may have guessed tech, but 18 of the 33 were healthcare companies (primarily biotech).

As of April 2019, 14 Bay Area companies have gone (or plan to go) public in 2019:

- Alector: IPO on 2/6/2019

- Harpoon Therapeutics: IPO on 2/8/2019

- Levi’s: IPO on 3/20/2019

- Lyft: IPO on 3/29/2019

- Slack: S-1 confidentially filed 2/4/2019

- Postmates: S-1 confidentially filed 2/7/2019

- PagerDuty: S-1 filed 3/15/2019

- Pinterest: S-1 filed 3/22/2019

- Zoom: S-1 filed 3/22/2019

- Airbnb

- CrowdStrike

- Cloudflare

- The RealReal

- Uber

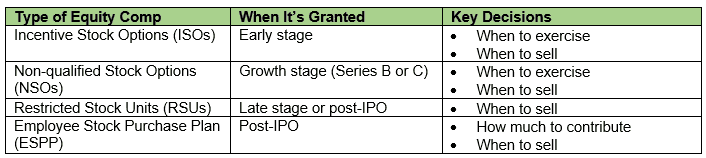

Types of Equity Compensation

There are four types of equity compensation. This table summarizes when each is granted, and the important decisions to make. Where your hire date falls into your employer’s lifecycle determines the type of equity compensation you have:

The most popular question/comment from prospective clients is, “I don’t understand how my ‘stock options’ work.” When I ask for more information, they’re unsure whether they have ISOs or NSOs. Or they end up having RSUs rather than stock options. This doesn’t surprise me since equity compensation is complex. And HR departments likely aren’t teaching their employees how and when their equity compensation is earned and taxed.

Step 1: Get Organized

Gather Important Paperwork

Your company likely uses a third-party company like Solium, Schwab, or E*Trade to administer their equity compensation plans. Log in and download the following files:

- Plan Document (general to company, not specific to you or your grant)

- Grant Agreement and any supplemental materials (specific to you)

The Grant Agreement contains valuable information about your specific grant(s), such as:

- Grant date

- Exercise price (a.k.a. strike price) for stock options

- Number of options or RSUs granted

- Vesting schedule

- Date of expiration

For your stock options (both ISOs and NSOs), your stock plan administrator tracks how many options are vested vs. unvested, how many options you’ve exercised (if any), and the taxes paid at time of exercise (for NSOs). If you’ve previously exercised options, the stock plan administrator also tracks how many shares you own.

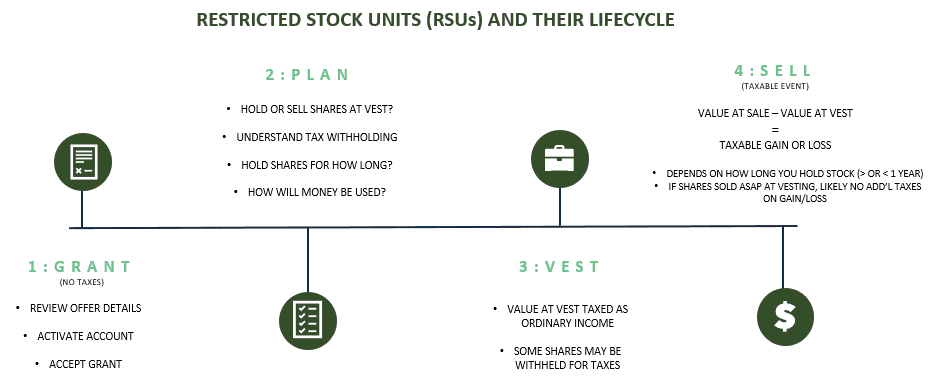

RSUs at private companies are subject to “double trigger” vesting. For your RSUs to vest, two things must occur:

- Time requirement: for example, 25% vest after one year, then monthly vesting thereafter

- Liquidity event requirement: either an IPO, merger, or acquisition must occur

The stock plan administrator tracks how many RSUs have met the time-based requirement for vesting. Once the IPO occurs, you will meet the second criteria for vesting the RSUs.

Step 2: Create a Long-Term Plan

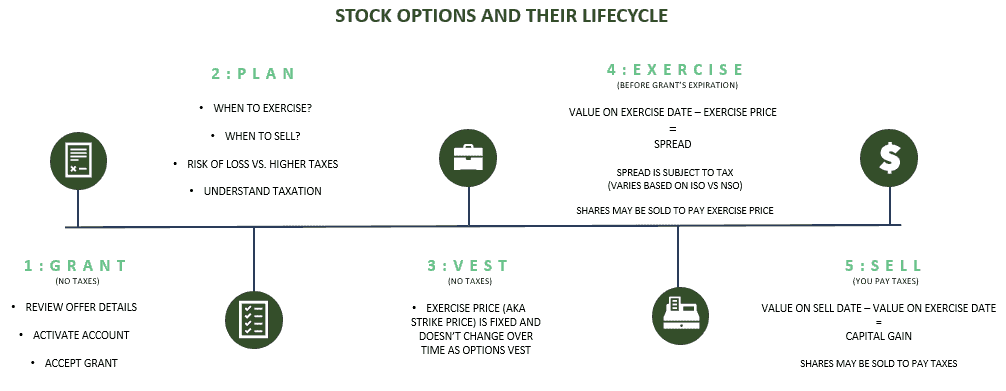

A key decision for stock options (both ISOs and NSOs) is when to exercise (see “4: Exercise” in the diagram):

A key decision for stock options and RSUs is when to sell the resulting shares of company stock. Most people focus on taxes when making these decisions. But beware of letting the “tax tail wag the economic dog”.

You should make these key decisions based on your long-term goals, and your need to diversify. Prospective clients often say they want to hold stock for favorable capital gains tax treatment. But don’t forget about concentration risk, or the risk of tying up a substantial portion of your net worth in your company’s stock. Many prospective clients don’t think about concentration risk until after they’ve accumulated a substantial amount of company stock.

A behavioral finance phenomenon called mental accounting often occurs when it comes to equity compensation. People tend to treat money differently depending upon the source of that money. They spend “found” money like a $3,000 tax refund or gift more freely than $3,000 earned from their paychecks. Money from your equity compensation is another example of “found” money. Let’s use big numbers to illustrate my point: most people wouldn’t spend $300,000 of their hard-earned savings on a speculative investment. But if they were paid $300,000 worth of a speculative investment, many would want to keep the investment.

My Approach to Working With Clients Expecting an IPO

- Articulate goals. This provides context to clients when they make the key decisions about stock options and RSUs. Everyone’s goals are different and are based on each client’s values and priorities. Some want to retire earlier. Others want to buy a home or increase charitable giving.

- Run long-term projection. I use financial planning software to run a long-term projection to compare: (a) how much my clients’ goals will cost, and (b) current plus future savings. This helps clients decide whether to sell the shares, and what to do with the cash. Some reinvest the cash in a diversified portfolio. Others keep the cash to fund specific goals like a down payment, home renovation, or providing financial support to family.

Decide Whether to Exercise Stock Options

One of the key decisions for stock options is when to exercise. To make this decision, it’s important to remember there are two components of stock option value:

- Intrinsic value (built-in profit)

- Time value (potential profit)

Calculate the intrinsic value by taking the current share price minus the exercise price. Let’s say your company’s stock is $50/share, and the exercise price is $10/share. Your built-in profit (before taxes) is $40. Some people forget to discount the intrinsic value of the stock option by the exercise price.

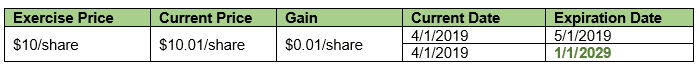

People often disregard the time value of their options. Consider this scenario:

At first, you may yawn at the $0.01 intrinsic value ($10.01 – $10). But add the following dates:

If you’re only a month away from the grant’s expiration, you’d be right to yawn. It’s unlikely the stock price will jump in a month, putting the option further “in the money” (e.g., higher intrinsic value).

However, when you’re nearly ten years from the grant’s expiration, there’s a far greater chance that the stock price will increase over time. There’s tremendous time value in the option. If the stock price climbs over the years, the beauty of stock options is that you decide when to exercise the option (e.g., when to buy the stock at $10/share).

Framework: When to Exercise Stock Options

Some people wait right until the option’s expiration date. A better strategy is to use the following framework:

- When intrinsic value > time value –> exercise

- When intrinsic value is significant portion of net worth –> exercise

Before you exercise options, I recommend that you work with a financial planner or tax professional to run a tax projection. The tax projection will quantify the AMT tax impact if you exercise ISOs. And you can proactively offset the ordinary income from the exercise of NSOs with income deferral techniques such as increasing 401(k) contributions, or perhaps increasing charitable gifts.

Decide Whether to Keep or Sell the Stock

You’ve exercised stock options, and/or your RSUs have vested. The next decision is what to do with the company stock. Your goals and creating a long-term financial plan provides clarity on what to do with the stock.

Summary of Income and Taxation

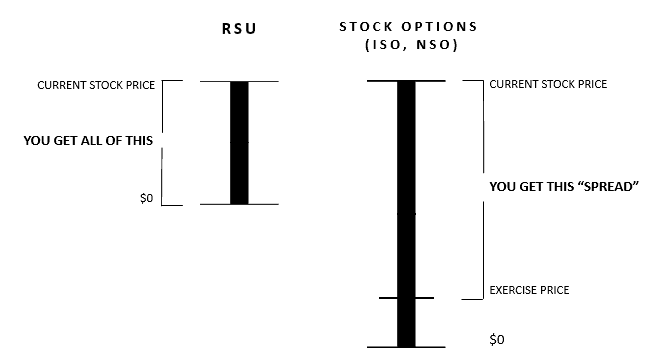

This illustrates the pre-tax income from RSUs and stock options. Stock options provide a larger potential economic benefit compared to RSUs:

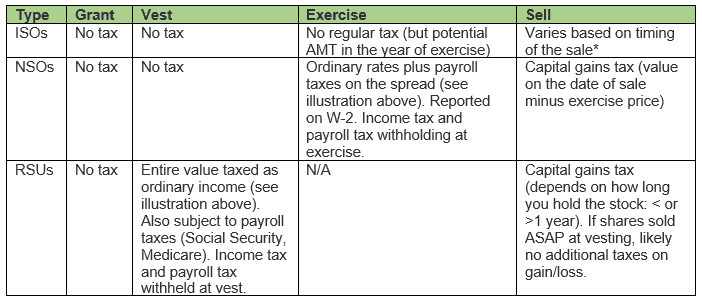

This table summarizes tax impact through the lifecycle of stock options and RSUs:

*Special Note on ISOs

For ISOs, if you sell the resulting stock at least two years from grant and one year from exercise, this is a “qualifying disposition”. The benefit is the spread is subject to long-term capital gains tax treatment. The beauty of ISOs is that they transform ordinary income to more favorable capital gains tax treatment.

Otherwise, the sale of stock is disqualifying disposition. The taxation is the same as for NSOs: ordinary income tax treatment on the spread at exercise (or spread at sale if that’s lower). Income from a disqualifying disposition isn’t subject to withholding. Is reported on W-2.

The reality is that most ISO holders don’t meet the requirements for a qualifying disposition. For example, a same day exercise and sale after IPO would fail the “one year from exercise” requirement.

A potential landmine for ISOs is AMT. The Alternative Minimum Tax (AMT) rules are complicated. In a nutshell, you have to calculate your tax bill twice: under the regular rules, and under the AMT’s special rules. Each year, you must pay either your regular tax liability, or your AMT liability, whichever is greater. Assuming you keep the shares beyond the calendar year of the exercise, the spread (fair market value on the day of exercise minus the strike price) isn’t subject to regular income taxes, but it counts as income under the AMT system.

When your ISOs have a low exercise price, it may be tempting to exercise these ISOs while you’re company is still private, and get the clock started on the qualifying holding period. However, due to AMT, you may end up with a hefty tax bill on paper gains from your ISO exercise, and you’re stuck with illiquid shares that you can’t sell to pay the tax bill. If your company is publicly-traded and you exercise your ISOs, the risk is having to sell stock when the share price has dropped to generate cash to pay the tax bill. You could set up an payment plan with the IRS (and Franchise Tax Board if you’re a California resident), but this will incur interest and penalties.

Step 3: Prepare for an Emotional Roller Coaster Post-IPO

After the IPO, there’s a 90-180 day lockup period where you can’t sell the stock. Ex-employees are usually subject to the lockup too.

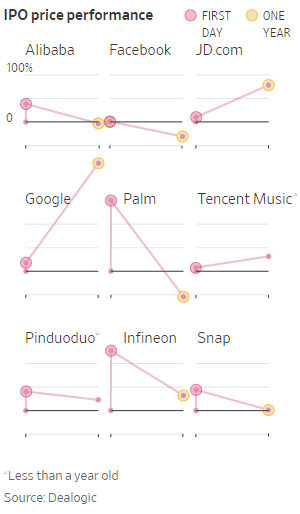

Be ready for a rollercoaster ride during the lockup period. Remember that prices can go down! This is a great chart from the Wall Street Journal showing how several big tech companies’ stock price performed at IPO versus one year later. Some companies like Google skyrocketed, but many like Facebook dropped below the IPO price.

Other Considerations If You’re Years Away From an IPO

I’m assuming most readers are weeks or months away from an IPO. But in case you’re at a company that’s a few years from an IPO, you have even more choices available to you:

- Early exercise provisions: sometimes companies allow their employees to exercise stock options before With early-exercise options, the IRS essentially lets you pick when you want to pay taxes on the spread. Note that early exercise of ISOs is considered a disqualifying disposition.

- Section 83(b) election: within 30 days of receiving restricted stock. When you early exercise stock options, the shares are considered restricted stock. And filing an 83(b) election can lead to favorable tax treatment: if the value of your company increases, you minimize ordinary income, and maximize capital gains. You accelerate recognition of income to the grant date, and if the share price increases, the gain will be taxed at capital gains tax rates. This strategy could make sense if the 409A valuation (“stock price” for private companies) is low at date of grant.

- Qualified Small Business Stock (QSBS): keep records if your stock is Qualified Small Business Stock. Your company will let you know if QSBS treatment applies. You must hold the stock for five years to qualify. The gain on QSBS stock is excluded from federal income tax depending on when it was acquired. The exclusion is the larger of: (a) 10x original tax basis, or (b) $10 million from federal income tax

- Section 83(i) election: this is a new tax law that is supposed to help people with equity compensation at private companies. It allows you to defer tax on option exercise and RSU vest until the liquidity event or five years, whichever is sooner. However, it’s unclear whether people will be able to take advantage of 83(i) elections since an employer must grant options/RSUs to at least 80% of its workforce, and the employee must write a check to the company to cover taxes. This could be a pain in the neck for employers because they must track employees (and ex-employees!) for five years to ensure you cut a check for taxes to the company (which the company then sends to the IRS).

Closing Remarks

Work with a financial planner or tax professional (the sooner the better) who’s experienced with stock option and RSU planning. A financial planner can help you create a holistic plan before your lockup ends.

A financial planner or tax professional can review the fine print of your Plan Document and Grant Agreement(s) to answer questions you may not have considered:

- What happens to your equity compensation if you die, quit, or get fired?

- What if the stock price drops?

- Taxes: when do you have to pay, and how much? Can the company withhold shares to cover taxes owed? If ISOs, will there be an AMT bill?

- Timing of the IPO: will it happen later in the year? Due to the 180 day lockup, you can’t sell shares in time to pay taxes owed next April 15th. What’s the plan to cover the tax bill?

Have questions about your specific situation? Schedule a free consultation.