Donate Stocks: Save on Taxes, and Reduce Concentration Risk

Edited 6/2/2020 and 6/4/2020: if you’re angry/disturbed/depressed by racial injustices like George Floyd’s murder, there are many ways you can help. Here’s a short list of organizations to financially support, as well as a few fundraisers for victims’ survivors:

- The Movement for Black Lives (email Charles Long, charles@m4bl.org, in advance if you want to donate stock)

- The Bail Project (email Chris McCain, chris@bailproject.org, in advance if you want to donate stock)

- Black Visions Collective (email resources@blackvisionsmn.org in advance if you want to donate stock)

- Reclaim the Block

- National Lawyers Guild (note: contributions aren’t tax deductible charitable contributions, but contributions to the National Lawyers Guild Foundation are)

- Official George Floyd Memorial Fund (GoFundMe for George Floyd’s surviving family members)

- I Run With Maud (GoFundMe for Ahmaud Arbery’s mother, Wanda Cooper Jones)

- Justice for Breonna Taylor (GoFundMe for Breonna Taylor’s surviving family members)

In a previous post, I wrote about concentrated stock risk (Stockpile of Company Shares: Nice (But Stressful) Problem to Have). I discussed the first two solutions: keep the shares, and sell the shares. In today’s post, I discuss the third solution: donate the shares.

If charitable giving is a priority, donating your company stock is a win-win: your favorite charitable organizations benefit, and you benefit financially as well.

Supporting charitable organizations benefits you in two ways:

- It reduces your concentration in your company stock. You want to donate stocks that are at a gain and were purchased at least one year ago.

- It reduces your income taxes AND capital gains taxes.

Let’s focus on the tax savings.

Reduce Income Taxes

I mentioned two types of tax savings when you donate investments:

- Reduced income taxes due to the tax write-off for charitable giving (assuming you itemize).

- Reduced capital gains tax.

We’ll focus on reduced income taxes in this section, and then reduced capital gains in the next section.

Income Taxes 101

Thanks to the 2017 Tax Cuts and Jobs Act, the standard deduction greatly increased. If you want your charitable giving to reduce your income taxes, you need to ensure that you give enough money away such that your itemized deductions is greater than your standard deduction. Download my free guide, Financial Self-Care for Superstar Women, and read the “Quick Primer on Income Taxes” section to learn more.

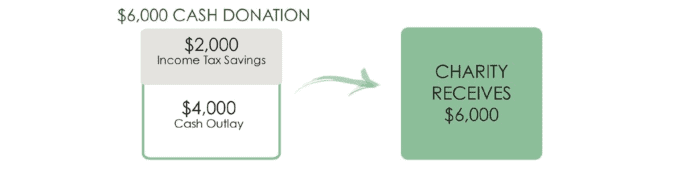

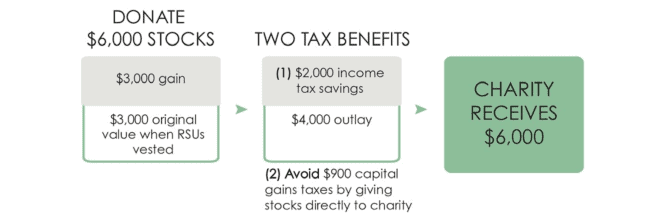

Donate Cash/Check

Let’s say you’re a single filer who wants to write a $6,000 check to your favorite charity. Because the US government wants taxpayers to donate to charitable organizations, the IRS encourages you by giving you a tax break that reduces your tax bill. Assuming your combined marginal tax rate is 33.3% (24% federal + 9.3% state), you save $2,000 on taxes. In other words, rather than $6,000 cash going out the door, your outlay will be $4,000 after the tax savings. And the charity still receives the full $6,000.

Sell Investments, Then Donate the Cash

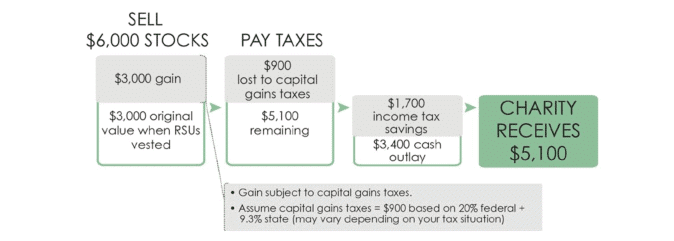

You may be wondering, “What if I sell $6,000 worth of company stock? Isn’t that the same thing?” The answer is No, and that’s because of capital gains taxes.

Capital gains taxes are different from income taxes. Capital gains taxes apply when you sell investments or property at a gain. Let’s assume the $6,000 of stocks have a $3,000 gain. In other words, the shares that you acquired when RSUs vested were valued at $3,000 on the vesting date(s), and have since grown by $3,000 ($3,000 gain).

When you hold investments for at least one year and one day, long-term capital gains taxes apply. By selling the investments, you lose $900 to capital gains taxes, which lowers your tax write-off, and lowers what the charity receives.

Reduce Capital Gains Taxes by Donating Company Shares Directly

Instead of writing a $6,000 check, you can donate $6,000 of investments directly to a charitable

organization. By donating an appreciated security “in-kind,” you receive TWO tax benefits:

- You can still write off the full $6,000 for the income tax deduction.

- You avoid paying capital gains taxes on the gain.

Meanwhile, the charity can sell the stock and pocket the full $6,000. Charities do not pay capital gains taxes because non-profit organizations are exempt from taxes.

Strategies for Donating Your Company Shares

Strategy #1: Charitable Lumping

If you want to itemize your charitable giving, you need to donate enough such that itemizing is greater than the standard deduction. For the typical single, high-earning renter in the Bay Area, this means your charitable giving must be at least $2,401.

You might balk at $2,401 if it’s significantly higher than your usual charitable giving. Let’s say your budget is $600 per year ($50 per month). You could take advantage of the charitable lumping strategy where you roll multiple years of contributions into one. In this example, you could combine three years of charitable giving into this year, allowing you to itemize on your tax return. You’d skip your charitable giving for the next two years.

Strategy #2: Donor Advised Fund

A Donor Advised Fund is a charitable investment account, which you can open at several financial institutions. This strategy may make sense if you have a significant percentage of your net worth tied up in your company stock with large capital gains.

Donor Advised Funds are technically charities. Financial institutions have separate legal entities set up as charitable organizations, which allow you to get the tax write-off (e.g., Vanguard Charitable, Schwab Charitable). You can contribute cash and/or investments such as your company shares. You get a tax deduction for the year in which you donated the cash and/or investments. Meanwhile, the dollars have the potential to grow tax-free in the account.

You can then disburse the funds to the charities of your choice. Contributing to a Donor Advised Fund is

a way of front-loading several years of gifts:

- You can disburse the funds as slowly or as quickly as you wish. If you die before the Donor Advised Funds runs out of money, you can name a successor to administer the account.

- You get a tax deduction for the year in which you “donated” the cash and/or investments to the Donor Advised Fund.

- But you don’t get to take a second deduction when the gift is disbursed to the end charity.

General Notes

- You’re better off donating long-term investments with large capital gains.

- To qualify for the tax savings, the organization must be a non-profit 501(c)(3) organization.

- If you’re subject to blackout periods, you likely will have to donate your company stock during an open trading window.