Stock Options 101: How the Taxes Work (Part 2 of 2)

Stock options and taxes are top of mind when I speak to people whose companies are going public. In my previous post, we reviewed the basics of stock options.

In this post, we’ll review taxes, including the dreaded AMT. We’ll look at:

- Non-qualified Stock Options (NSOs)

- Incentive Stock Options (ISOs)

Within each of these sections, we’ll review taxes at exercise, and taxes at sale of the resultant shares.

This article assumes your options have vested. You’ve met the time-based requirement and have the right to exercise the options.

You can learn even more by downloading my free guide, Preparing for an IPO. The guide also covers how to prepare for the emotional roller coaster of the IPO process.

Taxation of Non-qualified Stock Options

Taxes at Exercise: Spread (“Bargain Element”)

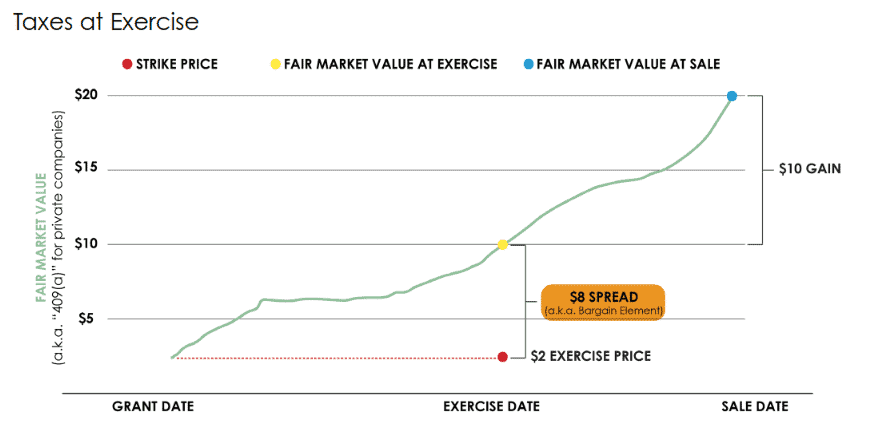

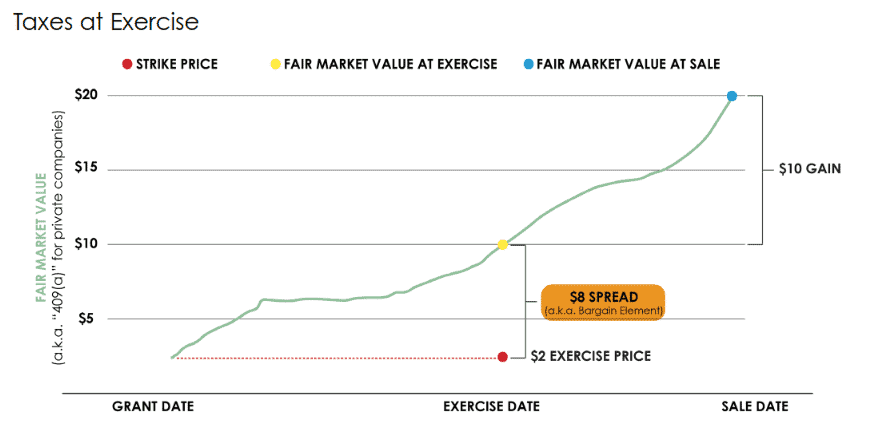

You’ve decided to buy your company stock (exercise your stock options) for the fixed price in your grant agreement (strike price). The spread between: (a) the stock price on the exercise date, and (b) the strike price, is also known as the bargain element. And the bargain element is subject to a variety of taxes:

- Income tax (both federal and California). The bargain element will be included as wages on your W-2.

- Payroll taxes: Medicare Social Security, and California SDI (State Disability Insurance).

In this illustration, you paid $2 for stock that’s worth $10. The share price at exercise minus the exercise price (a.k.a. strike price) equals the $8 bargain element:

The $8 per share profit is compensation income. The $8 profit is NOT capital gain.

In terms of when you have to pay these taxes:

- Some are withheld upfront at exercise. You might need to come up with extra cash (in addition to the exercise price) when you exercise NSOs.

- And you may owe a balance next April 15th. I help clients calculate this number. If you don’t have a financial planner, consult a tax professional for help.

The upfront withholding is based on flat rates defined by IRS and California FTB regulations:

- Federal income tax: 22% (37% once your supplemental wages exceed $1,000,000)

- California income tax: 10.23%

- Medicare tax: 1.45%

- Additional Medicare tax: 0.9% (once your total wages exceed $200,000)

- Social Security tax: 6.2% (up to the wage limit)

- California State Disability Insurance: 1.2% (up to the wage limit). If you don’t live in California, your locality may have its own version of state disability or other payroll taxes.

You must pay the rest by next April 15th. The default 22% federal and 10.23% California withholdings may not cover your full tax liability. Work with a tax professional or financial advisor to figure out whether to pay estimated taxes throughout the year (rather than waiting until next April 15th to pay the balance due). Otherwise, you risk incurring a late payment penalty from the IRS and California FTB.

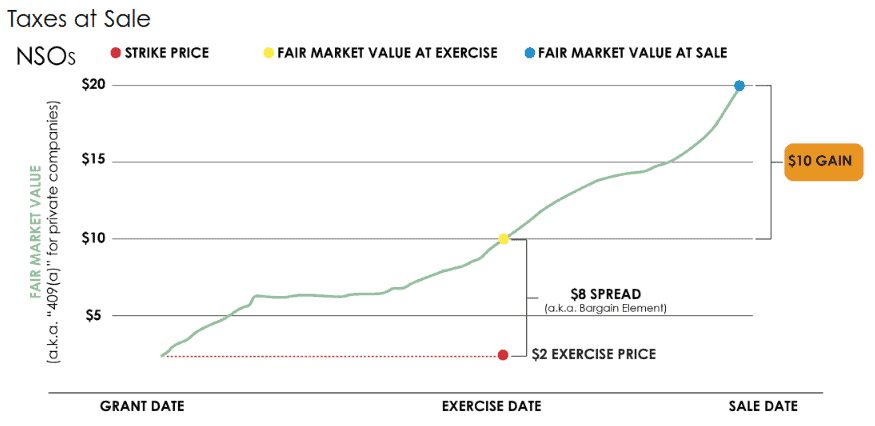

Taxes at Sale

You now own shares with a new purchase price $10. The purchase price (a.k.a. cost basis) is no longer $2. It increased by the $8 of profit on which you were taxed at exercise.

Let’s pretend you sell those shares when they’ve grown to $20 per share:

Your profit is $10. This $10 per share profit is capital gain.

Federal Capital Gains Tax

The amount of federal capital gains tax you owe depends on the holding period:

- If you hold the shares 1 year or less, short-term capital gains tax applies to the $10. Short-term capital gains are taxed at the same rate as compensation income.

- If you hold the shares > 1 year, you pay long-term capital gains tax: 15%-23.8%. The exact rate depends on your filing status and income. The tax rate for long-term capital gains tax is lower than for compensation income.

State of California Capital Gains Tax

California doesn’t have a separate capital gains tax system. The same tax rate applies whether you have short-term or long-term capital gains. California is the highest tax state in the US. Your tax rate on the $10 profit will be 9.3% to 13.3%. The exact rate depends on your filing status and income.

Taxation of Incentive Stock Options

Taxes at Exercise

You’ve decided to buy your company stock (exercise your stock options) for the fixed price in your grant agreement (strike price). The spread between: (a) the stock price on the exercise date, and (b) the strike price, is also known as the bargain element.

The taxation of the spread for ISOs is very different from NSOs:

- No “regular” income taxes

- No payroll taxes

- But the bargain element may be subject to Alternative Minimum Tax (AMT)

In this illustration, you paid $2 for stock that’s worth $10. The share price at exercise minus the exercise price (a.k.a. strike price) equals the $8 bargain element:

The $8 per share profit is income for AMT purposes if you hold the shares past 12/31.

In terms of when you have to pay these taxes:

- No taxes are withheld when you exercise of ISOs.

- Be sure to set aside a tax reserve when you exercise ISOs. I help clients calculate this number. If you don’t have a financial planner, consult a tax professional for help.

Alternative Minimum Tax (AMT)

The Alternative Minimum Tax (AMT) rules are complicated. In a nutshell, you must calculate your tax bill twice: under the regular rules, and under the AMT’s special rules. Each year, you must pay either your regular tax liability or your AMT liability, whichever is greater.

Whether you must pay AMT depends on when you sell the shares resulting from ISO exercises:

- If you sell the shares the same year you exercised the ISO (a.k.a. disqualifying disposition), AMT doesn’t apply. Instead, the profit is taxed as compensation income (i.e., regular income taxes apply).

- If you sell the shares after 12/31, then the bargain element will count as income for AMT purposes. For example, if you exercise 1,000 ISOs on 9/1/2020, and you keep the shares past 12/31/2020, then you may have to pay AMT due 4/15/2021.

Five states also have AMT: California, Colorado, Connecticut, Iowa, and Minnesota.

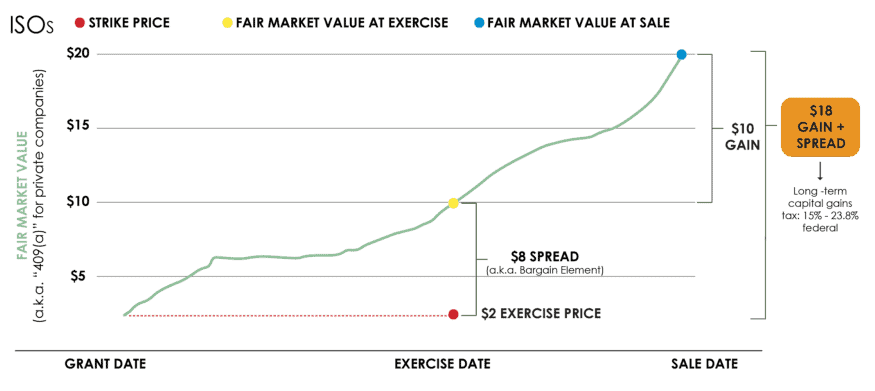

Taxes at Sale

The beauty of ISOs is that you can convert the full $18 profit into long-term capital gain. When we reviewed NSOs above, only $10 was capital gain, and the remaining $8 was compensation income.

Special Holding Period

To convert the entire $18 into long-term capital gains, you must meet two holding periods. The sale date of the ISO shares must be:

- At least two years from the ISO grant date, and

- At least one year from the exercise date

The entire $18 per share profit is taxed at lower federal long-term capital gains tax rates:

- 15%-23.8%. The exact rate depends on your filing status and income.

- The tax rate for long-term capital gains tax is lower than for regular income taxes, which top out at 37%.

State of California Capital Gains Tax

California doesn’t have a separate capital gains tax system. The same tax rate applies whether you have short-term or long-term capital gains. California is the highest tax state in the US. Your tax rate on the $18 profit will be 9.3% to 13.3%. The exact rate depends on your filing status and income.

Warning on Exercising ISOs When Your Company is Still Private

When your ISOs have a low exercise price, it may be tempting to exercise these ISOs while your company is still private. Exercising sooner would start the clock on the “one year from exercise” rule.

However, due to AMT, you may end up with a hefty tax bill on the paper gains from your ISO exercise, and you’re stuck with illiquid shares that you can’t sell to pay the tax bill.

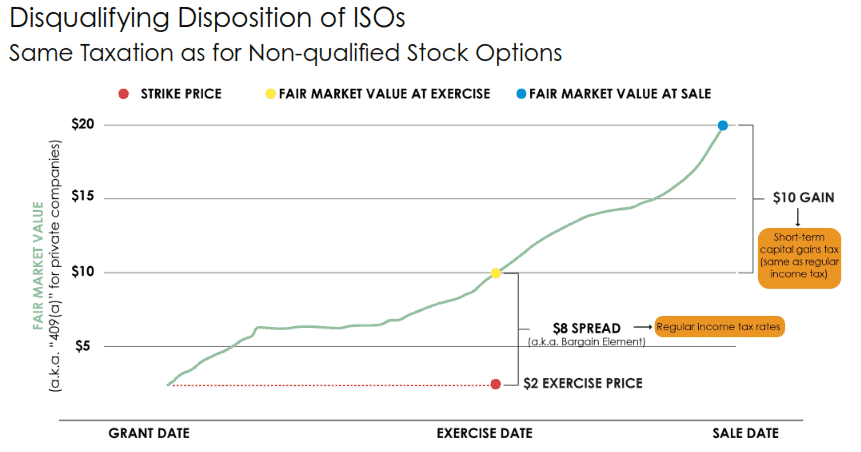

If You Don’t Meet the Special Holding Period Rules: Disqualifying Disposition of ISOs

The “at least one year from exercise” rule is what trips up most ISO holders. If the date that you sell the company stocks is at least two years from grant date, but less than one year from the exercise date, then this is known as a “disqualifying disposition.” This means the taxation is the same as for NSOs:

Warning Regarding Taxes and Disqualifying Disposition of ISOs

Remember that for ISOs, no taxes are withheld at exercise. For qualifying dispositions of ISOs, this isn’t a problem because you won’t owe regular income taxes or payroll taxes. (Although you may need to set aside cash for AMT).

But for disqualifying dispositions of ISOs, you’ll owe income tax (federal, state). And none of these taxes will be withheld on your behalf!

It’s so important to hire a financial planner, or at the very least a tax professional, before you exercise stock options. This will help you avoid a surprise tax bill on April 15th.

How to Determine Your Tax Bill

Consult a tax professional (CPA or EA) before you exercise stock options. Ask the tax professional to run a tax projection to understand your tax liability. You’ll need to provide the following:

- Whether it’s an NSO or ISO

- Grant date

- Strike price

- Current share price

- The number of stock options you want to exercise

Hiring a tax preparer to file your tax returns is also a good idea – preferably someone who’s familiar with equity compensation

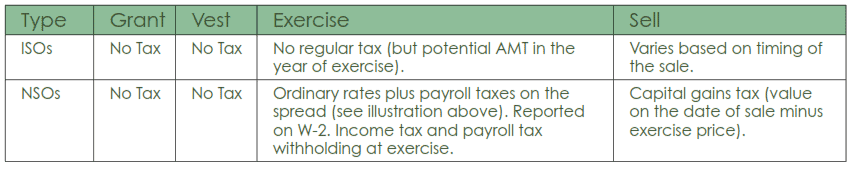

Summary of Taxes for Stock Options