Stock Options 101: When and How to Exercise and Sell (Part 1 of 2)

Your stock options are complicated. You may have several questions:

- When should I exercise?

- What should I do with the shares once we go public?

- What is a lock-up period?

- How does the tax part work?

- What the heck is AMT?

The IPO market is thawing. Soon, you’ll be able to convert your stock options from a promise to real money. Snowflake, Unity Technologies, and Asana recently went public. Airbnb plans to file its IPO later in 2020.

In today’s post, I’ll discuss the basics of stock options. And in my next post, we’ll discuss taxes (including the dreaded AMT) in more detail. If you want to get a head start, download my free guide, Preparing for an IPO.

What Are Stock Options?

Stock options represent the right (not requirement) to:

- buy stock (“exercise”)

- for a fixed price (“exercise price” or “strike price”)

- during a fixed period of time (usually 10 years)

There are two types of stock options: Incentive Stock Options (ISOs), and Non-qualified Stock Options, aka Non-statutory Stock Options (NSOs). My next post on taxes will distinguish between ISOs and NSOs. Today’s post will be more general.

Stock Options and Their Lifecycle

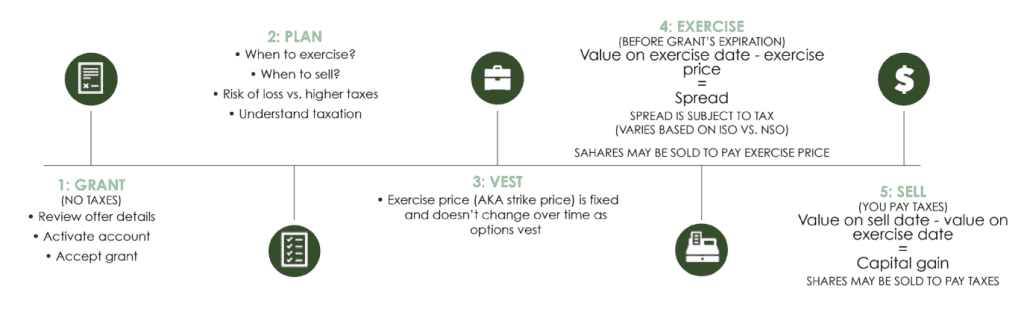

The lifecycle of stock options is the same whether you have ISOs or NSOs:

Grant: you were given stock options upon hire. Perhaps you received additional grants upon promotion. Activate your account on the equity website (Schwab, E*Trade, and Shareworks are common examples). Once you’ve logged in, accept the grant.

Plan: the IPO process will be an emotional roller coaster. Having a plan will help you mitigate the emotions.

Vest: how much time must elapse before you earn the right to exercise your options. The most common vesting schedule is 25% after one year, and then monthly or quarterly thereafter.

Exercise: once your options are vested, you have the right to buy (exercise) your company stock at a fixed price (exercise price, or strike price) at any point before the grant expires. Later in this article, you’ll learn a framework for deciding when to exercise your options.

Sell: once you’ve exercised your options, the final step is to sell the stocks. Later in this article, you’ll learn when to sell your stocks.

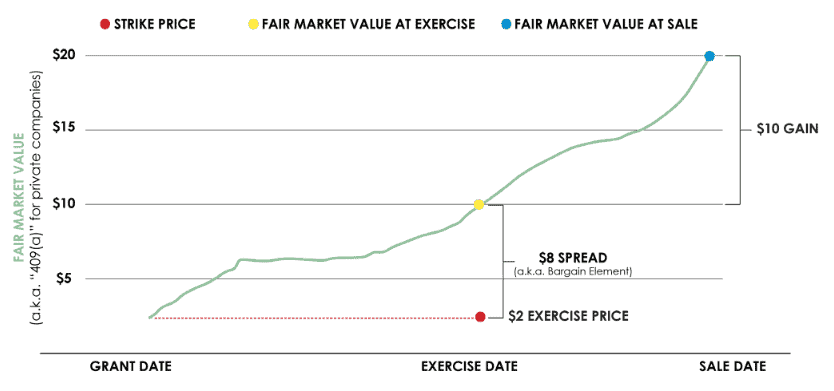

The way you make money from stock options, whether ISOs or NSOs, depends on your company’s “fair market value” at exercise and sale. “Fair market value” is a company’s share price. It’s easy to find the fair market value of a public company like Google because its stock price is public information. It’s harder to find the fair market value of a private company unless you’re an insider, such as an employee or venture capital investor. In the private company world, the stock price is more commonly known as the “409(a) value.”

In this illustration, you’ve been granted stock options with a $2 per share exercise price (a.k.a. strike price; marked by the red dot). Over time, your company’s fair market value (hopefully) grows, and you decide to exercise when it’s $10 per share (marked by the yellow dot).

In other words, you’re paying $2 for company stock that’s worth $10. This $8 spread is also known as the bargain element, and the taxation of the spread differs for ISOs vs NSOs (which I’ll discuss in my next post).

Continuing this example, the fair market value has grown to $20 when you decide to sell (marked by the blue dot). Tax authorities consider the purchase price (a.k.a. cost basis) to be $10 ($2 exercise price + $8 bargain element). Therefore, your gain is $10 per share ($20 fair market value – $10 cost basis). The taxation of the $10 gain differs for ISOs vs NSOs (which I’ll discuss in my next post).

Decide When to Exercise

One of the key decisions for stock options is when to exercise.

The first step is to see if you have enough cash to exercise the options. If you have 2,500 vested options at $20 exercise price, then you’ll have to cough up $50,000, which is a significant amount of cash for most people. If you don’t have the cash to exercise while your company is private, then you can simply wait for your company to IPO.

It’s important to remember there are two components of stock option value:

- Intrinsic value (built-in profit)

- Time value (potential profit)

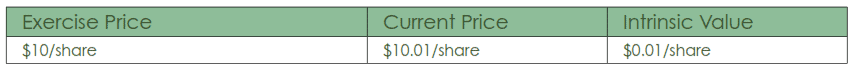

Calculate the intrinsic value by taking the current share price minus the exercise price. Let’s say your company’s stock is $50/share, and the exercise price is $10/share. Your built-in profit (before taxes) is $40. Some people forget to discount the intrinsic value of the stock option by the exercise price.

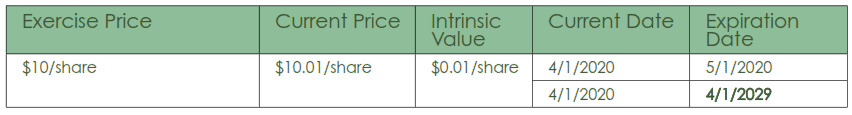

People often disregard the time value of their options. Consider this scenario:

At first, you may yawn at the $0.01 intrinsic value ($10.01 – $10). But add the following dates:

If you’re only a month away from the grant’s expiration, you’d be right to yawn. It’s unlikely the stock price will jump in a month, putting the option further “in the money” (e.g., higher intrinsic value).

However, when the grant’s expiration is 10 years away, there’s a far greater chance that the stock price will increase over time. There’s tremendous time value in the option. If the stock price climbs over the years, the beauty of stock options is that you decide when to exercise the option (e.g., when to buy the stock at $10/share).

FRAMEWORK: WHEN TO EXERCISE STOCK OPTIONS

Use one or both of the following frameworks to decide when to exercise:

- When intrinsic value > time value –> exercise

- When intrinsic value is a significant portion of your net worth –> exercise

A financial planner with expertise in equity compensation planning can help you make the exercise decision in the context of your broader financial goals. At the very least, before you exercise options, I recommend that you work with a tax professional to run a tax projection. The tax projection will quantify the AMT tax impact if you exercise ISOs. And you can proactively offset the ordinary income from the exercise of NSOs with income deferral techniques such as increasing 401(k) contributions, or perhaps increasing charitable gifts.

How to Exercise

Now that you understand when to exercise your options, and what the tax consequences will be, let’s discuss how to exercise your stock options.

Step 1: Log Into Your Equity Website

Check to see how many stock options are vested and therefore exercisable. If you’re a longtime employee, you may have multiple option grants that are exercisable.

Step 2: Select How You’ll Pay the Exercise Price

- Pay in cash (wire the payment from your bank account) – this is your only selection if your company is still private.

- Cashless exercise – this is a choice if your company is public. E*Trade/Shareworks/Schwab/etc uses some of the sale proceeds to cover the exercise cost and tax withholding. You don’t have to cough up any cash to exercise the option or pay tax withholding.

- Sell to cover – this is slightly different from a cashless exercise in that you sell just enough shares to cover the exercise cost.

Step 3: Tax Withholding

If you exercise NSOs, your company must withhold taxes income tax (federal, state) and payroll taxes (Medicare, Social Security, local taxes if applicable). Be sure to consult a tax professional to determine your total tax bill. It’s very possible that the amount withheld will not meet your total tax obligation.

Step 4: Exercise the Option(s)

You should be able to exercise through your equity website.

Step 5: Tax Forms

if you exercised ISOs, during next spring’s tax season, your company will file Form 3291 with the IRS and give you a copy. You don’t need to attach this form to your tax return. But you will need to do an AMT calculation on Form 6251 if you exercise ISOs and hold the resulting stock through the calendar year of exercise.

When to Sell

We discussed the frameworks to determine when to exercise: when the intrinsic value of the stock options > time value, and/or the intrinsic value is a significant portion of your net worth. Now that you’ve exercised the options (aka bought your company’s stocks at the fixed exercise price), the best course of action is likely to cash in your profits by selling the stocks, and investing in a diversified portfolio.

How to Invest the Sale Proceeds

When I help my clients invest in a diversified portfolio, I put them in a mix of stocks and bonds using low-cost mutual funds or exchange-traded funds (ETFs) that allow them to invest in thousands of stocks and bonds across the world (US and non-US) and across all segments of the economy (healthcare, technology, manufacturers, etc).

An exception to selling the stocks right away is if you want to meet the special holding period rules for ISOs. In my next post, I’ll discuss the tax benefits of “qualifying dispositions” of ISOs.

You’re already relying on your company for your paycheck. It may be wise to avoid tying your personal wealth to your company’s fortunes.

How to Sell (Assuming the Post-IPO Lock-up Has Expired)

Step 1: Log Into Your Equity Website

You will see your brokerage account, which contains the company stocks that you own.

Step 2: Select the Order Type

- Market order: sell the stocks immediately at (or close to) the current trading price.

- Limit order: sell the stocks only if the price is at least a price that you define. If you want at least $50 per share, but your company’s stock price remains below $50, your sale won’t go through. Word of caution: if you’re subject to blackout windows, make sure you cancel an unfilled limit order so that it doesn’t accidentally execute during the blackout period (a big no-no).

- Stop order: sell the stocks ASAP if the stock price drops below a certain price.

- Stop limit order: is a combination of a stop order (stocks are sold only after they reach a certain price) and limit orders (where you set the minimum price for which you’ll sell stocks). If your company stock is $45 but you’re worried the price will decline, you can set a stop price of $40; if the stock price falls to $40, your order is live. And if you also set a limit price of $38, this is the absolute lowest price you’re willing to sell for. If the sale doesn’t occur before the stock drops below $38, your order will not be filled.

As you go down the list of order types, there are more decisions that need to be made. The greater the number of decisions, the higher the risk of “analysis paralysis.”

Step 3: Select the Timing of the Order

- Day order: the duration of the order is limited to the trading day.

- Good until cancelled: the duration of the order is open: there isn’t a set expiration date.

- Fill or kill: an order to sell stocks that must be executed immediately in its entirety; otherwise, the entire order is cancelled. Partial fulfillments aren’t allowed.

- Immediate or cancel: an order to sell stocks that requires all or part of the order to be executed immediately. Any unfilled parts of the order are canceled. Partial fulfillments are allowed.

- Extended Hours: while standard market hours are 6:30 AM to 1 PM Pacific, orders can take place during “pre-market” hours (4 AM to 6:25 AM Pacific) or “after hours” (1:05 PM to 5 PM Pacific).

Unless your company stock is thinly traded, a day order is likely sufficient for your needs.

Post-IPO Trading Restrictions

Lock-up Period

After your company is listed on the stock exchange, you likely will not be able to exercise options or sell stocks right away. This is because a lock-up period may apply. This is a waiting period after the IPO that forbids company insiders from selling shares. The lock-up period typically lasts six months. When you log into your equity plan, you’ll see 0 shares.

Blackout Periods

Once the lock-up period ends, you may continue to face restrictions on selling company stock. Many companies, including Facebook and Lyft, forbid all employees from buying or selling company stock during “blackout periods.” But other companies, such as Microsoft and Cisco, enforce blackout periods only for their executives.

Trading Windows

If you’re subject to blackout periods, you can sell company stock during a “trading window,” specific windows of time after your company’s quarterly earnings release. This is to prevent insider trading, which is a violation of federal securities law. Your company will announce when trading windows open.

Next Up: Taxes

In my next post, learn how stock options are taxed. This includes the dreaded AMT (Alternative Minimum Tax) for ISOs.