Stockpile of Company Shares: Nice (But Stressful) Problem to Have

Against the backdrop of the COVID-19 epidemic, we experienced the sharpest and fastest bear market in history. The term “bear market” refers to market drops of more than -20%. The S&P 500 (large US stocks), for example, was down -35.2% between 2/19/2020 and 3/23/2020. For context:

- During the Global Financial Crisis, the bear market occurred over 175 days

- In the “Great Fall” starting 2/19/2020, however, the S&P 500 took a mere 16 days to drop more than 20%!

The stock market has rallied in head-spinning fashion. If your company recently went public and the stock price has risen, your shares may now comprise a significant portion of your net worth. If you’ve worked at an established tech company for several years, you’ve likely amassed a valuable stockpile of shares too.

If you have a lot of company stock, learn more about your three choices:

- Keep the shares

- Sell the shares

- Donate them

And if you’d like to learn more about the top questions I’m hearing during this unnerving time, download my free guide, Financial Self-Care for Superstar Women.

Keep the shares

The path of least resistance is to do nothing. You could let the problem grow as RSUs continue to vest every quarter. If you really want to keep some shares, consider limiting your exposure to no more than 5% of your portfolio.

Risks of Keeping Your Shares

There’s a type of investment risk known as concentration risk, or “putting all your eggs in one basket.” Concentration risk arises when you have a single stock that that represents more than 5% of your portfolio. The technical reason that tying up a lot of your money in a single stock is known as idiosyncratic risk. This describes factors and events specific to that one company that could cause its share price to fall. A diversified portfolio such as a global mutual fund, however, will invest in thousands of stocks in the US and internationally, and across all sectors of the global economy. This diversified portfolio is exposed to the risk of a stock market downturn, but if one stock falls in value, other stocks will act as a cushion by falling less, or even increasing in value.

There’s also the risk of tying your “human capital” and “financial capital” to your employer:

- You already are relying on your employer for a paycheck

- You don’t want your personal wealth to also rely on your employer (specifically its stock price)

Enron is the ultimate nightmare scenario. There are sad stories of Enron employees whose 401(k)s were primarily invested in the company’s stock. They lost their jobs, and their retirement savings were wiped out. Years later, some former Enron employees describe having to work well into their golden years.

Sell the shares

Let your goals determine how much to sell. At the very least, sell enough for:

- Your emergency fund. Ideally you want at least six months of expenses set aside.

- Upcoming major expenses. This could include a down payment, private school or college tuition, financial support to family members, or a new car.

Let’s say you’ve built $200,000 in your company’s stock. You plan to use this money for a down payment on your very first home.

But then calamity strikes: the stock price drops 19% in a single day (which is what happened to Facebook’s stock price on July 26, 2018). The $200,000 down payment fund is down to $160,000 overnight. You might have to delay your dream home purchase.

Tech stocks like Facebook, Microsoft, and Google have performed incredibly well in the last ten years. But it’s impossible to know which stocks will perform well in the future.

Here are some notable examples of single day stock price drops:

- PG&E (PCG): -52% on 1/14/2019

- Bank of America (BA): -26.2% on 10/7/2008

- Facebook (FB): -19% on 7/26/2018 (this is the largest single day drop based on market cap: $120B loss)

- Microsoft (MSFT): -14.5% on 4/3/2000

- Apple (AAPL): -12% on 1/24/2013

- Google (GOOG): -5.3% on 2/2/2018

What to do With Future Shares

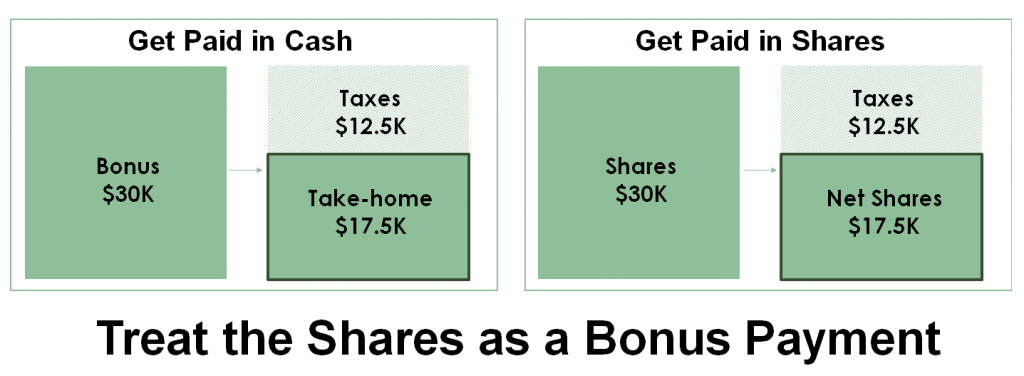

“I believe in my company’s prospects.” This is a common refrain when clients talk about keeping their stock. It’s possible that your company’s stock price will increase. I reframe the issue, however: “If your company paid $30,000 cash bonus, would you use this money to purchase company stock?”

Most clients quickly answer, “No, I’d keep the cash.” If you answered “No,” then you should think of the RSU payment as a bonus that happened to be paid in shares rather than cash. In other words, sell all of the shares immediately; your company will withhold taxes, and you keep the remaining cash.

In this illustration, compare $30,000 cash bonus (left) vs. $30,000 stock bonus when the RSUs vest (right). In both cases, you pay the same amount of taxes, and you net $17,500 (either in cash, or stock based on the stock price on the vesting date).

Treat the RSUs as a bonus. Sell the shares, and you can re-invest in a diversified portfolio. Instead of owning just your company’s stock, you can own thousands of stocks and bonds through mutual funds or ETFs (exchange traded funds) in the US and internationally. And you’ll invest in a variety of sectors, which includes tech (as well as healthcare, consumer durables, and the other industries comprising the global stock and bond markets).

Donate Your Shares

If charitable giving is a priority, you can give away shares of stock to charitable organizations. Charities will happily accept your stocks, and they will immediately sell the shares and keep the cash to fund their mission.

Check out my blog post on donating stocks to learn about how you benefit financially:

- Reduced taxes (income taxes AND capital gains taxes)

- Reduced concentration in your company stock