2020 IRS Changes That May Affect Your Paycheck

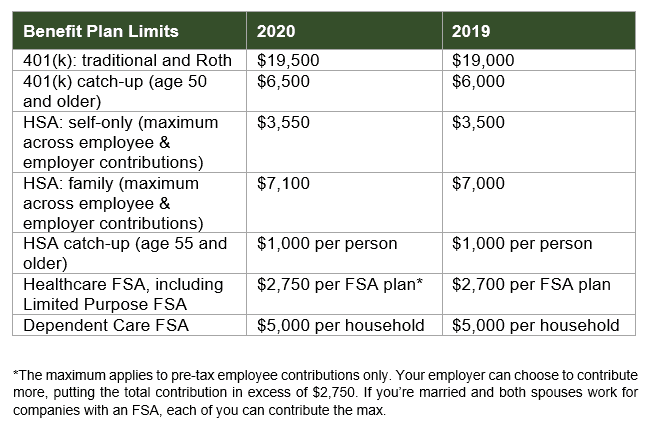

Happy New Year! If you review your paystub, you’ll see several deductions for your 401(k) and other workplace benefits. The IRS has updated how much you can contribute to the following benefit plans via paycheck deductions in 2020:

You can update your 401(k) contributions at any time during the year. For the remaining benefit plans, you can change the contribution amounts during open enrollment.

Earnings Caps for Payroll Taxes (Social Security, California SDI)

When you review your paystub, you’ll also see deductions for taxes. These taxes fall into two categories:

- Income taxes (federal and state of California)

- Payroll taxes (Social Security, Medicare, and California State Disability Insurance (SDI))

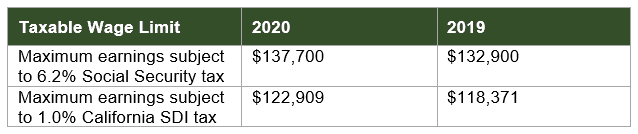

What’s unique about the Social Security and California SDI payroll taxes is that the amount of your earnings subject to these taxes is capped. The caps change every year:

If you’ve ever noticed a bump in your paychecks later in the year, it’s because your earnings have surpassed these caps, and you no longer have to pay Social Security and California SDI taxes.

No Earnings Caps for Medicare Payroll Tax

All your earnings are subject to the 1.45% Medicare tax.

If your earnings surpass $200,000, you’ll have to pay additional Medicare tax of 0.9%.

Demystifying the Jargon on Your Paystub

- “OASDI”: another term for Social Security. This stands for Old Age, Survivor, and Disability Insurance. Social Security provides more than retirement (“Old Age”) benefits. It also provides survivor’s benefits to widows/widowers and children under 18, and disability benefits.

- “Fed Med/EE”: this refers to Medicare, the federal medical insurance program for certain disabled individuals, and people who are age 65+. “EE” stands for employee. “ER” stands for employer; your company must also pay Medicare and Social Security taxes on your behalf.

- “FICA”: another term for Social Security and Medicare (Federal Insurance Contributions Act).