Buying Your First Home: 5 Steps to Success

The pandemic is accelerating many of my clients’ home buying timeline. San Francisco renters are leaving in droves. A buyers’ market is developing for SF condos that don’t have private outdoor space.

Buying a home will likely be the biggest purchase of your life. I’ve outlined five steps you can take to start preparing.

#1. Determine Whether to Buy

The first step in determining to buy a home is asking yourself why you want to purchase a home. Good reasons to buy a home include:

- Wanting a large yard for your pets and/or children

- Having the ability and space to build an ADU for an aging relative (Accessory Dwelling Unit, sometimes known as an in-law unit)

- Building a separate workshop for your hobbies (woodworking, playing a musical instrument…)

- Renovating to your personal tastes

- Wanting predictable housing expenses: mortgages are fixed payments for 30 years, whereas rent can increase drastically if you’re not in a rent-controlled building

If you want to buy a home, it’s important to understand your motivations. Here’s a list of questions to get you thinking:

- Do I really want to live in the suburbs / Tahoe / rural area for the long-term?

- Does buying a home make sense for my future desired lifestyle?

- Will buying a home limit my career opportunities by tying me down to one area?

- Do I have the time and cash flow to maintain a home?

- How much daily and weekly upkeep will the property require?

- What value will owning provide that renting doesn’t provide to me?

Fiction: Renting is a Waste of Money

As a renter, you benefit from:

- Having a place to live.

- Convenience: a landlord will take care of repairs and maintenance

- Flexibility: if you decide to move, the most you’ll lose is your security deposit

I occasionally hear people say you should buy a house because “it’s a good investment.” In reality, the stock market has historically performed better than residential real estate. And the all-in cost of homeownership is higher than renting. If your focus is superior returns, then you’ll likely be better off continuing to rent, and investing the difference in a long-term investment portfolio.

Sheila Bair, then chairwoman of the FDIC, gave a little-noticed speech in the wake of the Global Financial Crisis in 2010. She stated, “Sustainable homeownership is a worthy national goal. But it should not be pursued to excess when there are other, equally worthy solutions that help meet the needs of people for whom homeownership may not be the right answer.” In other words, renting is a perfectly fine solution!

#2. Decide What’s “Affordable”

Everyone holds their own unique financial situation and vision of an ideal home. One person may desire to have a big house for entertaining family and friends. If your idea of a fun weekend is browsing at Home Depot, you may want a fixer-upper home.

Given your ideal home, look at listings to get a rough idea of prices. Websites like Redfin and Trulia provide estimates of the mortgage, property tax, and insurance.

Review your budget and replace rent with mortgage, property tax, and insurance. Compare this revised spending to your take-home pay. Can you continue to afford 401(k) contributions and other planned savings? Many clients save a significant amount of cash on top of their 401(k) contributions. If homeownership drastically reduces (or even eliminates) this cash savings, are you comfortable with this?

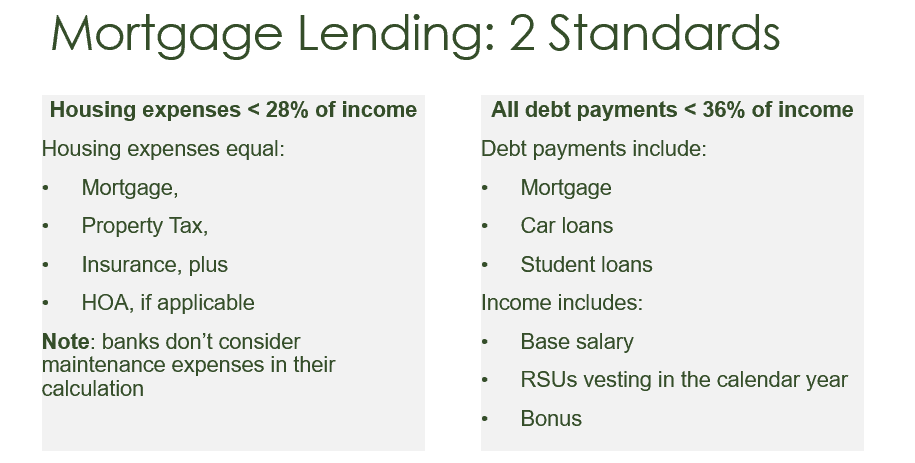

How Loan Officers Determine What’s “Affordable”

Most people must borrow to buy a home. In the mortgage application process, loan officers follow their own standards for determining what’s affordable from an underwriting perspective.

Loan officers run two calculations:

- Home expenses must be < 28% of income

- Debt payments must be < 36% of income

When calculating your income, be sure to include all sources. Your base salary is only one component. The RSUs that vest this year count as income, for example.

#3. Save Enough for a Down Payment

A down payment is the amount of cash you put toward the home purchase. The more money you put down, the less you have to borrow.

Mortgage lenders usually require 5%-20% of the home price as the down payment. The percentage depends on the loan type. For example, government-backed mortgages such as FHA or VA loans have a smaller down payment requirement).

The most common down payment is 20% of the home purchase price. Although you can make a down payment of less than 20%, be aware that mortgage insurance will apply.

Naturally, the higher the home purchase price, the larger your down payment will be. For example, if your home costs $1 million and you put down 20%, you need $200,000 of cash.

Saving $200,000 of cash takes time and discipline. One strategy is to live solely on your base salary, and sock away your after-tax bonus and RSU income. If you get a raise, consider living on your old salary and saving the difference.

Perhaps you’ve let your RSU shares build over time. If you have a stockpile of shares, liquidating these shares is a quick way to raise cash for the down payment.

Once you have an idea of what your ideal home costs, take 20% of the purchase price to calculate your down payment savings goal. Next, create a system to transfer savings to a separate “Down Payment” savings account. Avoid investing these funds because stock (and even bond investments) can drop in value. If you had $200,000 in an investment account that was earmarked for a down payment, it wouldn’t have felt good to see as much as 30% ($60,000) evaporate during the most recent bear market in February and March 2020.

Commit to regularly contributing to your down payment fund. If you have a significant other, talk with them about how saving for a down payment may require a trade-off with your lifestyle, family, travel, entertainment, and other large purchases.

#4. Budget for the Unexpected: Repairs and Maintenance

Total Cost of Homeownership: It’s Not Just the Mortgage

When we reviewed the two lending standards, we calculated “home expenses” as follows:

- Mortgage

- Property tax

- Insurance

- HOA

When people compare renting versus buying, a common mistake is to compare the rent to the mortgage. But you can already see that there are many expenses beyond the mortgage. When you calculate the all-in home expenses, homeownership is typically more expensive than renting.

Wild Card of Homeownership: Repairs & Maintenance

In the “home expenses must be < 28% of income” calculation, banks don’t include repairs and maintenance in their calculation. You should add repairs & maintenance to your budget, however. Although you don’t know exactly when repairs and maintenance will occur, they will occur at some point. Appliances like garbage disposals and refrigerators eventually wear out. Roofs need to be replaced, which is a bigger expense.

Unexpected headaches happen too. Here’s a list of actual repairs that my friends or clients had to deal with:

- Termites that were destroying wood fences

- Burst pipe that flooded the downstairs dining room

- Leaking washing machine that flooded the downstairs neighbor’s condo unit

- Showing up on move-in day to find a living room filled with six inches of water. This person called the seller who said, “It’s not my problem” (and it wasn’t)

How to Budget for Repairs & Maintenance

Here are two guidelines to setting this budget:

- The 1% rule: set aside 1% of the home’s purchase price annually for ongoing maintenance. For example, under this rule, if your home costs $900,000, you should also budget $9,000 per year for maintenance expenses. Because condos have HOA fees, the maintenance expense is typically lower compared to a similarly-sized single-family house.

- Square-Foot Rule: estimate $1 per square foot annually.

By setting aside funds every year, you’ll have cash reserves to cover these unexpected repairs.

#5. Have A High Credit Score

Credit reporting agencies calculate your credit score. A higher credit score (700+) means you’re a more creditworthy borrower. This translates into a lower mortgage rate, which in turns means you pay less in interest expenses.

Here are some easy ways to protect (or improve) your credit score:

- Review your credit report and request corrections if applicable. You can get a free copy at www.annualcreditreport.com.

- On-time payments. Be sure to pay your credit cards and other bills on time.

- Avoid opening new loans (like a credit card) or closing credit cards as you get closer to applying for the mortgage. These actions temporarily bring down your score.

- Length of credit history: keep your oldest card open. Set up a subscription like Netflix to make sure the oldest card isn’t closed due to inactivity.

- Credit utilization ratio: you want to use <20% of each credit card’s limit. Pay your credit card bill twice a month if necessary to keep this ratio <20% per card.

Looking Ahead: Renovating Your New House

Once you decide to buy, you may decide to renovate either right away or over time. In my blog post, An Interior Designer’s Tips on Preparing For Your First Renovation, I interviewed Alice Chiu of Miss Alice Designs in San Francisco.

She explains the differences between interior designers, contractors, and architects. And she advises that it’s best to start by hiring an interior designer or architect.

A general contractor takes drawings produced by an architect or an interior designer. They build based on the drawings. A general contractor usually does not purchase any of the cosmetic materials like faucets, sinks, appliances, tiles, furniture, or accessories. Instead, they purchase building materials like sheetrock and wood.

Some contractors won’t provide a bid unless they first see the drawings from an architect or designer that helps them understand the scope of the work.

What Renovations Provide the Biggest Bang for your Buck?

Alice Chiu answers this frequently-asked question:

- Improving your home’s energy efficiency such as replacing your windows or water heater

- Updating your landscape

- Remodeling your Kitchens and Bathrooms (could be on a small scale such as giving your cabinets a new paint color, replacing the countertop and backsplash, or switching out light fixtures)

- Replacing your floors with hardwood or engineered wood

- Giving your home a fresh coat of paint